Bitcoin Outperforms Gold and Silver as Asset Resilience Sparks Debate

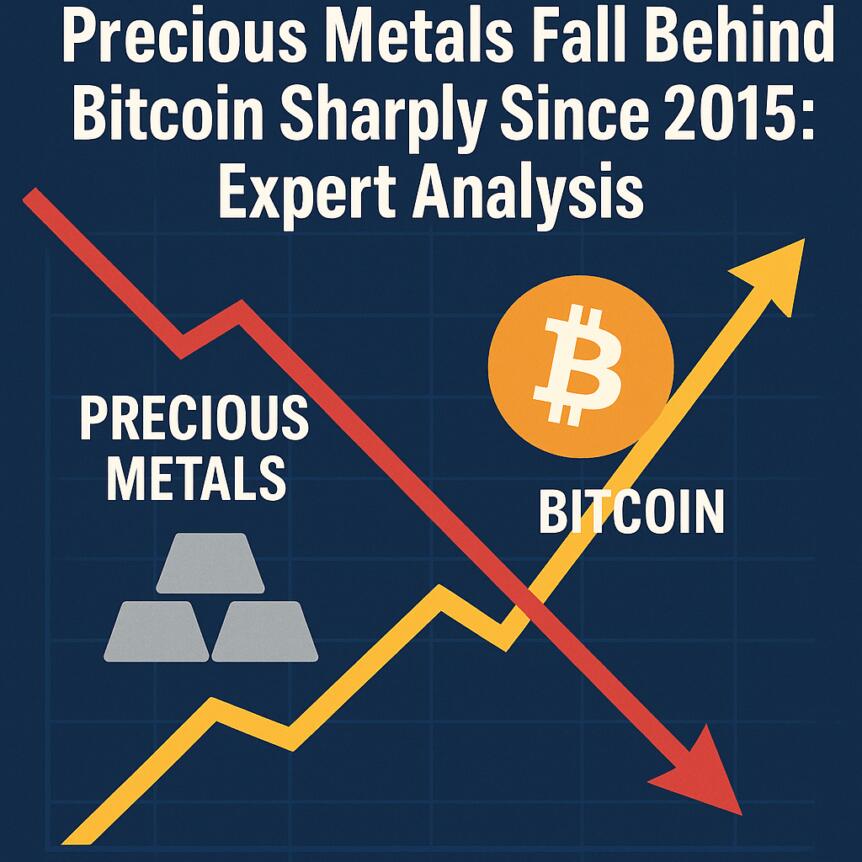

Since 2015, Bitcoin has demonstrated remarkable growth, surpassing traditional precious metals by a significant margin. According to analyst Adam Livingston, the cryptocurrency has appreciated by over 27,700%, while gold and silver have gained approximately 283% and 405%, respectively. This stark divergence underscores Bitcoin’s position as a leading store of value in recent years, fueling ongoing debates about its long-term viability compared to traditional assets.

Key Takeaways

- Bitcoin has significantly outperformed gold and silver since 2015, with a return of 27,701% versus gold’s 283% and silver’s 405% gains.

- Critics, including Peter Schiff, suggest that comparisons should focus on shorter timeframes, arguing that Bitcoin’s dominance might be waning.

- Experts highlight that commodity prices tend to converge toward production costs over the long term, with new gold and silver sources becoming profitable at current prices.

- The ongoing debate persists as precious metals continue to reach historic highs amid a declining US dollar, with Bitcoin experiencing stagnation in some metrics.

Tickers mentioned:

Crypto → BTC, ETH

Stocks → MSTR, COIN

Sentiment: Neutral

Price impact: Neutral. The contrasting performances of gold, silver, and Bitcoin reflect differing investor sentiment and macroeconomic factors driving each asset class.

Market context: The broader crypto market is experiencing a period of consolidation amid macroeconomic shifts, including the dollar’s weakness and inflation concerns.

Bitcoin’s Resilience Sparks Ongoing Debate

Since its inception in 2009, Bitcoin has emerged as a formidable asset, drastically outperforming gold and silver. Despite some critics questioning its long-term sustainability, its rapid appreciation over the past decade underscores its role in diversified portfolios. The recent surge in gold and silver prices—reaching all-time highs of approximately $4,533 and nearly $80 per ounce in 2025, respectively—intensifies the debate about which asset serves as the superior long-term store of value.

Meanwhile, critics like Peter Schiff argue that Bitcoin’s dominance is fading, emphasizing the importance of a shorter-term comparison—suggesting that the digital asset’s growth phase may be over. Conversely, proponents point to factors such as fixed supply and institutional adoption as key drivers that continue to bolster Bitcoin’s long-term appeal.

The debate extends to asset correlations, with precious metals experiencing record prices amid a declining US dollar, which dropped nearly 10% in 2025, marking its worst yearly performance in a decade. According to analyst Arthur Hayes, this weakening dollar, combined with the Federal Reserve’s easing monetary policy, could bolster the prices of scarce assets like gold, silver, and Bitcoin going forward.