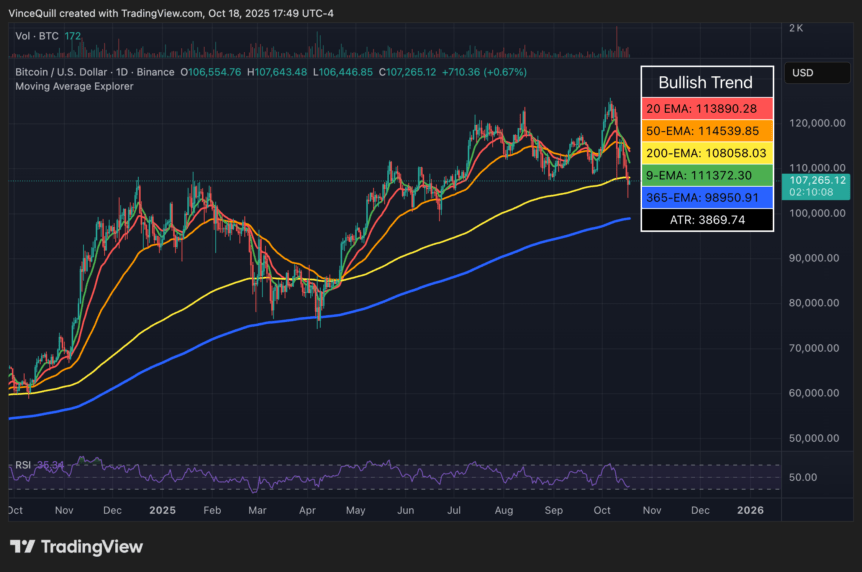

The cryptocurrency market faced significant turbulence after a brief rally that saw Bitcoin reaching an all-time high of over $126,000. Amidst this surge, the largest Bitcoin holder—believed to be Satoshi Nakamoto—experienced a substantial unrealized loss of over $20 billion due to declining prices. This episode highlights ongoing volatility in the crypto markets, driven by macroeconomic concerns, market liquidations, and geopolitical tensions. Despite the recent crash, experts believe the long-term fundamentals of crypto remain intact, signaling stability amid short-term corrections.

- Satoshi Nakamoto’s Bitcoin holdings are valued at over $117.5 billion, reflecting a significant position in the market.

- The crypto market experienced a record $20 billion in liquidations during a sharp downturn triggered by macroeconomic fears.

- Despite the sell-off, Bitcoin managed to stay above the $100,000 mark, underscoring market resilience.

- Analysts consider the recent crash a short-term correction with no lasting impact on long-term fundamentals.

- Market sentiment remains bullish, with positive macroeconomic signals and growing institutional interest.

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, holds the largest known Bitcoin stash, containing over 1 million BTC. At current prices, this portfolio is valued at over $117.5 billion, according to data from Arkham Intelligence. During Bitcoin’s recent rally to over $126,000 in October, Nakamoto’s holdings swelled to a peak value of more than $136 billion.

However, the crypto markets were battered by cascading liquidations in the perpetual futures sector on October 8. The trigger was a social media post from U.S. President Donald Trump, suggesting increased tariffs on China, which sparked fears of a renewed trade war. This event unleashed panic selling, culminating in a record $20 billion in liquidations and causing sharp declines in many altcoins—some dropping by over 99%. Despite the turmoil, Bitcoin maintained its position above the $100,000 threshold, demonstrating notable resilience.

Market crash is a temporary setback, not a reevaluation of fundamentals

The recent sharp decline is widely viewed as a short-term correction rather than a sign of underlying issues, according to experts at The Kobeissi Letter. They explain that the decline was driven by excessive leverage, limited market liquidity, and external geopolitical shocks—factors that exacerbate volatility in the crypto space.

The analysts remain optimistic about the market’s prospects, citing the likelihood of a trade deal and pointing to Bitcoin’s ongoing strength. They highlight that despite macroeconomic headwinds, the asset continues to serve as a store of value, with recent correlations between Bitcoin and traditional risk assets like gold indicating macroeconomic shifts.

Previously, The Kobeissi Letter noted that Bitcoin’s peak coincided with the dollar’s weakest year since 1973, suggesting a major macroeconomic transition. The rising prices of risk-on assets alongside traditional safe havens underscore a complex market environment where macro trends influence crypto dynamics, reinforcing the asset’s growing role in diversified portfolios.

Market participants and analysts remain cautiously optimistic, emphasizing that the recent declines are likely a short-term correction amid macroeconomic tensions. As institutions continue to adopt cryptocurrencies and macro factors evolve, the long-term outlook for the crypto markets maintains an upward trajectory, driven by increasing institutional interest and macroeconomic shifts influencing crypto regulation and valuation.