Michael Saylor’s company, Strategy, continues to expand its Bitcoin holdings despite heightened market volatility. The firm, already the world’s largest public holder of Bitcoin, made another purchase during last week’s crypto downturn, reaffirming its long-term bullish stance on the cryptocurrency. The move comes after Bitcoin’s sharp drop below $104,000 amid the broader sell-off triggered by the so-called “Black Friday crypto crash.”

- Strategy acquired an additional 168 Bitcoin for $18.8 million during last week’s market dip.

- The company now holds a total of 640,418 BTC, worth around $47.4 billion.

- Recent purchases mark a slowdown compared to earlier in 2025, when monthly buys reached 25,000 BTC.

- Strategy’s stock (MSTR) has dropped 21% this month but remains up 50% year-over-year.

- Other firms like Metaplanet continue to follow Strategy’s lead with major Bitcoin treasury allocations.

Strategy confirmed the acquisition of 168 Bitcoin (BTC) for approximately $18.8 million last week, according to a post shared on X. The purchase price averaged $112,051 per Bitcoin, although the crypto asset briefly fell below $104,000 on Friday, reflecting continued pressure across global crypto markets.

With this addition, Strategy’s total Bitcoin holdings reached 640,418 BTC, accumulated at a total cost of $47.4 billion, averaging $74,010 per coin. The company’s consistent accumulation strategy has made it one of the most influential players in institutional Bitcoin adoption.

Strategy’s path to 700,000 BTC

While the latest purchase was relatively modest compared to past accumulations, it reinforces Strategy’s steady approach. Earlier this year, the firm made aggressive monthly purchases averaging around 25,000 BTC in April and May. Based on recent trends — with around 5,620 BTC bought monthly in August and September — Strategy could reach the 700,000 BTC milestone within 11 months if its pace continues.

The purchase followed a 220 BTC buy the previous week for $27.2 million, which came just after Bitcoin hit a new all-time high above $126,000 before rapidly dropping back to $110,000 during the market turbulence.

MSTR takes another dip

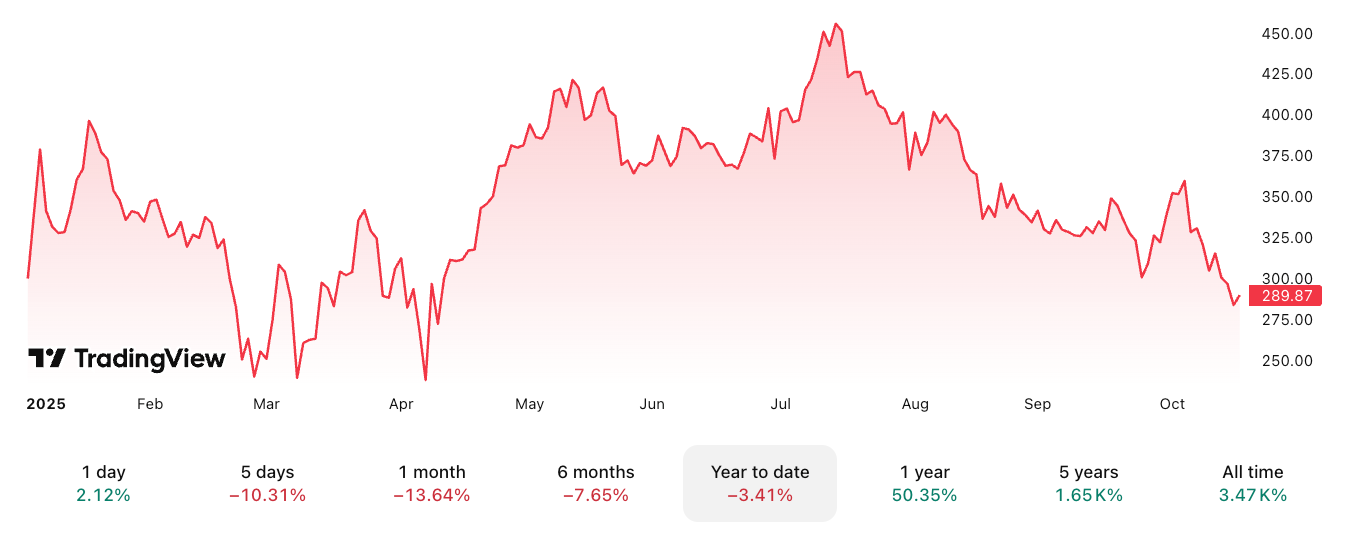

Despite consistent Bitcoin buying, Strategy’s common stock (MSTR) continued its downward slide last week, falling below $284 — a 21% drop since October 5, according to TradingView data. Still, MSTR remains up 50% compared to last year and has soared more than 1,650% in the past five years, reflecting investors’ long-term confidence in Bitcoin exposure.

The company’s lowest stock price this year was $238 in April, while its highest point came in July above $455. Even as its accumulation rate slows, other corporations continue to mirror Strategy’s Bitcoin treasury approach.

Japan’s Metaplanet, for example, has accumulated 30,823 BTC (worth roughly $34.1 billion) since adopting a Bitcoin standard in 2024. However, its enterprise value recently fell below the value of its holdings as the company’s market-to-Bitcoin NAV ratio dropped to 0.9, signaling investor caution despite bullish long-term fundamentals.