Bitwise has submitted a proposal to the U.S. Securities and Exchange Commission (SEC) to introduce a new investment vehicle called the “Stablecoin & Tokenization ETF.” This exchange-traded fund aims to mirror an index composed of firms involved in stablecoins and blockchain tokenization, providing investors with targeted exposure to key crypto markets.

According to the recent SEC filing, the ETF’s index features a diverse mix of companies—including stablecoin issuers, blockchain infrastructure providers, payment processors, and crypto exchanges—as well as regulated crypto exchange-traded products (ETPs) with holdings in Bitcoin (BTC) and Ethereum (ETH). The index will be subject to quarterly rebalances, with an even split between two segments: an equity sleeve and a crypto asset sleeve.

The equity side will focus on companies closely tied to stablecoins and tokenization, while the crypto asset portion will emphasize blockchain infrastructure supporting these assets, including oracles and other supporting technologies. The prospectus notes that assets eligible for inclusion must meet specific criteria, with the largest crypto ETFs within the sleeve capped at 22.5% exposure.

In the competitive landscape, Bitwise faces rivals such as Nicholas Wealth’s Crypto Income ETF (BLOX), which blends equities with crypto-related assets to offer diversified exposure. Founded in 2017, Bitwise manages over 20 U.S.-listed crypto ETFs, solidifying its role as a leading asset manager in the crypto space. However, the company has declined to comment publicly on pending filings, citing regulatory considerations.

Stablecoins and Tokenization Drive Growth in Crypto Markets

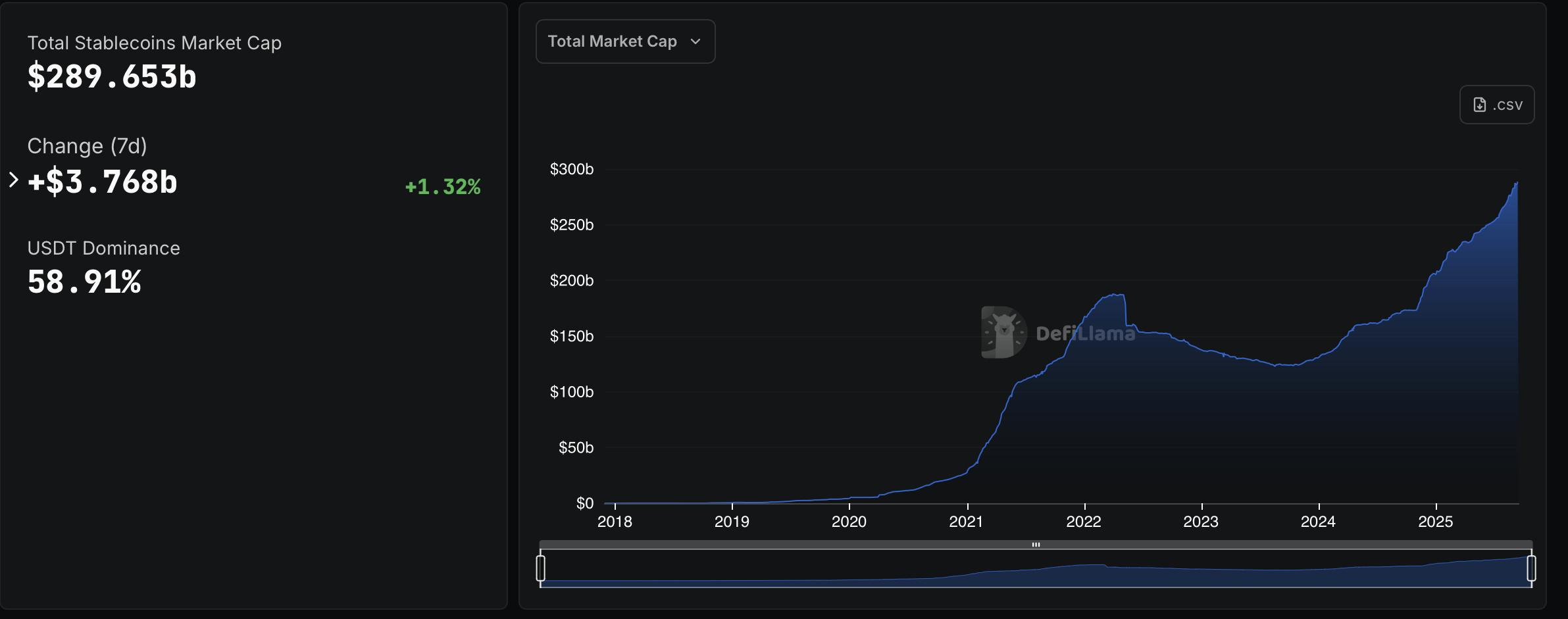

Since the U.S. passed the GENIUS Act in July—establishing a regulatory framework for stablecoins—the sector has experienced rapid expansion. The stablecoin market grew to nearly $268 billion between January and early August, a 23% increase from $205 billion, and currently stands at approximately $290 billion, according to DefiLlama.

Simultaneously, tokenized real-world assets (RWAs)—such as bonds and credit instruments traded on blockchain—have also gained traction, reaching around $76 billion in onchain value. The U.S. administration’s supportive stance on crypto innovation, particularly post-Trump’s inauguration, has spurred increased interest and regulatory clarity around the tokenization of traditional assets, bolstering DeFi applications and the broader crypto ecosystem.

The focus on stablecoins and tokenized assets underscores the evolving landscape of cryptocurrency adoption and regulation. With more ETF proposals, including Bitwise’s latest filing, many expect increased institutional participation and a broader acceptance of blockchain technology’s role in traditional finance.

The SEC is currently delaying decisions on several ETF proposals, with final rulings anticipated in October and November. If approved, Bitwise’s ETF could debut as soon as November, potentially marking a significant milestone for crypto investment products and the mainstream integration of blockchain-based assets.