- Institutional Ethereum holdings are drying up, raising concerns over liquidity and market support levels.

- Expert analysis indicates that shorting Ether may be a prudent hedge against Bitcoin exposure, given structural weaknesses.

- Technical indicators warn of a possible sharp decline in ETH price if key support levels near $3,000 fail.

- Despite market volatility, Ethereum-focused treasury companies remain largely bullish, holding millions of ETH.

- Market sentiment has turned cautious following the October crypto crash, with momentum hard to regain in digital assets.

As the cryptocurrency landscape shifts, institutional investors continue to prioritize Bitcoin, leaving Ethereum’s liquidity and strategic positions increasingly strained. A recent market analysis suggests that shorting ETH could provide a valuable hedge for investors with exposure to Bitcoin, especially in light of Ethereum’s perceived vulnerabilities.

The report highlights that, historically, Ethereum benefited from narratives around digital asset treasury management, with institutions accumulating ETH and distributing it to retail investors—often creating positive price feedback loops. However, this pattern now appears to be fading amid decreased transparency and shifting capital flows, which could lead to significant price corrections.

Supporting this view, technical signals point toward a potential dip in ETH’s value if key support levels around $3,000 are breached. Analysts indicate a possibility of prices falling toward $2,700, with weekly stochastic indicators flashing signs of a topping pattern. “The multi-year wedge formation shows a false breakout reminiscent of previous trend reversals,” the researchers state, emphasizing potential downside risks.

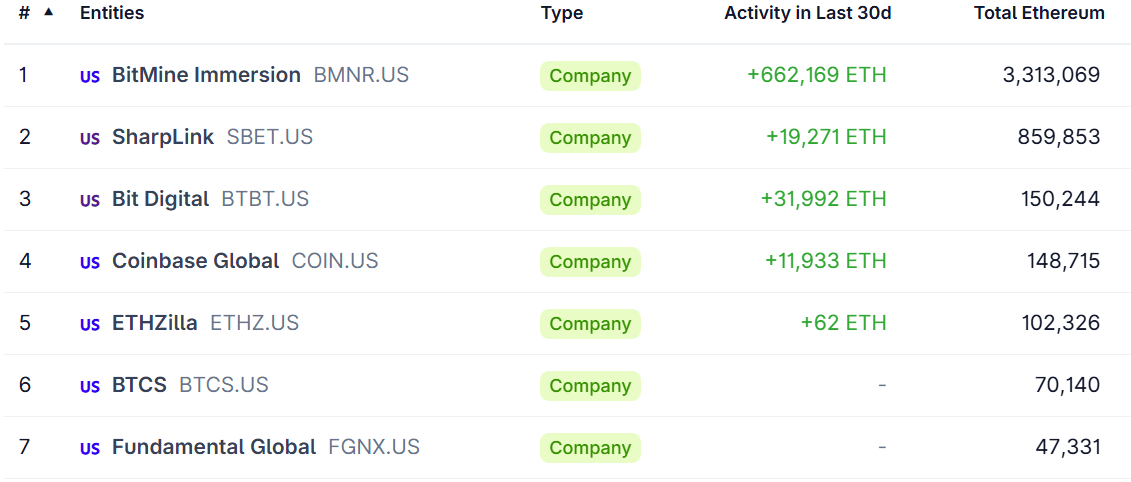

Despite these warnings, many Ethereum-focused treasury entities remain optimistic. Currently, 15 such companies hold a combined 4.7 million ETH, with industry leader BitMine owning approximately 3.3 million ETH. Other notable holders include SharpLink and Bit Digital, maintaining substantial ETH reserves.

Market participants remain divided on Ethereum’s near-term outlook. While BitMine’s Chair Tom Lee continues to forecast a potential rise to $10,000 for ETH this year, citing its resilient base established since 2021, broader market sentiment has adopted a more cautious tone following the sharp sell-off on October 10. The crash erased nearly $19 billion in crypto positions, triggering widespread hesitation across digital asset markets.

Although bullish voices persist, especially among long-term holders and treasury entities, recent volatility underscores the fragility of the current crypto environment. As regulatory scrutiny and market sentiment oscillate, investors are scrutinizing technical signals and macro factors for clues on Ethereum’s future trajectory amid the evolving landscape of blockchain and decentralized finance.