January delivered a mix of on-chain momentum and macro headwinds, spotlighting how activity on major networks can surge even as prices wobble. In particular, Solana and Ethereum posted notable milestones, while Bitcoin miners in the United States faced weather-driven disruption. Beyond network metrics, the month also underscored the growing role of crypto in everyday commerce as PayPal highlighted rising merchant adoption. The month’s narrative wove together rapid token launches, upgrade-driven efficiency gains, and geopolitical jitters that reverberated through risk assets, leaving investors weighing the pace of innovation against real-world constraints.

Key takeaways

- Solana (CRYPTO: SOL) saw a 115% jump in active daily addresses by Jan. 28, regularly surpassing 5 million, driven by renewed memecoin minting and an ecosystem push around token launches.

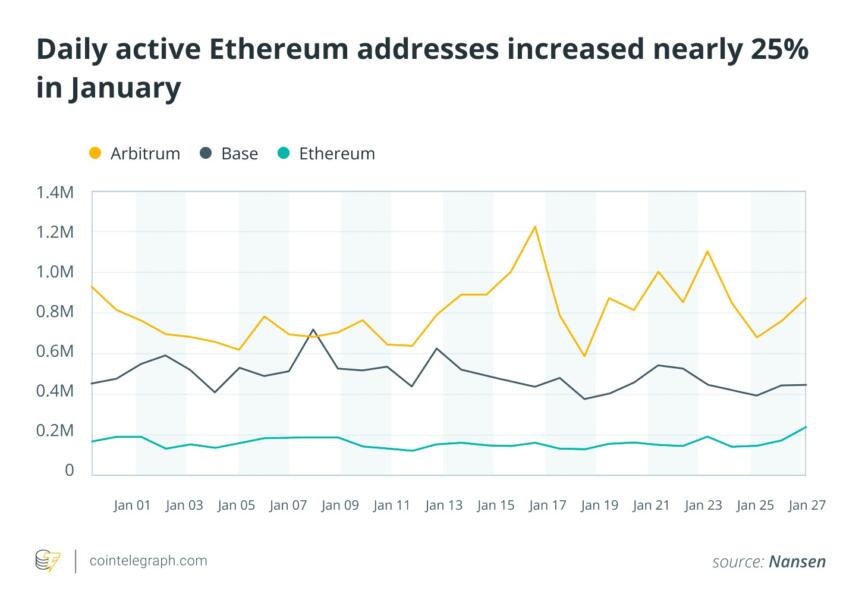

- Ethereum (CRYPTO: ETH) activity surged 25% in January after a December milestone where the network surpassed several major Layer 2s in daily active addresses, aided by upgrades that boosted throughput and lowered costs.

- Network fees on Ethereum remained low on average, dipping to under $0.01 on Jan. 29 as capacity improvements took effect.

- Bitcoin (CRYPTO: BTC) faced price volatility, briefly pushing toward $100,000 mid-month before retreating to around $87,000 amid geopolitical headlines centered on Greenland and broader risk-off sentiment.

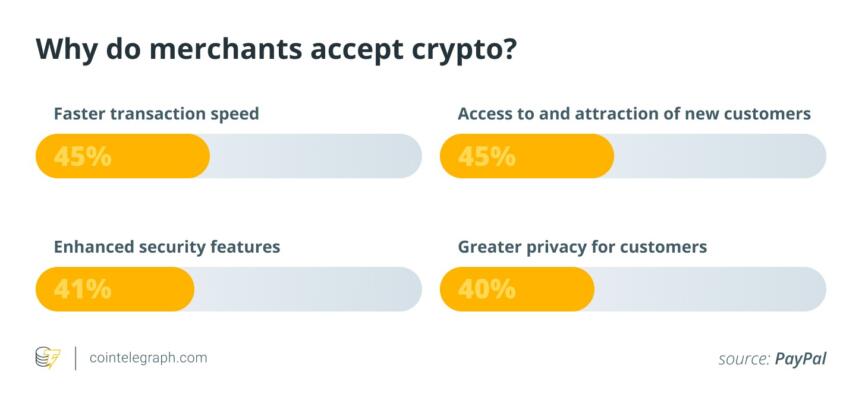

- Merchant adoption of crypto payments continued to expand in the US, with four in ten merchants reporting acceptance, and 84% predicting crypto payments will become mainstream within five years, per a PayPal (EXCHANGE: PYPL) January report.

Tickers mentioned: $BTC

Price impact: Negative. Bitcoin moved from a monthly high near $97k to about $87k amid geopolitical headlines and shifting risk sentiment.

Market context: The month illustrated how on-chain activity can accelerate even as macro headlines and policy signals shape risk appetite, with Ethereum’s upgrade cycle contributing to lower fees and Solana’s launch-driven activity underscoring a healthy, if episodic, ecosystem dynamic.

Why it matters

The January dynamics underscore a recurring theme in crypto markets: on-chain activity can accelerate even in periods of price uncertainty when infrastructure improvements, developer activity, and user demand coalesce. Solana’s surge in active addresses signals continued trust in its ability to support rapid token launches and decentralized applications, particularly as launch platforms like Bags compute the economics of new tokens and liquidity taps into a broader user base. The 115% rise in daily active addresses by late January, anchored by data from Nansen, points to a cohort of participants returning to activity after a quieter stretch, and it hints at a cyclical pattern of experimentation and completion within Solana’s ecosystem.

Ethereum’s resilience, evident in a 25% rise in daily active addresses in January, reinforces the narrative of a network maturing beyond episodic speculation. After overtaking some notable Layer 2s in December, Ethereum’s continued usage reflects a combination of broader dApp engagement and ongoing optimizations—essentials for a network contemplating sustained scalability. The drop in average transaction fees to sub-cent ranges around the end of January illustrates how upgrade-driven capacity expansions can alter user experience, lowering the cost barrier to routine usage and potentially widening the audience for on-chain services. This dynamic matters for builders seeking predictable costs and users seeking reliable, fast transactions.

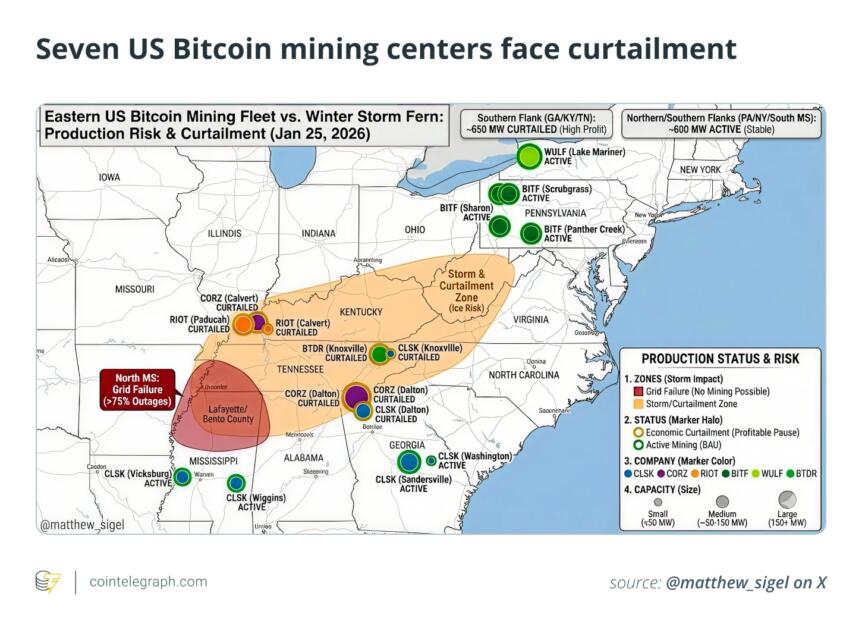

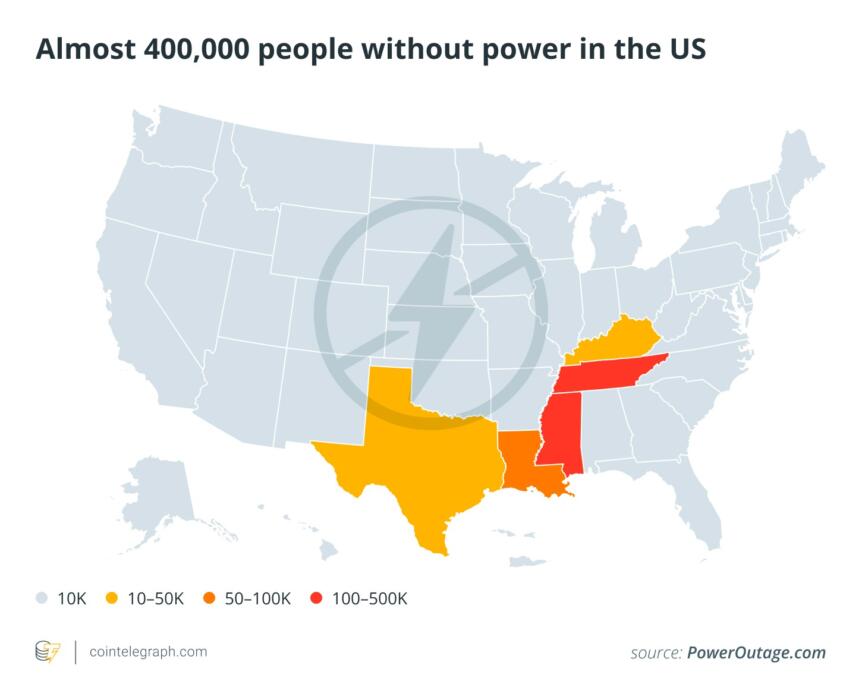

On the funding, infrastructure, and governance side, the month’s events remind market participants that energy and risk management remain acute for miners, especially in climates where grid stability is tested. The storm-induced curtailment scenario in the United States—where seven mining operations faced potential reductions—highlights the sector’s reliance on demand-response programs and the delicate balance between profitability and grid reliability. As Matthew Sigel, head of digital assets research at VanEck, noted, these facilities can act as flexible loads, a capability that could prove valuable during periods of grid stress. The broader takeaway is that mining economics are increasingly intertwined with energy policy and regional weather events, not solely with Bitcoin price movements.

Beyond network activity and mining resilience, the integration of crypto into everyday commerce continued to gain traction. PayPal’s January report showing that roughly 40% of US merchants accept crypto marks a meaningful expansion from niche adoption to a broader business reality. With 84% of merchants surveyed expecting crypto payments to become mainstream within five years, the trend points to a persistent demand-side readiness among consumers and a growing willingness among merchants to accommodate digital assets in checkout flows. The combination of merchant adoption alongside on-chain efficiency gains strengthens the case for crypto as a viable complement to traditional payments, even as headline risk and regulatory chatter persist.

The January price narrative was tempered by geopolitics. Bitcoin’s mid-month push toward the $100,000 level gave way to a retreat as Trump-era tensions and Greenland-related headlines created risk-off dynamics across markets. Analysts argued that cryptocurrencies did not provide a safe haven during a broad market sell-off triggered by policy rhetoric and cross-border tensions. While the macro environment remains uncertain, the month’s on-chain signals suggest that user activity and infrastructure improvements could sustain longer-term momentum, even if short-term price action remains fragile in response to external shocks.

What to watch next

- Solana ecosystem activity: Track the pace and quality of token launches on Bags and any shifts in memecoin issuance that could drive activity into February.

- Ethereum upgrade cadence: Monitor further network efficiency gains, blob sizes, and gas-price dynamics as core developers push toward finalization milestones and the walkaway test concept gains broader attention.

- Mining and energy dynamics: Watch potential curtailments or reliefs as winter weather patterns evolve, and assess how demand-response programs influence miner economics and network security.

- Crypto payments adoption: Follow PayPal’s ongoing reporting on merchant uptake and consumer usage to gauge how mainstream adoption is progressing and what that means for on-chain settlement velocity.

- Geopolitical and regulatory signals: Remain attentive to developments that could impact risk sentiment, capital flows, and the willingness of institutions to engage with crypto markets during periods of geopolitical tension.

Sources & verification

- Nansen data on Solana’s active daily addresses, with figures peaking above 5 million by late January.

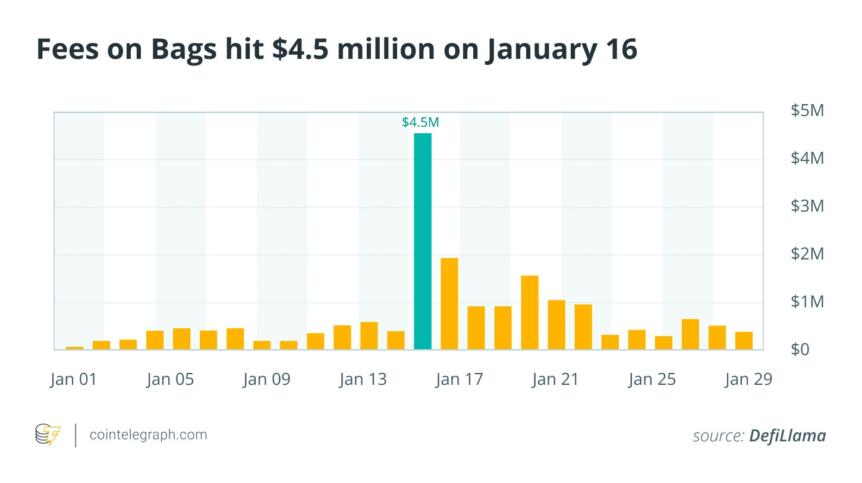

- DeFiLlama metrics showing Bags platform fee activity and the token-launching landscape on Solana, including the comparison with Pump.fun.

- Etherscan gas tracker figures indicating January 29 average Ethereum fees below $0.01.

- Vitalik Buterin’s public remarks on Ethereum’s “walkaway test” and the idea that the network should function without constant developer intervention.

- VanEck commentary by Matthew Sigel on how mining operations can operate as flexible loads to support grid stability during stress periods.

- PayPal’s January report on crypto payment adoption, noting the share of US merchants accepting crypto and the sentiment around mainstream adoption in five years.

- Geopolitical developments around Greenland and related market responses that influenced risk-on assets such as Bitcoin.

Market reaction and key details

Solana (CRYPTO: SOL) posted a striking gain in on-chain activity in January as the ecosystem gathered momentum around token launches and integrations. By Jan. 28, total active daily addresses on the Solana network exceeded five million, marking a roughly 115% jump from the start of the month. The surge aligned with a renewed minting cycle on the Bags launchpad, a Solana-based platform that has become a hub for new tokens, and with the broader appetite for fast, low-fee transactions. The momentum was amplified by a parallel development: the release of Claude Cowork, an AI agent from Anthropic intended to help manage tasks, which developers leveraged to accelerate token-related experiments. The resulting activity helped lift network usage into new territory even as the broader market navigated a volatile January.

Following this spike, fees on the Bags ecosystem reached about $4.5 million on Jan. 16, highlighting how surges in launch activity can temporarily elevate on-chain costs. By contrast, the broader Solana ecosystem had experienced days with substantially lower fees in late 2024 and 2025, underscoring how launch-driven demand can create short-lived headwinds for users and developers participating in token drops. The number of tokens that “graduated” from Bags continued to outpace other Solana launch venues, indicating Bags’ growing role as a go-to path for new projects seeking initial liquidity and community engagement.

On Ethereum (CRYPTO: ETH), activity mirrored a maturation trajectory that has been evident since late 2023. After Ethereum overtook several prominent Layer 2 networks in daily active addresses in December, January’s metrics showed a further 25% uptick in on-chain activity. Upgrades implemented through the month improved blob sizes and reduced transaction costs, with average fees dipping below $0.01 on Jan. 29, according to on-chain trackers. The upgrades were framed by the ecosystem as foundational work toward a more scalable and accessible platform, enabling more users to transact without the friction that previously constrained adoption.

That momentum occurred in the context of Vitalik Buterin’s call for a “walkaway test”—a benchmark for Ethereum to function sustainably without developers actively guiding the chain. The thrust behind the comment was to emphasize that a resilient network should continue to meet users’ needs even in the absence of ongoing, hands-on governance. In tandem with this vision, Ethereum’s upgrades were designed to improve efficiency and lower costs for end users, reinforcing the idea that long-term usability is central to network health.

Meanwhile, Bitcoin faced a different set of headwinds in January. A winter storm disrupted power grids across the Southeast and South Central United States, prompting seven mining operations to consider curtailment. Data cited by Matthew Sigel of VanEck indicated that major players—Riot Platforms, Core Scientific, CleanSpark, and Bitdeer—maintained the ability to reduce grid demand through demand-response programs, a mechanism that can help stabilize power costs for operators while preserving grid reliability. The storm’s impact extended beyond energy, with travel disruptions, outages, and a humanitarian toll in several states as conditions worsened. The price narrative reflected this mood, with Bitcoin briefly testing near $100,000 earlier in the month before retreating toward $87,000 as turbulence persisted.

Beyond price action, crypto payments continued to gain traction in the broader economy. PayPal, a major payments processor, reported that four in ten US merchants now accept crypto, signaling increasing practical acceptance of digital assets in everyday commerce. The same report highlighted that crypto payments can offer faster settlement and enhanced privacy, factors that could drive further merchant experimentation in 2026. PayPal (EXCHANGE: PYPL) executives noted that crypto payments are moving beyond experimentation into everyday commerce, with 84% of merchants anticipating crypto’s mainstream status within five years.

The month’s mixed signals—robust on-chain activity on Solana and Ethereum against price swings driven by geopolitics and weather—underscore a market still in the process of reconciling technology-driven momentum with macro risk. The Greenland headlines, which briefly suggested potential policy pivots and security considerations, reminded markets that crypto assets remain sensitive to global political developments. Analysts argued that while cryptocurrencies don’t always act as a hedge in the face of geopolitical stress, their growing integration into real-world use cases—from token launches to payments—could help sustain longer-term interest even when price action turns choppy.

https://platform.twitter.com/widgets.js