Key takeaways

Stablecoins significantly reduce settlement times and cross-border transaction costs while enabling programmable rewards, surpassing traditional credit card systems in efficiency.

Americans pay over $100 billion annually in card processing fees. Stablecoins offer a faster, more affordable alternative for payments, potentially saving billions.

Major players like Ripple, Gemini, and Moca are integrating stablecoins into mainstream commerce through innovative products such as Ripple’s RLUSD, Gemini’s XRP Card, and Moca’s Air Shop.

As leading companies explore stablecoin adoption, they are poised to become central to US payment infrastructure, transforming how consumers and businesses transact.

Since their introduction in 2014, stablecoins have dramatically impacted the crypto landscape by providing a stable digital currency, anchoring the volatile crypto markets to real-world assets. Unlike traditional banking, which centralizes deposit holding and services, stablecoins operate on decentralized networks, reducing costs and improving efficiency in global transactions. They have replaced many banking functions, creating an ecosystem where programmable services and flexible rewards—such as loyalty points—are now possible on blockchain technology.

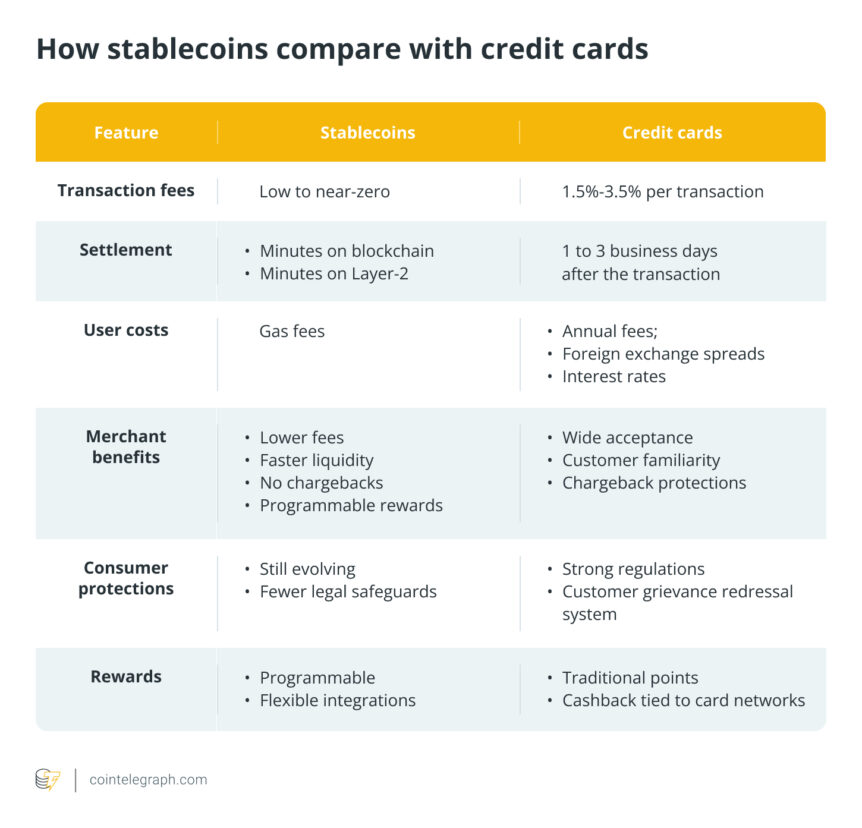

Each US credit card transaction entails fees—typically between 1.5% and 3.5%—that erode merchant margins and inflate prices for consumers. In contrast, stablecoins facilitate near-instantaneous settlements on blockchain platforms, drastically lowering costs and improving transparency. This shift could reshape merchant profits and consumer pricing by bypassing costly card networks.

The cost you pay for credit cards

While credit cards offer convenience, they come with hidden fees—interchange fees, network charges, and processing costs—that often translate into higher retail prices and reduced profit margins for merchants. Consumers ultimately bear some of these costs indirectly through higher prices. Stablecoins, pegged to stable assets like the US dollar, present a compelling alternative by enabling speedier, lower-cost transactions with clear fee structures.

Did you know? Unlike traditional cashback or points, stablecoins support programmable rewards, allowing merchants to customize incentives, trade or save rewards, and maintain token value, significantly transforming loyalty programs.

What are stablecoins?

Stablecoins are cryptocurrency tokens pegged to stable assets such as the US dollar, gold, or Treasury securities to maintain a steady value. Their stability makes them suitable for everyday transactions, unlike volatile cryptocurrencies like Bitcoin or Ether. Supported by reserves, stablecoins combine blockchain’s efficiency with the reliability of traditional currency.

Stablecoins like USDC by Circle and Ripple’s RLUSD—recently approved and launched on global exchanges—are revolutionizing payments with faster, cheaper, and borderless capabilities. These digital assets are increasingly viewed as essentials in modern financial systems.

Stablecoins vs. credit cards: The case for a better payment system

Stablecoins address critical issues in US payments, including high fees and slow fund settlements. While credit card transactions can be perceived as instant, actual settlement can take days and incur significant costs. Stablecoins settle within seconds or minutes on blockchain, at a fraction of the cost, offering a more efficient solution for merchants and consumers alike.

With blockchain-powered loyalty programs, customers gain true ownership of their rewards, providing flexibility and real value. For example, projects like Air Shop leverage stablecoins to enable transparent, interoperable loyalty schemes across numerous merchants, transforming traditional reward points into versatile and stable assets.

The $100-billion potential: How stablecoins could disrupt the credit card industry

In 2024, US consumers made over 56 billion transactions worth more than $5.5 trillion using traditional credit cards. Stablecoins threaten to reshape this landscape by offering nearly fee-free and instant transactions. Should stablecoins capture just 10-15% of this market, they could redirect billions in savings to merchants and consumers, pushing for widespread adoption in retail, airlines, and e-commerce sectors.

Major companies are blending traditional and blockchain-based payment methods, as seen with Gemini’s XRP Credit Card and upcoming stablecoin-powered loyalty platforms. This evolution signals a future where stablecoins may become integral to US financial infrastructure, offering faster, cheaper, and programmable transactions.

Stablecoins are becoming a core component of the financial system

As regulatory clarity and institutional support grow, stablecoins are positioning themselves as a foundational element of modern finance. They promise faster, more cost-effective, and programmable transactions, redefining payment systems and customer engagement. Major retail giants and fintech firms exploring proprietary stablecoins signal a shift towards a blockchain-enabled economy, aiming to reduce costs and enhance financial inclusion.

While credit cards remain entrenched, stablecoins are poised to become central to US commerce, reshaping incentives, lowering costs, and enabling innovative customer loyalty and payment solutions in a rapidly evolving financial landscape.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making decisions.