In a noteworthy development, U.S. President Donald Trump announced plans to meet with Chinese President Xi Jinping at the upcoming Asia-Pacific Economic Cooperation (APEC) summit in Seoul, Korea. The meeting, scheduled for October 31, marks a potential de-escalation in ongoing trade tensions between the two economic powerhouses, sparking positive movements across global markets, including the cryptocurrency sector. As diplomatic efforts step up, traders are watching closely for signs of stability that could breathe new life into the volatile crypto markets.

- President Trump confirms a high-level meeting with Xi Jinping at the APEC summit amid easing trade tensions.

- The announcement leads to a rally in cryptocurrency prices, with Bitcoin and top altcoins posting gains.

- Crypto market sentiment remains cautious, affected by fears of a prolonged trade war and past market crashes.

- Analysts project short-term volatility but reinforce confidence in the long-term bullish trend of crypto markets.

United States President Donald Trump confirmed on Sunday that he will meet with China’s President Xi Jinping at the upcoming APEC summit in Seoul, scheduled to start on October 31. Trump’s remarks came shortly after a period of heightened trade tensions between the two nations, with previous statements suggesting skepticism about face-to-face negotiations. However, his recent comments signal a potential shift towards diplomacy, easing fears among investors and traders.

During an interview with Fox News, Trump described Xi Jinping as “a very strong leader” and praised his remarkable personal story. He emphasized the importance of a fair trade deal, stating, “We’re going to be fine with China, but we have to have a fair deal. It’s going to be fair.” Previously, Trump had expressed skepticism about engaging with Xi at the summit, even suggesting there was “no reason” to meet, and had announced additional tariffs on Chinese goods, which greatly impacted crypto markets.

“[Xi Jinping] is a very strong leader, a very amazing man. You can look at what he’s done, where he is in his life. It is an amazing story. It’s a story for a great movie. I think we’re gonna be fine with China, but we have to have a fair deal. It’s going to be fair.”

Previously, Trump indicated there was little reason to meet at the summit, coinciding with the announcement of new tariffs on Chinese exports, which triggered a sharp decline across crypto markets. The resulting market turmoil saw nearly $20 billion in liquidations in crypto derivatives — the largest in history — fueled by high leverage, thin liquidity, and elevated risk levels amidst the chaos.

Crypto markets respond positively to diplomatic signals

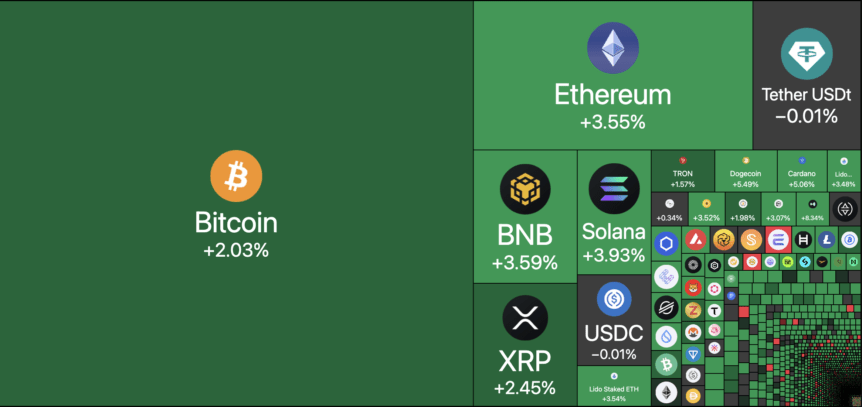

Following Trump’s remarks, Bitcoin (BTC) experienced about a 2% increase, reflecting initial optimism. Other leading cryptocurrencies also gained, with Ether (ETH), Binance Coin (BNB), and Solana (SOL) each rallying between 3.5% and 4%, according to real-time data from TradingView.

Despite these gains, overall market sentiment remained cautious, with the Crypto Fear and Greed Index plunging to a six-month low of 22 last Friday, signaling “Extreme Fear” amid concerns that geopolitical tensions could persist or escalate. Traders remain wary, especially after the recent market crash, which saw a massive liquidation cascade in crypto derivatives markets. Still, analysts suggest that this downturn is likely temporary, maintaining confidence in the long-term bullish outlook for the crypto space.

Experts at the Kobeissi Letter emphasized that technical factors are driving the short-term volatility, but the fundamental outlook remains strong. Investors and traders continue to watch for potential regulatory developments and macroeconomic trends that could influence the future trajectory of cryptocurrency markets.