London is steering crypto regulation into a clearer senior lane, with the Financial Conduct Authority closing in on a formal regime after a multi-year rulemaking sprint. The FCA released its final consultation on January 23, laying out a package of 10 regulatory proposals designed to bring crypto assets and crypto businesses under a unified framework. The plan targets a three-year process ending in March 2027, with full implementation expected by October 2027. In contrast to the United States, where regulatory efforts have stalled amid partisan debates around the CLARITY Act, the United Kingdom has pursued a centralized, regulator-led approach intended to align digital assets with the broader financial system. If realized, the framework could offer clearer compliance pathways for firms and stronger protections for consumers, while positioning the UK as a renewed hub for crypto activity.

Key takeaways

- The FCA published a final consultation on January 23 detailing 10 regulatory proposals to govern crypto activities in the UK.

- The regime is slated to conclude in March 2027, with full implementation by October 2027, following a three-year rulemaking horizon.

- Distinct from the US, the UK will rely on a centralized model under a single regulator (the FCA) to determine which assets fall under which rules.

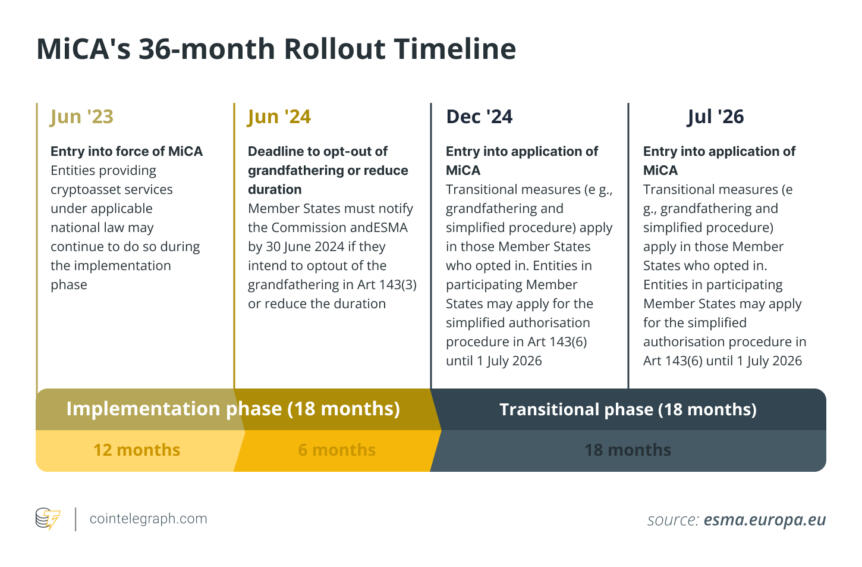

- UK policy explicitly integrates crypto into existing financial services law, rather than layering on industry-specific “light-touch” wrappers, a contrast to Europe’s MiCA approach.

- Public discussions about stablecoins and their regulatory treatment emphasize a single national regime, potentially reducing cross-border interoperability frictions cited by some observers.

Market context: The move comes amid a global regulatory push as markets weigh liquidity, risk sentiment, and the direction of crypto policy in major economies. The UK’s approach contrasts with ongoing MiCA developments in Europe and the U.S.’s drawn-out debates over agency jurisdiction and stablecoin licensing. With the FCA’s timeline and framework now public, market participants are watching how swiftly firms can align operations to the forthcoming standards while continuing to navigate evolving supervisory expectations.

Sentiment: Neutral

Price impact: Neutral. At this stage, the public consultation signals regulatory clarity and may encourage compliance planning, but immediate price shifts are not evident from the release itself.

Trading idea (Not Financial Advice): Hold. Institutions and incumbents may begin reallocating resources toward regulated activities as details crystallize, but investors should wait for final rules and enforcement guidance before adjusting exposure.

Market context: The FCA’s framework aligns crypto activities with established financial services regimes, a move that could influence liquidity dynamics by encouraging compliant players to scale operations within the UK market and potentially attracting international entities seeking regulatory certainty.

Why it matters

The FCA’s approach marks a deliberate shift away from piecemeal, sector-specific add-ons to a holistic regime that treats crypto assets as part of the country’s financial architecture. By outlining clear categories and mapping assets to corresponding rules, the regulator aims to reduce ambiguity for firms seeking to operate in the UK, from custodians to trading venues and payment service providers. This could lower the compliance burden relative to navigating a patchwork of state, federal, and international requirements and may pave the way for greater institutional participation.

Industry voices highlighted the advantage of a centralized framework in avoiding inconsistent regulatory signals that have tempered development in other markets. Nick Jones, CEO of Zumo, praised the FCA’s public consultation as a way to incorporate stakeholders’ concerns without allowing policy disagreements to derail progress. The broader message is that a unified regime can deliver predictable governance: a key factor for institutions evaluating whether to deploy capital and technology at scale in a familiar, well-regulated environment. The UK’s intended model aims to harmonize consumer protections with the operational realities of crypto businesses, reducing the risk of off-shoring and unregulated structures that have bedeviled the market in other jurisdictions.

At the same time, observers emphasize that the UK framework deliberately departs from MiCA’s design philosophy. While MiCA contemplates an expansive, horizontally integrated regime across the European Union, the UK’s plan focuses on extending existing financial regulation to crypto participants rather than grafting a bespoke, lighter-wrapped regime onto an unregulated sector. Wiggin partner Marcus Bagnall noted that this approach could raise compliance costs in the near term but would likely yield a more robust foundation for institutional money. In practice, that means more rigorous disclosures, governance, and custody standards—elements that could improve investor confidence and facilitate product development for regulated clients.

Another dimension is the regulatory stance on stablecoins. The UK’s centralized system envisages a single national regime that treats stablecoins as part of financial services, potentially streamlining licensing for issuers and service providers. In contrast, the U.S. contemplates a more intricate mix of federal and state licensing, with multiple regulators and Treasury involvement. That divergence, some analysts suggest, could create interoperability friction across markets and complicate cross-border settlements. The UK’s framework seeks to minimize such friction by eliminating compelling jurisdictional ambiguity for stablecoin entities operating within the UK’s borders.

The FCA’s integration drive also aligns with a broader political economy goal: reviving the UK’s ambition to become a crypto hub. After an initial push under Prime Minister Boris Johnson, the drive slowed as market conditions deteriorated. Proponents now argue that a clear, enforceable regime is essential to attracting legitimate participants, enabling product diversification, and safeguarding consumers in an era of rapid innovation. The regulator’s willingness to engage with stakeholders early—through a public consultation process that is group-wide in scope—signals a more disciplined path toward maturity for the UK crypto sector.

Beyond the policy mechanics, the framework signals a practical shift for practitioners. The long-term objective is to foster a compliant ecosystem where retail investors gain access to regulated services with clearer asset custody standards and dedicated protections. While the path will be costlier in the near term, the anticipated outcome is a market structure that can withstand scrutiny, meet prudential standards, and withstand the volatility that has long characterized the space. There is an implicit bet that regulated, transparent access will attract new capital and talent, reviving the UK’s ambition to be a globally relevant crypto technology hub.

The policy dialogue surrounding stablecoins, as well as the broader attempt to integrate crypto into existing financial rails, illustrates a fundamental tension: how to preserve innovation while ensuring consumer safety and market integrity. Analysts note that the UK’s approach could help mitigate some of the regulatory ambiguities seen in other jurisdictions and provide a more predictable runway for asset custody, disclosures, and enforcement. As the FCA’s final framework continues to evolve through consultation and eventual rulemaking, the impact on operational practices—from risk management to onboarding and KYC procedures—could be substantial for both incumbents and newcomers.

Observers also point to the UK’s broader regulatory philosophy: instead of a MiCA-style wrapper tailored to a rapidly expanding crypto sector, the FCA is extending established financial regulation to encompass crypto-asset firms. In practical terms, that means clearer supervisory expectations, more consistent capital and disclosure requirements, and a framework designed to support customer protections in a way that can be scaled for institutional use. As Nick Jones and other industry figures have argued, the net effect could be a more robust, diligence-ready market architecture that invites compliant players to participate in the UK ecosystem at scale. The emphasis remains on a regulated environment where consumer trust is anchored to clear rules for asset custody, disclosure, and market conduct.

While the path to full implementation remains lengthy, the momentum around the FCA’s framework signals a renewed appetite for orderly growth in the UK crypto space. For participants who have long advocated for regulatory clarity—ranging from asset managers to custody providers—the prospect of a single, centralized rulebook is a meaningful inflection point. The framework’s success will hinge on the quality of the final rules, the speed and predictability of enforcement, and the extent to which the regime can harmonize with international standards without stifling innovation. If achieved, the UK could move from a cautious observer to a pivotal hub for compliant crypto activity, bridging traditional finance with the next wave of blockchain-driven solutions.

What to watch next

- March 2027: Conclusion of the three-year rulemaking process and key milestones for transitional provisions.

- October 2027: Targeted full implementation of the regime and the practical rollout for crypto businesses and service providers.

- Regulatory guidance on stablecoins and how issuers will be licensed, capitalized, and supervised under the centralized UK framework.

- Potential alignment or friction with Europe’s MiCA regime and any cross-border regulatory cooperation developments.

- Monitoring enforcement signals from the FCA as the regime moves from consultation to rulemaking and then into supervisory practice.

Sources & verification

- FCA’s final consultation release describing the 10 regulatory proposals and the stated March 2027 conclusion with October 2027 implementation timeline.

- Comparative discussions on centralized UK regulation versus the US CLARITY Act, including multi-agency licensing considerations for stablecoins.

- Industry commentary from Zumo’s Nick Jones and Wiggin’s Marcus Bagnall on the UK framework’s departure from MiCA-style wrappers and its institutional implications.

- Historical FCA actions on Travel Rule enforcement (Sept. 2023) and the 2023 stablecoins discussion paper, along with subsequent policy work on custody, disclosures, and market abuse.

- UK government crypto hub ambitions and related policy milestones, including the 2022 strategic plan and related discussions around operational clarity for crypto firms.

- Brian Armstrong’s activity on X referenced in the coverage of regulatory discussions (View on X).

UK’s centralized crypto regime: timeline, stakes, and global context

The FCA’s final consultation marks a turning point in the UK’s regulatory narrative for crypto. In a departure from the ad hoc adjustments of a rapidly evolving sector, the regulator lays out a forward-looking framework designed to align crypto-asset activities with established financial-service norms. The central premise is simple: bring crypto providers into the fold under a single, predictable regime that covers asset custody, disclosures, anti-money-laundering controls, and market integrity. This approach reduces the ambiguity that often haunts cross-border operations and makes it easier for compliant firms to scale within the UK market while offering clearer protections to retail investors.

Among the most notable contrasts with the United States is the UK’s centralized institutional architecture. By design, the FCA will determine which assets attract which regulatory requirements, reducing the complexity of navigating separate federal and state regimes. For stablecoins, in particular, the UK’s stance suggests a unified, national approach rather than a mosaic of licensing across various jurisdictions—a position some observers say could minimize cross-border market friction that has hindered interoperability in other markets.

From a business perspective, the framework promises to lower operational risk for firms that want to operate at scale within the UK. Yet it also imposes higher upfront compliance obligations, including robust disclosures and governance standards. Industry attorneys and corporate participants alike acknowledge that while the near-term costs could rise, the long-term benefits—greater investor protection, more predictable enforcement, and a more stable ecosystem—could attract institutional capital that has previously steered clear of regulatory uncertainty. In this sense, the UK is attempting to strike a balance between encouraging innovation and maintaining the financial system’s integrity.

The arc from implementation to execution will be shaped by ongoing consultations, implementation guidelines, and testing phases that help translate policy into concrete practice. As one industry executive noted, the environment for crypto firms could become more predictable, enabling firms to plan product roadmaps, governance structures, and custody arrangements with greater confidence. The ultimate question is whether the regime can deliver the operational clarity that businesses say they need to grow responsibly in a highly regulated landscape, while preserving the agility that drew many players to crypto in the first place. If the framework succeeds, it could help transform the UK into a credible global hub for regulated crypto activity, connecting the innovation of blockchain technologies with the stability of a well-regulated financial system.