Recent movements in the cryptocurrency markets highlight ongoing volatility driven by macroeconomic data and geopolitical tensions. Bitcoin’s price has remained under pressure amid stronger-than-expected U.S. employment figures and a surge in the US dollar. These factors are prompting traders to reevaluate risk and potential price targets for Bitcoin, with analysts suggesting that the cryptocurrency could soon test the $110,000 mark — a critical level that may determine its near-term trajectory.

- Bitcoin fell alongside stocks and gold following robust U.S. jobs data, signaling cautious sentiment among investors.

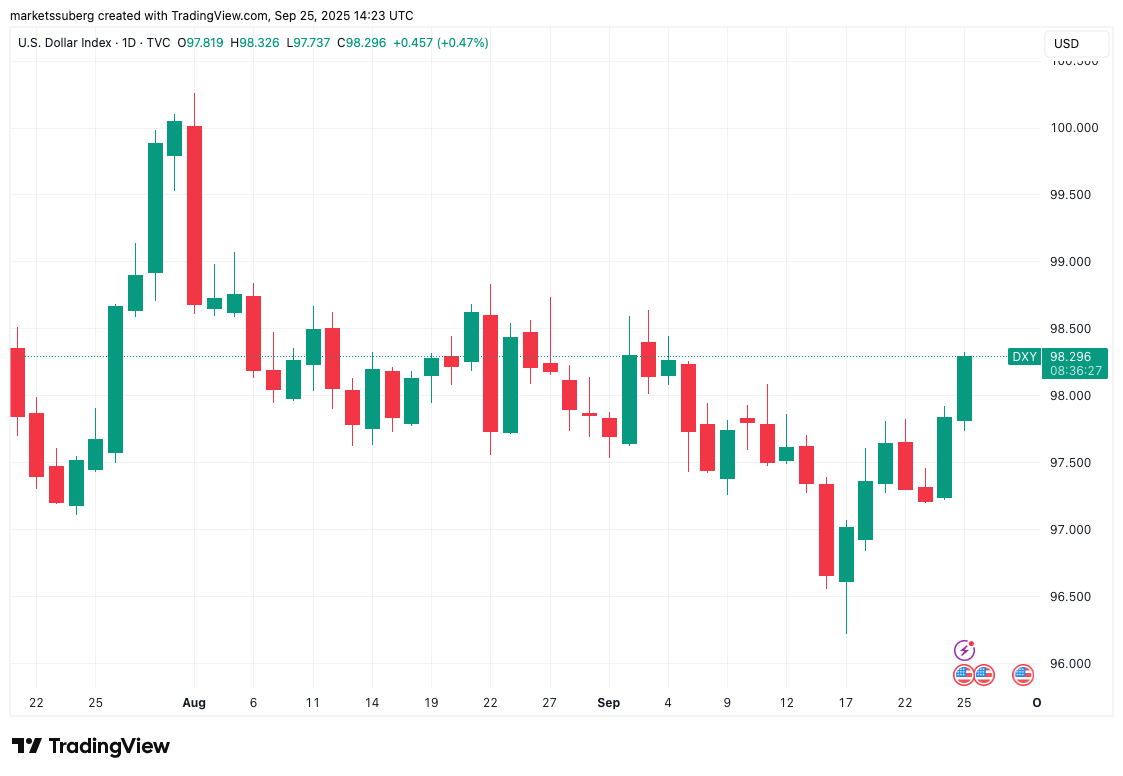

- The US dollar index reached three-week highs, exerting downward pressure on risk assets, including cryptocurrencies.

- Analysts believe that Bitcoin has a high chance of retesting $110,000, with a break above $115,200 necessary to challenge recent highs.

- Market uncertainty is compounded by ongoing geopolitical tensions, including Russia-Ukraine-related incidents.

US jobless claims pressure risk assets across the board

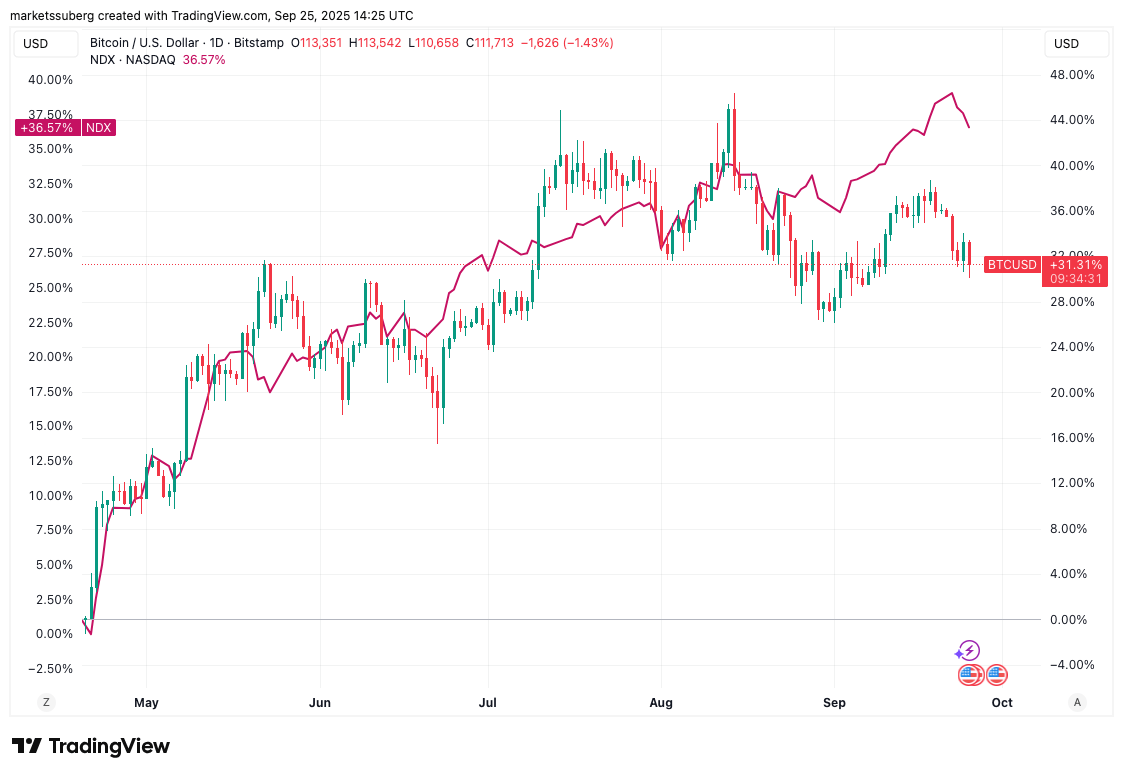

Data from Cointelegraph Markets Pro and TradingView confirmed fresh lows of approximately $110,658 for BTC on Bitstamp, signaling renewed weakness.

Interestingly, recent US jobless claims data undershot expectations, suggesting that labor market softness may be less severe than feared. This development has tempered expectations for aggressive Federal Reserve rate cuts, as reflected by the CME Group’s FedWatch Tool.

Market strategist Ryan Detrick commented on X that “initial jobless claims are no longer a worry,” pointing to the resilience of the labor market. This data led to a strengthening of the US dollar, with the DXY index hitting three-week highs, while equities, gold, and cryptocurrencies declined in tandem.

Market uncertainty persists amid ongoing geopolitical tensions, including reports of Russian jet intercepts over Alaska, further stoking risk aversion. Trading analysis from The Kobeissi Letter noted that the recent pullback in stocks was “overdue,” emphasizing that healthy bull markets do not move in a straight line.

Before this decline, stocks and gold had been setting record highs, highlighting divergent momentum within traditional and digital markets prior to the recent downturn.

$110,000 remains a critical level for Bitcoin’s next move

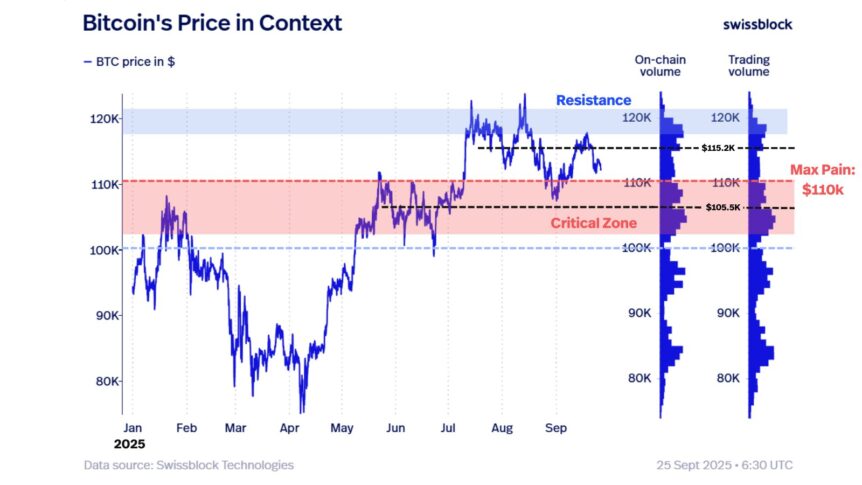

Market insights from Swissblock indicated that Bitcoin is currently in a delicate balancing act. The firm pointed out that BTC’s price has dropped below $113,000 and hovers just above $110,000, suggesting that a retest of this key support level is imminent.

To regain upward momentum, Swissblock emphasized that BTC would need to reclaim $115,200 to challenge recent resistance levels. Conversely, falling below $110,000 would open the path toward a potential $100,000 target, intensifying near-term downside risks.

The upcoming options expiry event, valued at approximately $17.5 billion, adds to market pressure, with $110,000 seen as a potential “max pain” zone that could trigger significant liquidations and volatility.

Trader analysis suggests that the market is heavily skewed with short positions, raising the likelihood of a short squeeze. Data from TheKingfisher highlights the dominance of short interest across major cryptocurrencies like Bitcoin, Ethereum, and Avalanche, with liquidations potentially fueling a bounce higher.

“$AVAX short-side is 96.2% of pending liquidations. $ETH at 78.3%. $BTC at 69.4%. This buildup of liquidations acts as a magnet for price,”

This situation could set the stage for a sharp reversal, especially if traders’ short positions are forcefully liquidated in a market looking for a catalyst to push higher.

This analysis underscores the importance of monitoring key support levels and the liquidity landscape, especially given the evolving nature of crypto regulation, DeFi markets, and the increasing prominence of NFTs in the broader blockchain ecosystem.