Bitcoin (BTC) traded lower against gold in January, sparking renewed debate about whether current prices offer an appealing entry point ahead of a potential shift in crypto market dynamics. Historical parallels are frequently cited: during the 2015–2017 cycle, BTC climbed from roughly $165 to $20,000 in around two years, a gain of about 11,800%. The latest data suggest BTC may be testing a similar setup—at a time when macro conditions and sentiment toward risk assets remain in flux. Bitwise Europe’s data on the BTC/XAU ratio highlighted a rare moment when the digital asset’s value, after adjusting for global liquidity, approached levels associated with major bottoms in prior cycles.

The ratio’s trajectory has drawn attention from technicians and strategic investors alike. A decline toward the -2 z-score zone on Bitwise Europe’s chart has historically marked periods of extreme undervaluation, coinciding with capitulation or significant turning points. That framing underpins the argument that Bitcoin could be poised for a substantial reevaluation, particularly if fresh capital begins to move away from traditional hedges like gold and into risk-on assets again. The prevailing line of thought is that BTC’s repricing would reflect a broader rotation rather than a one-off spike—an idea that has gained traction among several market observers.

“Today represents a better opportunity to be buying Bitcoin than 2017.”

The front line of debate, however, remains the pace and certainty of any rotation. Some analysts say capital may trickle from gold into Bitcoin over the course of February or March, driven by a confluence of factors including BTC’s relative value and selective appetite for risk assets. Notably, Bitwise European researchers and others have argued that such a rotation could begin even as gold continues its own strength in a broader macro backdrop. Among the voices in this discourse are André Dragosch and Pav Hundal, who have suggested that discounted BTC setups could reemerge as buyers re-enter the market. The sentiment is cautious—rotation is not guaranteed, and timing remains uncertain as traditional markets wrestle with macro signals and liquidity conditions.

The broader backdrop includes a divergence in performance between the yellow metal and BTC. Gold has been buoyant, with some forecasters predicting further strength in the coming months, while Bitcoin has struggled with a January pullback. Citi has projected a potential rise in silver, supported by demand dynamics in China and a softer U.S. dollar, while RBC Capital Markets has offered a more optimistic long-range forecast for gold, suggesting a potential rise to around $7,000 per ounce by the end of 2026. Against that setting, the case for a Bitcoin rotation into discounted levels grows more nuanced, hinging on how investors interpret inflation dynamics, liquidity, and the evolving narrative around digital assets as a strategic hedge or a risk asset.

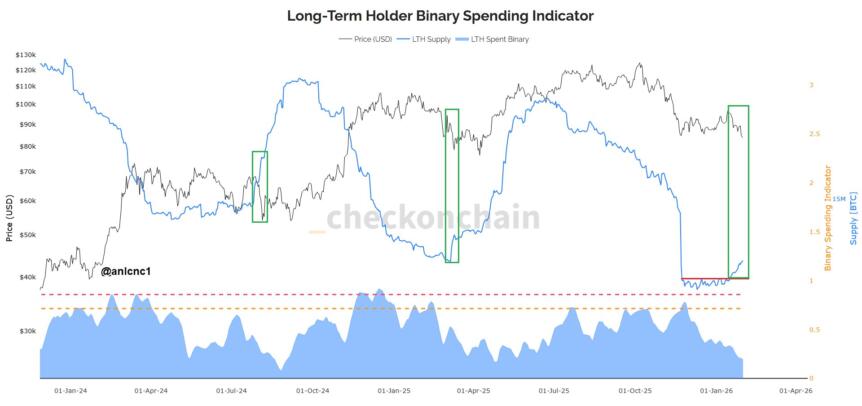

Analysts also note that the January sell-off did not uniformly wipe out confidence in Bitcoin’s longer-term thesis. Indeed, long-term holders have started to rebuild positions even as the price retreated. The LTH (Long-Term Holders) supply—capturing addresses that have held BTC for more than 155 days—began to recover during the downturn, signaling that patient investors remained willing to accumulate. A companion indicator, the LTH Spent Binary, which tracks whether long-term holders are cashing out or continuing to hold, continued its downward sweep, hinting that selling pressure among this cohort was waning. The historical pattern suggests that replenishing LTH supply and a falling Spent Binary often precede durable price basements and subsequent recoveries, a narrative supported by prior cycles where calmer distributions preceded sharp rebounds.

On-chain data, therefore, paints a more nuanced picture: even as the price moved lower, long-term holders absorbed the January sell-off, and the market watcher community looks for a foundation that could support a recovery. Anil, a market analyst who has tracked these patterns across multiple cycles, noted that in past periods of similar LTH behavior, BTC often found a resilient floor and then advanced once holders regained confidence. The April 2025 lows, for instance, provided a case study where LTH supply rebounded ahead of a roughly 60% rally in the following weeks, underscoring the potential power of patient accumulation to reshape the trend after a reset.

Why it matters

What makes this rotation debate important is its potential impact on how capital allocates across the crypto ecosystem and traditional assets. If a meaningful portion of capital begins to move from gold into BTC, it could reframe Bitcoin’s narrative from a speculative risk-on asset to a more balanced hedge or store-of-value instrument, depending on the macro regime. The on-chain signals—LTH accumulation and a shrinking LTH Spent Binary—offer a structural read that longer-term holders are building a base, even as spot prices retreat. For traders, this combination of macro cues and on-chain behavior could translate into a selective dip-buying opportunity rather than a wholesale entry point, particularly if February and March bring supportive liquidity and clearer catalysts.

From a market context perspective, the rotation thesis sits within a broader environment characterized by a crosscurrents of risk appetite, liquidity cycles, and evolving macro expectations. The gold rally has been a persistent feature of recent years, signifying its ongoing status as a hedge instrument for many investors. At the same time, the crypto market continues to attract capital through selections such as BTC’s supply dynamics and changes in investor sentiment toward risk assets. The tension between gold’s relative strength and BTC’s price action helps explain why many analysts describe the January pullback not as a definitive end to the bull case but as a potential recalibration that could set the stage for durable upside if holders’ confidence persists and the rotation unfolds in a measured way.

What to watch next

- February–March catalysts for a BTC-to-gold rotation and any shifts in liquidity conditions that could support a sustained reallocation.

- Changes in LTH supply and the LTH Spent Binary metric, which historically signaled the formation of robust BTC bottoms in prior cycles.

- Updates to Bitwise Europe’s BTC/XAU ratio data and any new confirmations of a bottoming pattern from on-chain analytics firms.

- Macro developments affecting gold and fiat liquidity, including policy signals and inflation expectations, that could influence hedging behavior.

Sources & verification

- Bitwise Europe BTC/XAU ratio data and the associated z-score context cited in market commentary.

- Public posts and market interpretations by Michaël van de Poppe on social media regarding buying opportunities in BTC.

- On-chain analysis and commentary from CheckOnChain.COM regarding Long-Term Holders and the LTH Spent Binary indicator.

- Cited market commentary on gold and silver price trajectories from Citi and RBC Capital Markets, as referenced in the analysis.

- Historical references to BTC performance during earlier cycles and the April 2025 lows as a precedent for LTH-driven rebounds.

Bitcoin vs. gold: rotation signals and implications

Bitcoin (CRYPTO: BTC) is entering a period where the relative value against gold (XAU) is scrutinized for clues about the market’s next major move. The currency’s price action in January, when BTC slipped further against gold after adjusting for liquidity, has become a focal point for traders seeking an inflection signal. Data from Bitwise Europe showed the BTC/XAU ratio approaching a historically meaningful extreme, a configuration that has historically preceded substantial BTC recoveries when market psychology shifts and risk appetite stabilizes. The charting narrative centers on a Z-score that has briefly slid into territory associated with major market bottoms, suggesting to some that BTC may be consolidating its position before a broader breakout.

Historical memory plays a role in how these conditions are interpreted. The most cited comparison looks back to the 2015–2017 bear-to-bull transition, during which BTC moved from roughly $165 to $20,000 within two years after a period of deep undervaluation relative to gold and other assets. The implication is not a guaranteed immediate upside, but rather a setup in which patient holders and disciplined buyers can position themselves ahead of a potential repricing. A popular tweet from a market commentator captured the mood: the current moment, according to the analyst, represents a better buying opportunity than in 2017 when the cycle began gaining momentum. While not a forecast, the sentiment underscores a belief that BTC could realize a more pronounced recovery if rotation from gold begins to take hold in the coming weeks.

On-chain observers emphasize that the January drawdown did not erase long-term conviction. The ongoing rebound in Long-Term Holders’ supply—addresses that have kept BTC for more than 155 days—paired with a continued decline in the LTH Spent Binary, points to a patient cohort that may be prepared to support a multi-month basing process. These structural dynamics matter because they can underpin a more durable ascent once price action aligns with macro and liquidity trends. Past cycles have shown that a base built by patient holders often precedes sizable upside, even when sentiment remains cautious in the near term. The narrative remains contingent on broader market conditions, yet the on-chain signals provide a level of confidence for those who view BTC as a longer-term play rather than a short-term speculator’s bet.

The rotation thesis is reinforced by a balancing of expectations around gold’s performance. While gold has appreciated over the past year, the pace and persistence of that strength are debated, with some analysts predicting continued gains driven by demand dynamics and currency weakness, and others warning that gold’s upside could be tempered by shifting macro factors. The reality is that the path from rotation signal to actual capital flow is rarely linear; it often requires a confluence of favorable liquidity, a stabilizing macro backdrop, and a narrative that convinces investors to shift weight from one hedge to another. In such an environment, Bitcoin’s fundamentals—particularly the resilience of on-chain holders and the evolution of market sentiment—could tip the balance toward a more sustained recovery if February and March reveal concrete catalysts and improved market conditions.

Overall, the January weakness has introduced a potential reset that could set the stage for a broader recalibration of BTC’s role in portfolios. It is a reminder that the crypto market remains sensitive to macro shifts, and that rotations—whether into BTC from gold or into other risk-on assets—depend on a complex mix of liquidity, investor psychology, and the evolution of on-chain signals. The coming weeks will be telling as market participants weigh these diverse factors and decide whether the current configuration marks the beginning of a durable baseline or a stepping stone to another leg down before the next leg up.