Bitcoin Magazine

Is Bitcoin Price Performance in 2025 Mirroring the 2017 Bull Cycle?

Following its unprecedented spike above $100,000, the Bitcoin price has taken a downward turn over several weeks. This unsettling shift has sparked discussions about whether Bitcoin’s trajectory is still paralleling that of the 2017 bull market. In this analysis, we will delve into the metrics and examine the current price behavior of Bitcoin in relation to past market uptrends, offering insights into what may be on the horizon for BTC.

Comparing Bitcoin Price Movements in 2025 to the 2017 Bull Cycle

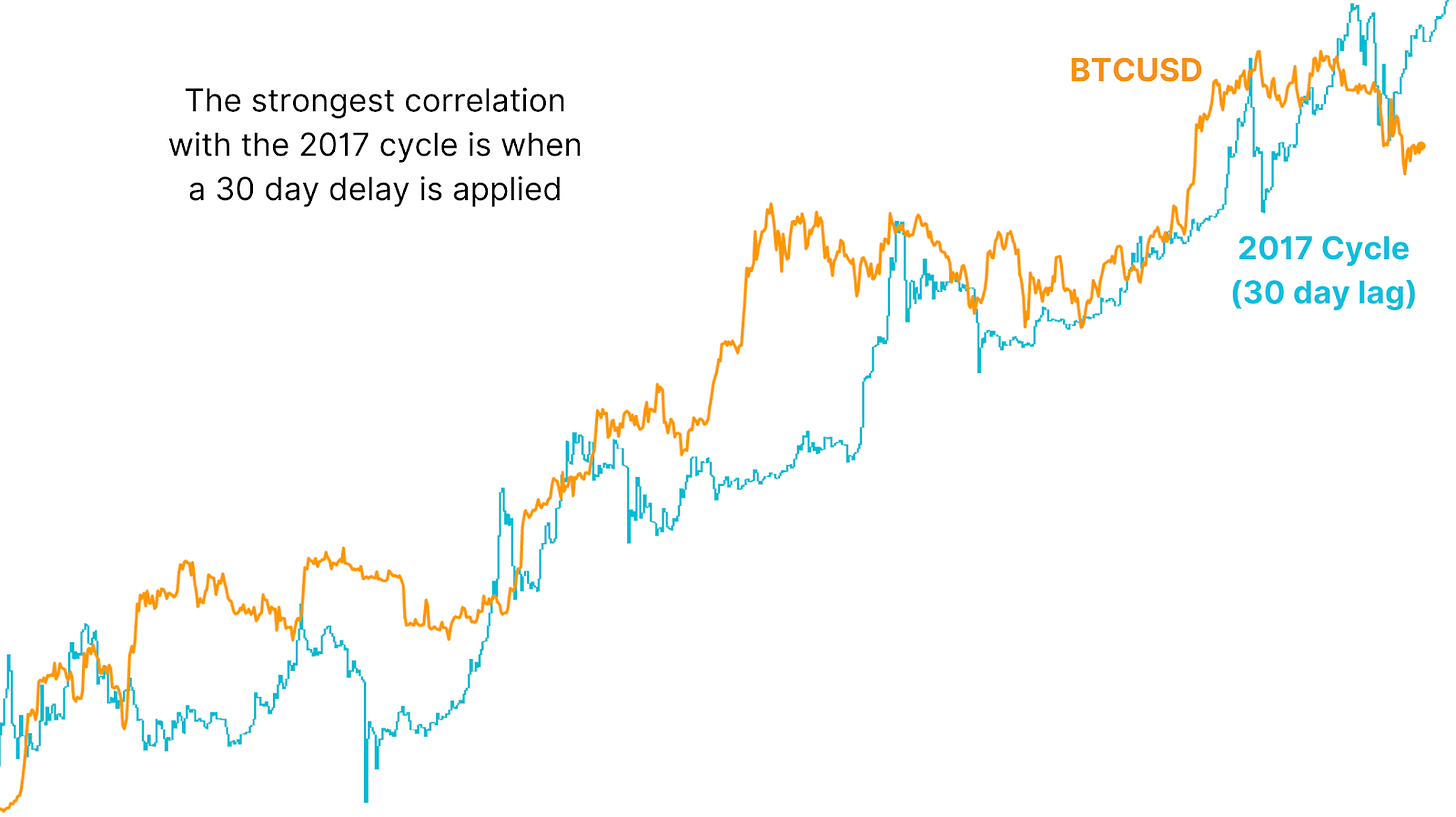

Since the lows experienced during the 2022 bear market, Bitcoin’s price trajectory has paralleled the remarkable growth witnessed from 2015 to 2017, a period that peaked with Bitcoin hitting $20,000 in December 2017. However, the recent downtrend marks a significant deviation from the patterns observed in 2017. If Bitcoin were indeed mirroring the earlier market cycle, we would have seen a rally towards new all-time highs in the past month. Instead, Bitcoin’s price has been largely stagnant or declining, indicating a weakening of the previous correlation.

Despite this recent divergence, the historical correlation between Bitcoin’s current market cycle and that of 2017 remains remarkably strong. Earlier in this year, the correlation stood at approximately 92%. The latest downward trend has slightly decreased this figure to around 91%, still indicating a very robust connection for financial markets.

Bitcoin Market Dynamics Reflecting 2017 Cycle Patterns

The MVRV Ratio serves as a vital metric reflecting investor sentiment. It assesses the discrepancy between Bitcoin’s current market price and the average acquisition cost of all Bitcoin held within the network. A rapid increase in the MVRV ratio suggests that many investors are realizing significant unrealized gains, often preceding market peaks. Conversely, when the ratio falls toward the realized price, it indicates that Bitcoin’s price is aligning closely with the average purchase price, frequently marking a bottoming out phase.

The recent drop in the MVRV ratio reflects Bitcoin’s setback from its peak values. Nevertheless, the MVRV ratio continues to exhibit structural similarities with the 2017 cycle, characterized by an early bull market surge followed by sharp corrections, resulting in an 80% correlation.

Assessing Bitcoin’s Price Correlation with 2017 Bull Cycle Metrics

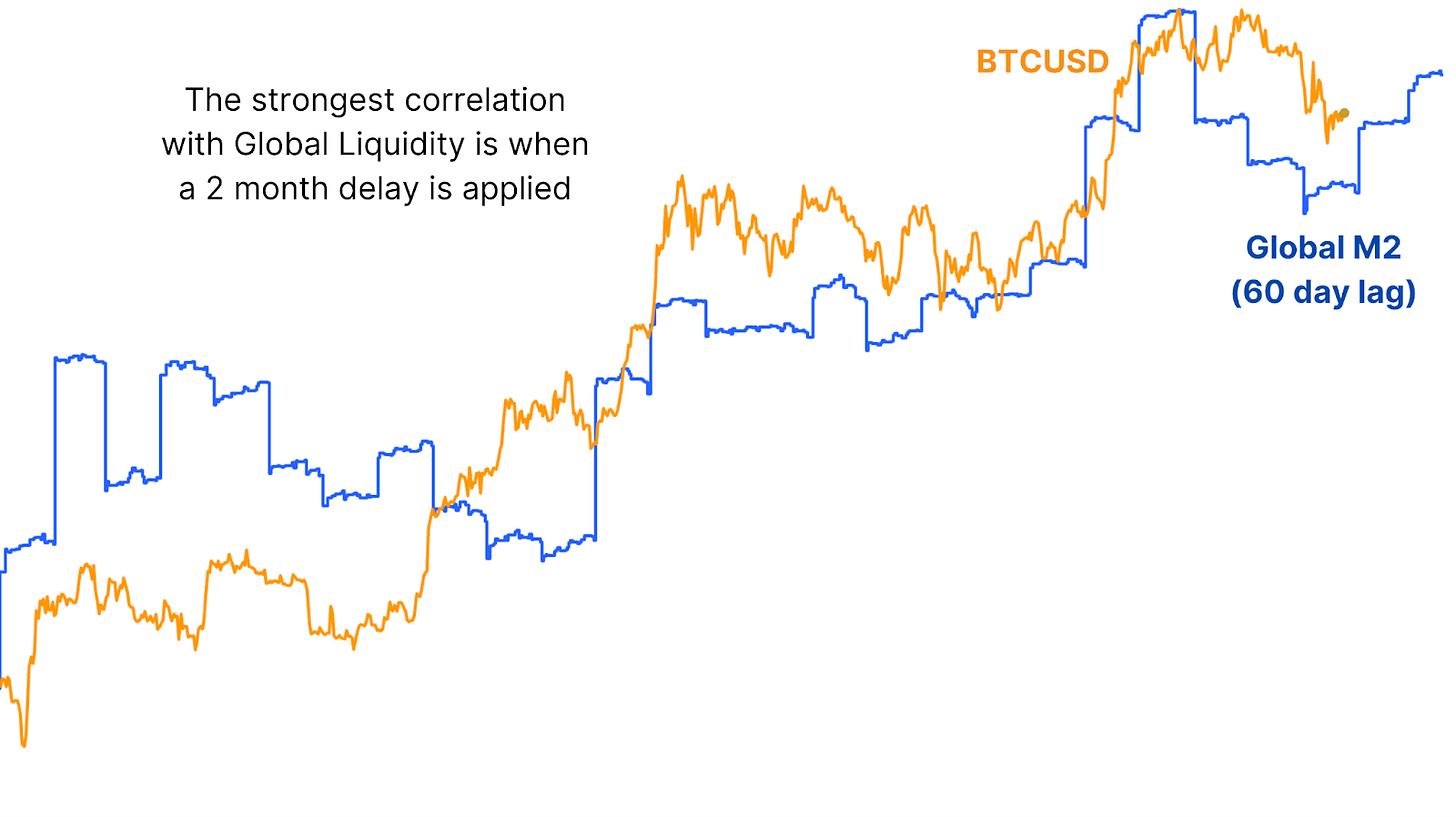

One potential reason for the recent divergence might be attributed to a data lag. Bitcoin’s price movements have demonstrated a strong linkage with Global Liquidity, which encompasses the total money supply in leading economies; however, historical data indicates that liquidity fluctuations tend to impact Bitcoin price action with a delay of approximately two months.

By introducing a 30-day lag to Bitcoin’s price trajectory in relation to the 2017 cycle, the correlation improves to 93%, potentially marking the strongest linkage recorded between the two cycles. This lag-adjusted model hints that Bitcoin may soon realign with the 2017 trajectory, suggesting an impending major price surge.

Interpreting 2017 Bull Cycle Indicators for Bitcoin’s Price Today

While history may not repeat itself precisely, it often echoes through time. Bitcoin’s current phase may not replicate the exponential gains witnessed in 2017, yet the market sentiment appears strikingly similar. Should Bitcoin reestablish its correlation with the lagging trends of the 2017 cycle, historical insights suggest a potential recovery from the ongoing downturn, paving the way for a significant bullish move.

Stay informed about Bitcoin’s price movements, live data, and analytical resources by visiting Bitcoin Magazine Pro.

Disclaimer: This article is intended for informational purposes only and should not be regarded as financial guidance. Always conduct your independent research prior to making investment choices.

This post Is Bitcoin Price Performance in 2025 Mirroring the 2017 Bull Cycle? first appeared on Bitcoin Magazine and is authored by Matt Crosby.