Ethereum’s Layer-2 ecosystem continues to evolve, with Aztec launching its mainnet Wednesday. Although currently functional only in a limited capacity, this milestone marks Aztec’s transition toward a fully decentralized network. The launch underscores the growing emphasis on privacy-focused solutions and decentralization within the blockchain space, fueling momentum around secure and autonomous scaling solutions for the crypto markets.

- Aztec has launched its “Ignition” mainnet, a trustless, partially functional Ethereum layer-2 network focused on privacy and decentralization.

- The protocol has renounced ownership of its core contracts, making it one of the few fully community-launched L2s in Ethereum’s ecosystem.

- Aztec staking has gone live, enabling token holders to participate in network consensus and earn rewards, with the current staked amount at 107.2 million AZTEC tokens.

- The ongoing token sale has raised over $2.7 million from whitelisted community members, with tokens slated for lockup periods of up to 12 months.

- Aztec aims to bootstrap liquidity with a Uniswap pool launching soon, while its fully diluted valuation is estimated at around $310 million based on the current token price.

Aztec, a blockchain project focusing on privacy-preserving transactions and decentralized finance (DeFi) on Ethereum, announced the launch of its mainnet Wednesday. The initial version, dubbed “Ignition,” is a consensus-producing chain capable of generating blocks but lacks the smart contract execution layer. This phased approach fuels anticipation for a fully decentralized network, distinguishing Aztec from many other layer-2 solutions that often rely on centralized operators.

According to data from L2Beat, only a handful of Ethereum layer-2 systems—in particular Facet v1 and Aztec’s former DeFi anonymization project, Zk.Money—are classified as fully decentralized, stage 2 systems. Aztec’s ownership of its rollup contract has been renounced, placing it among the few protocols with no centralized control or dependency on operators, requiring users or third parties to maintain the rollup system independently.

“Neither the Aztec Foundation, core team, nor investors can run nodes, stake, or participate in governance for the next 12 months,” the team explained in an email to mailing list subscribers. “This makes Aztec the first community-launched L2 in Ethereum history.”

While Aztec has not yet responded to inquiries, its open-source and community-driven approach emphasizes decentralization as a core principle. The network’s current focus includes staking activation, allowing token holders to participate in securing and governing the network.

Aztec staking goes live

Staking is now active for AZTEC token holders, enabling them to partake in network consensus mechanics, earn block rewards, and influence governance decisions. Early stakeholders are incentivized with higher rewards, as their contributions are crucial during the initial phases of network bootstrapping.

The staking dashboard shows approximately 107.2 million AZTEC tokens staked, primarily sourced from the initial genesis sale, which was targeted at community members to kickstart the mainnet. Importantly, both investors and the development team are currently excluded from staking activities.

The minimum staking amount is set at 200,000 AZTEC tokens, roughly $6,000 at current prices, which aligns with the ongoing community-only phase of token distribution. Demand, however, could push the value of AZTEC tokens higher if trading appetite increases beyond this baseline.

Token sale and future plans

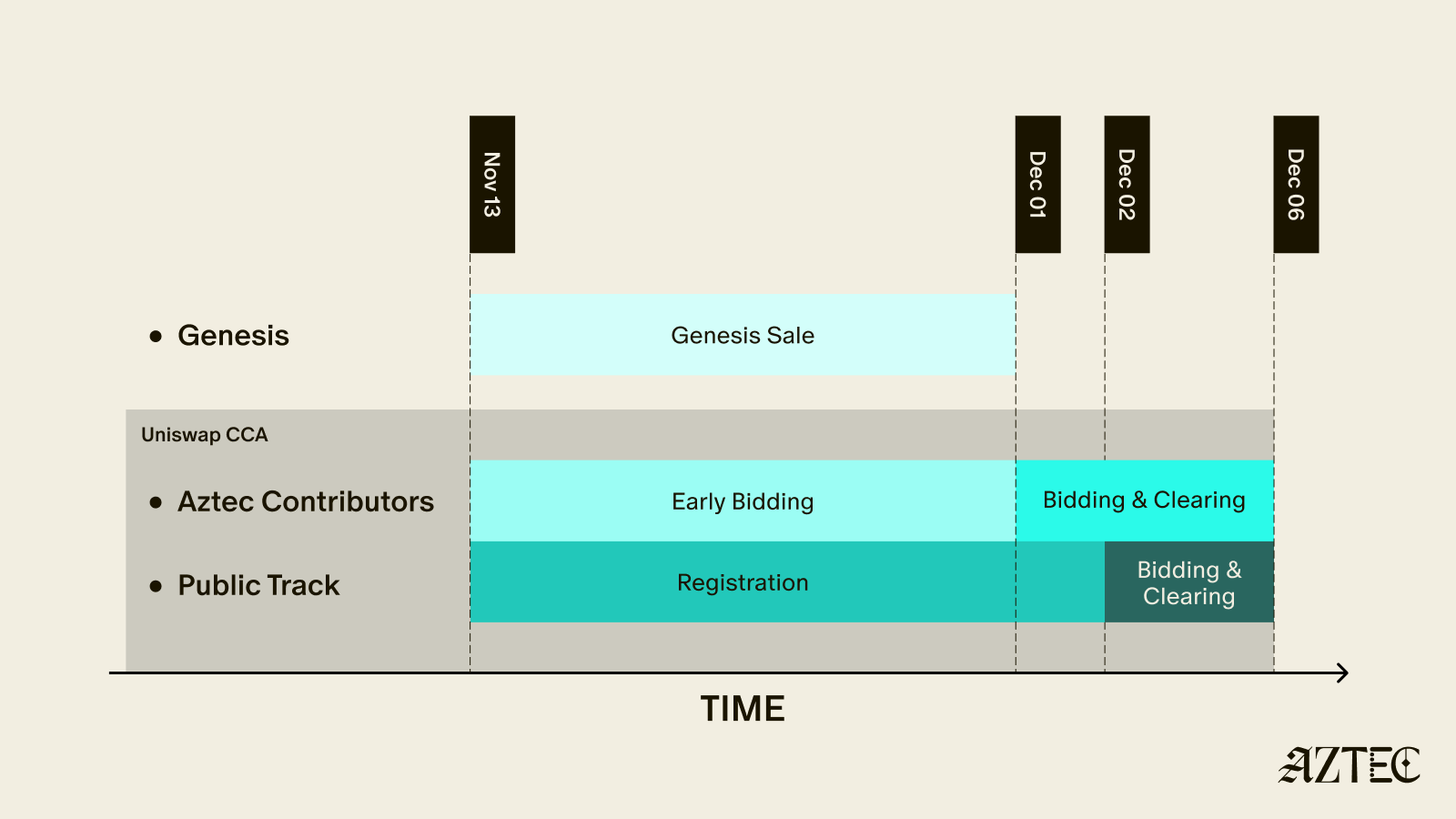

Aztec’s current token sale phase is restricted to whitelisted community members, with over $2.7 million raised from 2,209 bids since Nov. 13. The sale is scheduled to close on Dec. 1, with a subsequent public phase opening on Dec. 2. Participants will acquire tokens with lockup periods ranging from 90 days to a year, depending on community vote.

The tokens, which will amount to nearly 1.55 billion, represent about 15% of total supply, with a discounted initial price of roughly $0.03 per AZTEC—an attractive valuation compared to previous funding rounds that totaled over $119 million from prominent backers like Vitalik Buterin, Coinbase Ventures, Paradigm, and Andreessen Horowitz.

The project’s fully diluted valuation stands at an estimated $310 million, based on current token prices. On Dec. 6, a Uniswap liquidity pool holding 273 million AZTEC tokens (about 2.6% of total supply) will launch, aiming to facilitate secondary trading while ensuring some tokens remain unvested.