In recent comments, Binance CEO Richard Teng has highlighted that Bitcoin’s volatility mirrors that of traditional major asset classes, challenging the common perception of cryptocurrencies as exceptionally volatile. As the crypto market experiences fluctuations, Teng offers a perspective that aligns crypto price swings with broader financial market trends, suggesting a maturing asset class amid ongoing market adjustments.

- Binance CEO Richard Teng states Bitcoin’s volatility aligns with traditional assets during market cycles.

- Recent Bitcoin decline driven by investor deleveraging and risk aversion, similar to other assets.

- Bitcoin’s current price hovers just above $82,000, down nearly 35% from October’s all-time high.

- Despite dips, Bitcoin remains more than double its 2024 valuation, showing resilience.

- Bitcoin’s volatility has decreased significantly since 2013, now more comparable to traditional markets.

Market Behavior and Investor Sentiment

During a media roundtable in Sydney, Teng explained that the recent downturn in Bitcoin prices was largely propelled by investor deleveraging and a global mood of risk aversion. “What you’re observing isn’t unique to crypto; it’s part of broader asset class cycles,” Teng remarked. Despite the recent decline, Bitcoin trades just above $82,000, representing a nearly 35% drop from its record-high of over $126,000 on October 6. The overall crypto market capitalization has fallen to around $2.84 trillion from its peak of $4.28 trillion, reflecting widespread corrections across digital assets.

While the sector faces volatility, Teng emphasized that Bitcoin’s current levels are still notably higher than past years. “Over the last 1.5 years, the crypto market has delivered outstanding performance, so a pause for consolidation is healthy,” he stated.

“Any consolidation is actually healthy for the industry, providing a breather to find its footing.”

Bitcoin Volatility Compared to Traditional Markets

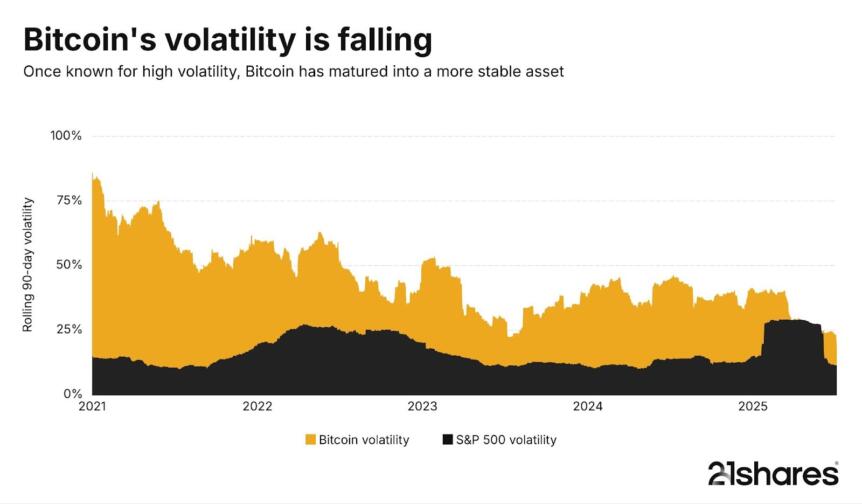

Teng’s assertion that Bitcoin’s volatility now aligns with other major asset classes prompts debate. Data shows that Bitcoin’s 60-day volatility in 2025 has fluctuated from around 1% to nearly 2.44%, as per BitBo. Historically, Bitcoin was known for much higher volatility; for example, in 2013, annualized volatility hit 181%, and in recent years, it has fallen to around 23%, according to 21Shares research.

Comparatively, during recent market turmoil, the S&P 500’s annualized volatility briefly surpassed Bitcoin’s but has since stabilized. Currently, Bitcoin’s annualized volatility stands above 50%, according to V-Lab, significantly higher than the S&P 500’s 15%. Outliers such as Tesla and AMD exhibit higher volatility figures—Tesla over 65%, AMD at 73%—but these are exceptions within traditional financial markets.

Overall, the trend indicates Bitcoin’s volatility is converging with that of well-established traditional assets, supporting its evolution as a more mainstream financial instrument—despite occasional spikes during turbulent periods.