Bitcoin experienced notable volatility last Friday, as fresh U.S. inflation data influenced both crypto and traditional markets. With a cooler-than-expected Consumer Price Index (CPI), investor optimism surged, boosting risk assets and pushing US stocks toward new record highs. This development has profound implications for the outlook of cryptocurrency markets and the broader economic landscape.

- Bitcoin’s price action remains volatile following a lower-than-anticipated CPI report.

- Market sentiment shifts towards expectations of continued interest rate cuts by the Federal Reserve through 2026.

- Bitcoin faces resistance at $112,000, with key support levels beginning to re-emerge amid positive macroeconomic signals.

Bitcoin (BTC) showed significant fluctuations on Friday as U.S. inflation data bolstered investor confidence, pushing stocks to fresh all-time highs. The cryptocurrency market responded to the release of the September Consumer Price Index (CPI), which came in below expectations, fueling hope for more easing measures from the Federal Reserve.

CPI Relief Sparks New Highs for US Stocks

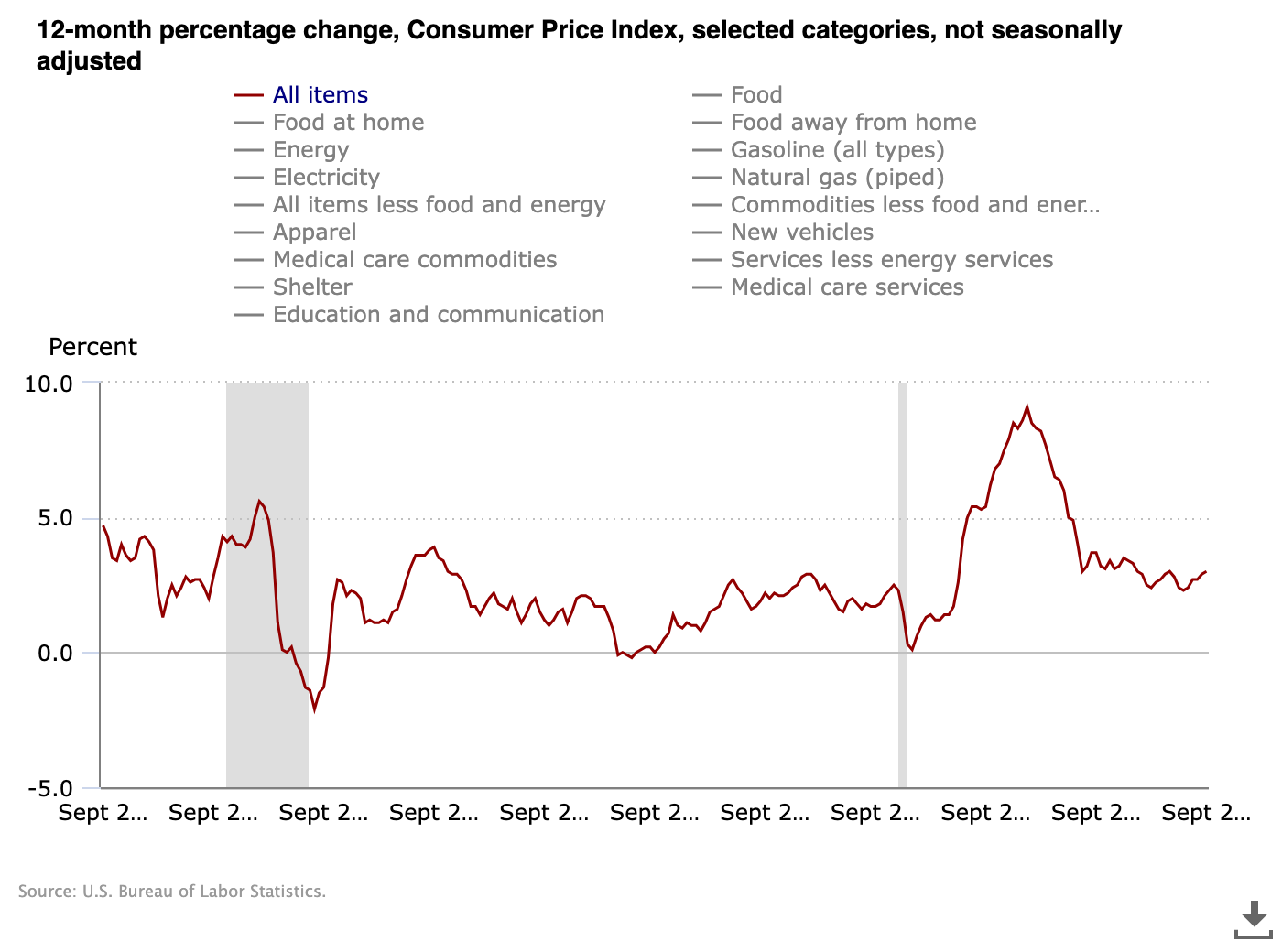

The CPI data revealed that both the headline and core inflation metrics dipped by 0.1%, hovering around 3%, according to an official Bureau of Labor Statistics release. These figures exceeded expectations, prompting a bullish response in markets and raising expectations for potential interest rate cuts in the near term.

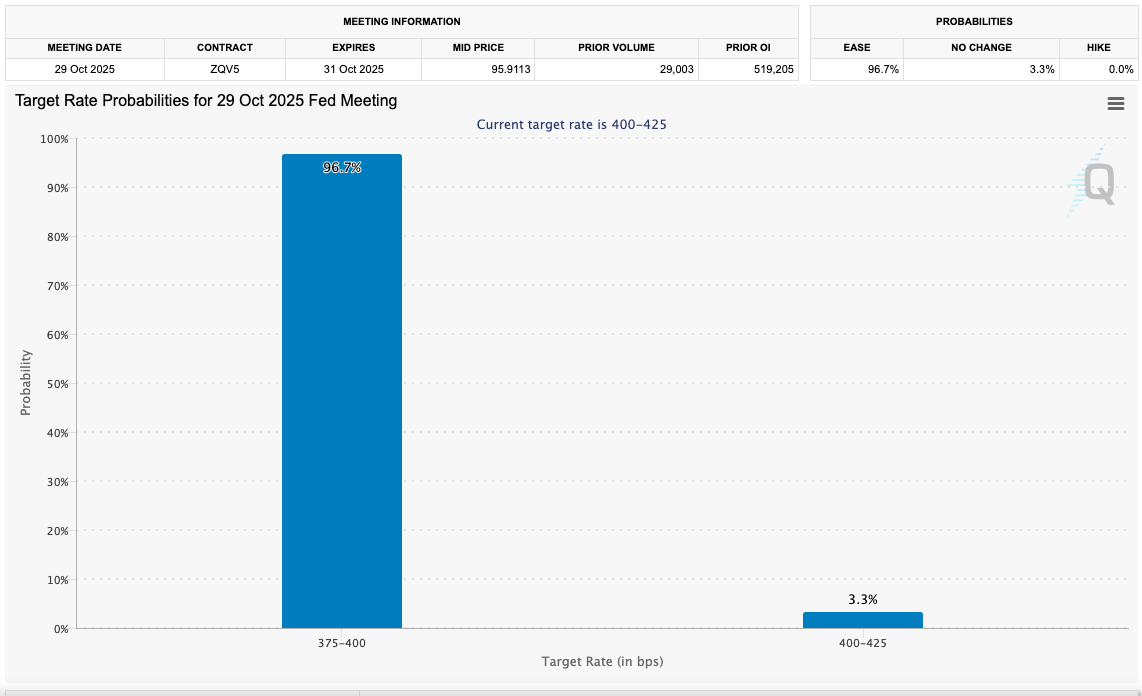

Reacting to the data, The Kobeissi Letter noted that the figures “pave the way for another Fed rate cut next week.” Markets showed strong momentum, with the S&P 500 reaching new heights. The CME Group’s FedWatch Tool indicated overwhelming odds of a 0.25% rate reduction at the upcoming October FOMC meeting.

Further analysis by Mosaic Asset Company highlighted that loose financial conditions—fueled by expected rate cuts—are likely to support continued economic growth and corporate earnings, which could sustain a rally into next year.

“That should be supportive for the economy and corporate earnings backdrop, which is necessary to drive the rally into next year.”

Bitcoin Struggles Despite Optimism

Despite the positive macroeconomic indicators, Bitcoin’s price faced selling pressure at market open. Traders remain cautious, citing limited buy support below current levels. Notable market participants, including Exitpump on Twitter, warned that thin bid sides on perpetual contracts could lead to sharp declines if selling accelerates.

$BTC Thin bid side on perps orderbook btw, can dump quickly pic.twitter.com/udWTGVJuq

— exitpump (@exitpumpBTC) October 24, 2025

Trade data from CoinGlass indicated significant liquidation risks around $110,000, as traders positioned themselves on laddered bids, signaling potential support zones but also heightened volatility risks. Meanwhile, technical analysts like Caleb Franzen emphasized the importance of key exponential moving averages (EMAs). Reclaiming these levels—specifically the 21, 55, and 200-day EMAs—is viewed as vital for future bullish momentum.

While Bitcoin’s rebound from the 200-day EMA is encouraging, analysts agree that a decisive break above the retest levels around the 21 and 55 EMAs is crucial to confirm a sustained rally, especially amid ongoing volatility in the crypto markets.

This dynamic market environment underscores the influence of macroeconomic factors, technical support levels, and market sentiment on the evolving landscape of cryptocurrency investments and regulation.