Bitcoin experienced its most significant correction of the current bull market on Monday, falling by 26.7%. This steep decline edged out the April correction of 26.5%, signaling potential exhaustion in recent market volatility. Analysts suggest that this pronounced dip might mark the final phase of leverage unwinding, potentially setting the stage for a renewed recovery.

- Bitcoin’s 26.7% decline marks the largest correction of the current cycle.

- The Crypto Fear & Greed Index remains in ‘Extreme Fear,’ possibly indicating a buying opportunity.

- Market stress indicators suggest elevated but not critical levels of volatility.

- Historical data shows that extreme fear frequently precedes strong Bitcoin rebounds.

- On-chain signals point to capitulation among short-term holders, hinting at a potential bottoming process.

“Extreme fear” often precedes profitable Bitcoin rebounds

Following Monday’s sharp downturn, Bitcoin’s local stress index remained elevated at 67.82, according to market analyst Axel Adler Jr., surpassing the WATCH threshold of 64 but not reaching levels typically associated with system breakdowns. Realized volatility on the day surged to a 4.55 Z-score, flagging heightened market stress and aggressive selling activity.

Over the last 24 hours, the stress index has eased into the 62–68 range, yet the short-term slope of +2.62 hints at ongoing volatility pressures. Meanwhile, the Crypto Fear & Greed Index remains in extreme fear territory, registering just 15—an area historically associated with strong upcoming gains. Past cycles reveal that when the index dips to this level, Bitcoin tends to generate substantial returns in the following weeks and months, with average gains of 10% over a week and maintaining momentum into 15–30 days. Six-month returns can reach 33%, highlighting the potential for a retracement after intense fear phases.

Economist Alex Kruger notes that historically, in all 11 capitulation events since 2018 where the index hit extreme lows, brief periods of weakness were followed by rebounds, reinforcing the idea that extreme fear can be a reliable indicator of an imminent turnaround.

Crypto analyst Victor David characterizes the recent decline as a downside range typical of late-stage market flushes, rather than signaling an overarching top of the cycle.

On-chain data indicates deeper capitulation among short-term holders, but signs point to a potential bottom

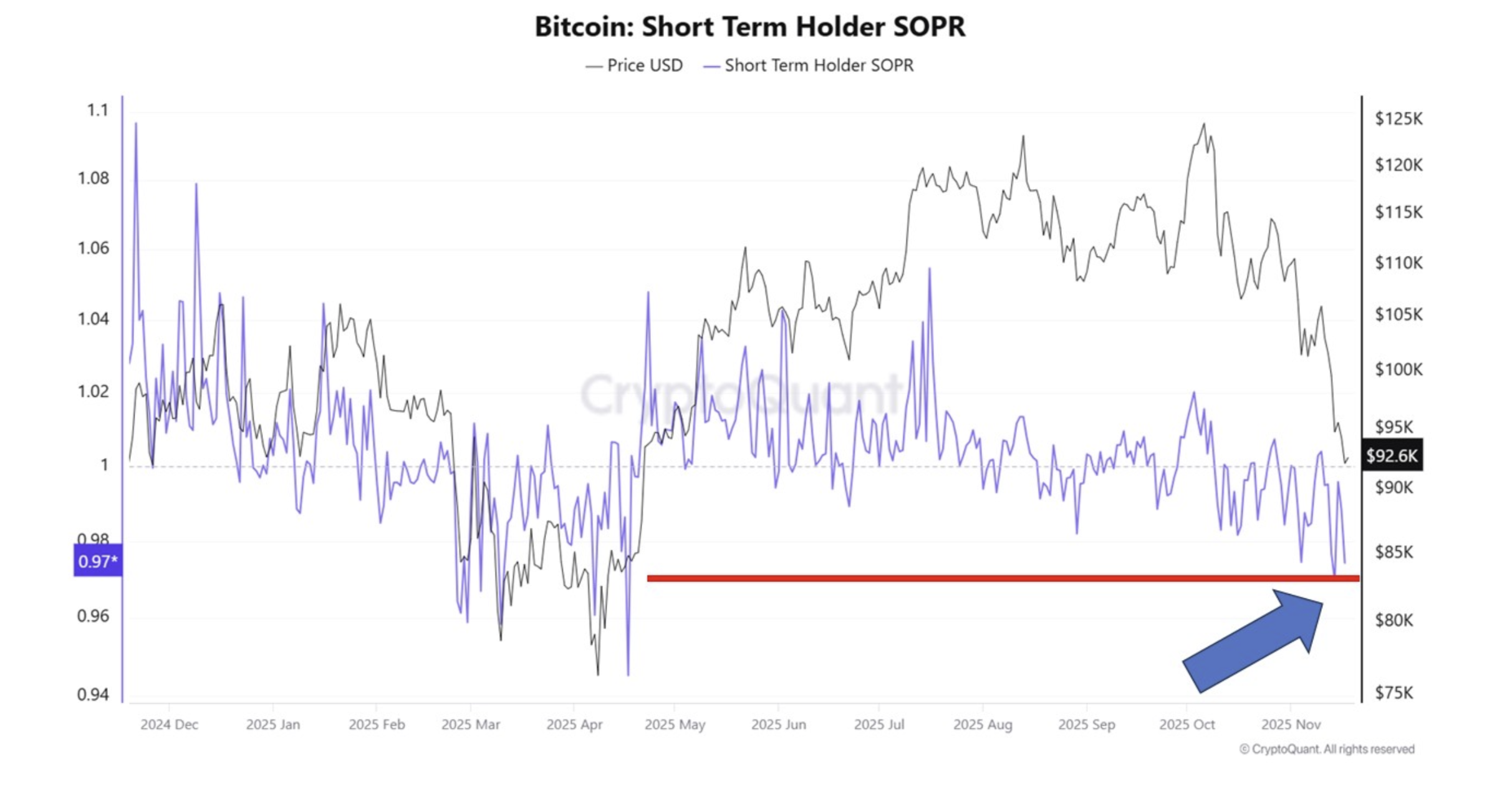

New on-chain analysis reveals Bitcoin is experiencing one of its most severe short-term holder (STH) capitulation phases of this cycle. The short-term profit ratio (SOPR) has fallen back to 0.97, implying STHs are predominantly selling at losses—a sign often associated with capitulation and market bottoms.

Similarly, the STH-MVRV ratio has dipped well below 1.0, indicating that most recent buyers are underwater—another hallmark of panic selling and weak hands liquidating their positions. The transfer of approximately 65,200 BTC to exchanges at a loss underscores active fear-driven selling.

While such signals do not guarantee an immediate market reversal, the combination of low SOPR, deeply negative MVRV levels, and increased exchange inflows at a loss suggests the current correction could be nearing its end, paving the way for a possible recovery in the coming weeks.

Related: Saylor dismisses concerns over Wall Street’s impact on Bitcoin during recent crash

This article does not contain investment advice. The cryptocurrency markets are volatile, and traders should perform their own research before making any decisions.