Bitcoin’s recent sharp decline has caused US spot Bitcoin ETF investors to move into losses for the first time since these investment products launched. As Bitcoin’s price dipped below $90,000, the average cost basis across all US Bitcoin ETFs now sits near $89,600, leaving many investors underwater. This shift highlights the ongoing volatility and changing sentiment in the crypto markets, influenced by macroeconomic factors and risk-off trading environments.

- US Bitcoin ETF investors are now in the red for the first time since product launches, with the average cost basis near $89,600.

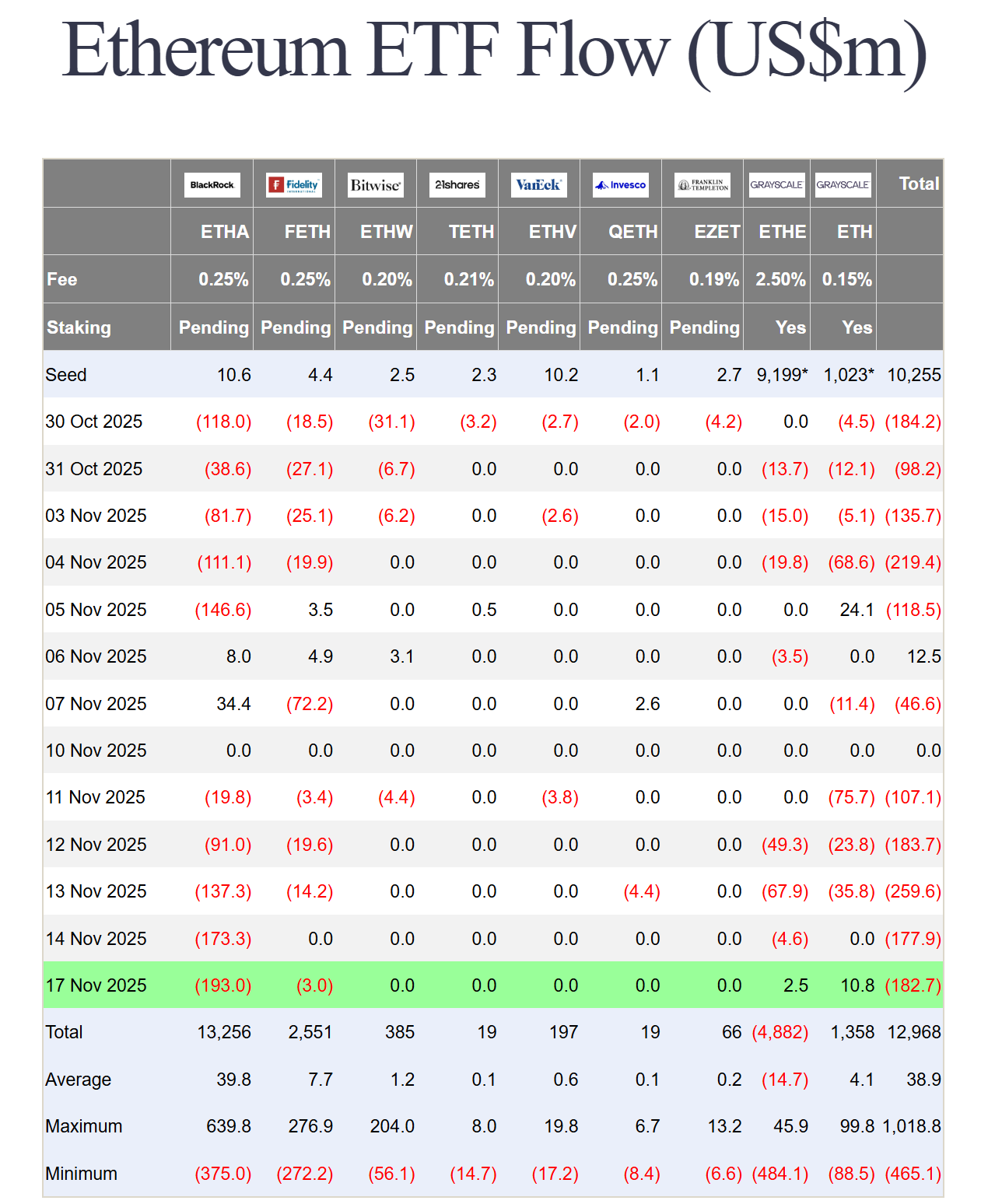

- Bitcoin and Ether ETFs are experiencing consistent outflows, marking a period of consolidating investor sentiment.

- Despite declines, some long-term investors remain profitable, especially those who entered during earlier bullish phases.

- Solana ETFs continue to gather inflows, defying broader market trends, with a cumulative net inflow of approximately $390 million.

Bitcoin’s swift decline has turned investor sentiment more cautious, with the current trading price around $89,500, according to data from CoinMarketCap. Analysts note that while many ETF holders are experiencing unrealized losses, long-term investors—particularly those who entered when Bitcoin was valued between $40,000 and $70,000—still remain in profit. The overall market tone remains sensitive to macroeconomic developments and liquidity conditions, which continue to influence cryptocurrency asset flows.

“Even with the average ETF cost basis above spot, most ETF holders are long-term allocators, so being underwater doesn’t automatically lead to quick sell-offs,” explained Vincent Liu, chief investment officer at Kronos Research. “In this risk-off environment, liquidity and macro cues are crucial. Tight conditions can exacerbate losses, while easing signals can restore confidence.”

Recent outflows underscore this trend. On Monday, US spot Bitcoin ETFs saw outflows totaling $254.6 million, according to Farside Investors. Leading the charge, BlackRock’s iShares Bitcoin Trust (IBIT) experienced $145.6 million in withdrawals, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) saw $12 million exit. Other notable outflows include ARK 21Shares Bitcoin ETF (ARKB) with $29.7 million and Bitwise Bitcoin ETF (BITB) with $9.5 million.

The outflows continue a streak that began on Nov. 12, when Bitcoin ETFs recorded $278.1 million in withdrawals, followed by an even larger $866.7 million loss on Nov. 13—the second-largest daily outflow on record. The trend persisted on Nov. 14, with an additional $492.1 million leaving these products. Ether ETFs also faced significant outflows, totaling $182.7 million on Monday, with BlackRock’s iShares Ethereum Trust ETF (ETHA) leading at $193 million in exits.

Market analysts suggest that a recovery may depend on clearer macroeconomic signals—such as disinflation, labor market resilience without breaking, and central bank policies tilting toward easing rather than tightening. “Once those signals align, liquidity can improve, volatility decrease, and flows may rotate back into crypto investment products,” Liu added.

Meanwhile, Solana-based ETFs have bucked the prevailing trend, continuing to see inflows for several consecutive days. On Monday, the Bitwise Solana Staking ETF (BSOL) secured $7.3 million in new capital, and Grayscale’s Solana Trust ETF (GSOL) added another $0.9 million. Since their late October launch, these funds have attracted roughly $390 million in cumulative net inflows, signaling strong investor interest in Solana’s ecosystem despite broader market declines.