- US spot Bitcoin ETFs experienced a third consecutive week of net outflows, totaling $1.1 billion.

- Bitcoin’s price declined by over 9.9% last week, falling to around $95,740 amid market correction concerns.

- Market analysts see signs of a “mini” bear market forming, with momentum waning and no clear catalysts for a rally.

- Despite outflows, Solana ETFs have achieved sustained inflows, defying overall market correction trends.

- Crypto markets are at a pivotal point, with macroeconomic factors and upcoming Federal Reserve policies likely to influence future trajectories.

US spot Bitcoin exchange-traded funds (ETFs) have experienced a challenging period, closing a third straight week in the red and intensifying concerns about a slowdown in one of Bitcoin’s most significant institutional demand channels. Last week alone, these ETFs experienced net negative outflows of $1.1 billion, representing their fourth-largest weekly outflow ever, according to data from Farside Investors. This mass exodus coincides with a sharp correction in Bitcoin’s price, which dropped over 9.9% during the same period, trading around $95,740 at the time of writing.

As Bitcoin faces these outflows, some analysts interpret the decline as part of an emerging “mini” bear market, reflecting diminishing momentum and the lack of new catalysts that might trigger a sustained rally. Crypto insights platform Matrixport highlighted that weakening ETF flows, reduced exposure from traditional investors, and macroeconomic conditions with no immediate triggers have made the market highly dependent on upcoming policy decisions from the Federal Reserve.

“Our data showed a market losing momentum and lacking the catalysts needed for a sustained rally,” wrote Matrixport in a recent post. “With ETF flows weakening, OG investors reducing exposure, and macro conditions offering no immediate catalyst, the path forward remains highly dependent on upcoming policy decisions from the Federal Reserve.”

The current crypto market environment remains at a critical juncture, with key price levels and macroeconomic factors poised to determine whether the trend continues downward or stabilizes. Investors are closely monitoring Federal Reserve policies and other macroeconomic triggers that could influence the next move in crypto markets, including Bitcoin, Ethereum, and alternative assets.

Despite the negative ETF flows and market correction, some bullish signals persist. US-based Bitcoin ETF inflows and investments from high-profile figures like Michael Saylor’s Strategy have been primary demand drivers throughout 2025, signaling ongoing institutional interest in cryptocurrency.

Related: Bitcoin ETFs bleed $866M in second-worst day on record, but some analysts remain bullish

Solana ETF inflows defy market gravity

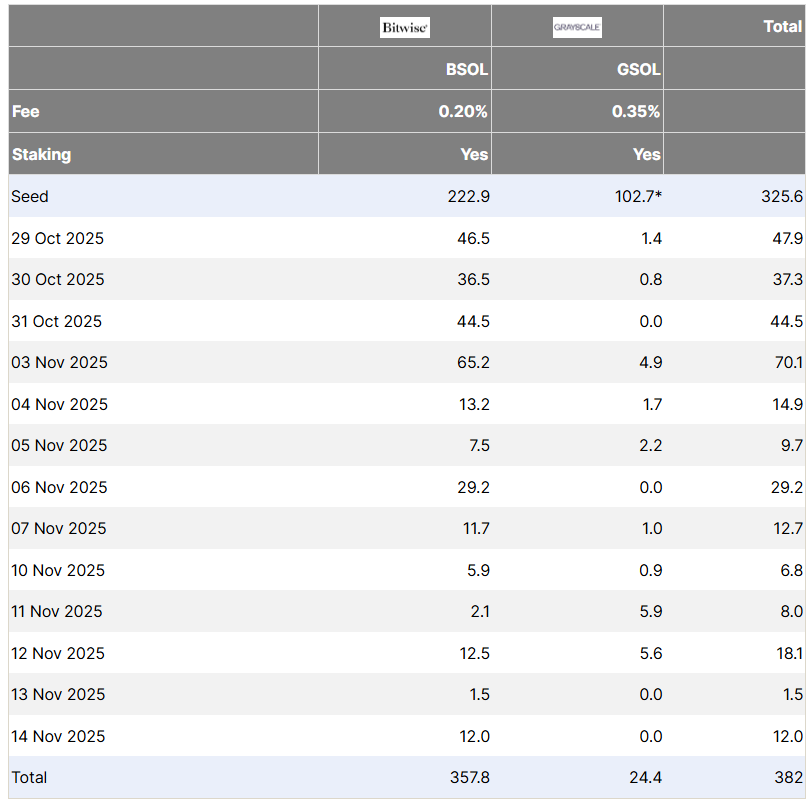

Meanwhile, Solana’s (SOL) ETFs have shown resilience, defying the broader crypto downturn with persistent positive inflows. Last week, Solana saw $12 million in ETF inflows, continuing a streak of 13 consecutive days of inflows since their launch on October 29.

In contrast, Ether (ETH) ETFs faced $177 million in outflows on Friday, marking their fourth consecutive red day. During the same period, Solana’s price declined by 15% over the week, and Ether’s dipped 11%, reflecting the volatility and divergent trends within the altcoin market.

Despite these ETF inflows, both Solana and Ether have experienced significant price declines, illustrating the complex interplay between institutional investment flows and market valuation in the rapidly evolving landscape of cryptocurrencies and DeFi projects.

For a deeper insight into crypto market trends and future predictions, industry experts emphasize the importance of macroeconomic conditions and policy developments, which are likely to shape the next leg of Bitcoin, Ethereum, and alternative crypto assets’ trajectory.