- Bitcoin ETF inflows surged to $524 million in a single day — the highest since early October, indicating a shift in risk appetite.

- Investors are responding positively post-October crypto crash, driven by institutional demand and improved macroeconomic signals.

- Legislative progress, including U.S. Senate approval of a funding package, boosts outlook for crypto markets.

- Despite some retail concerns, analysts view Bitcoin’s current correction as healthy and a precursor for renewed institutional participation.

- Crypto ETFs, particularly Bitcoin and Ethereum, continue to experience outflows but show signs of stabilization and potential reversal.

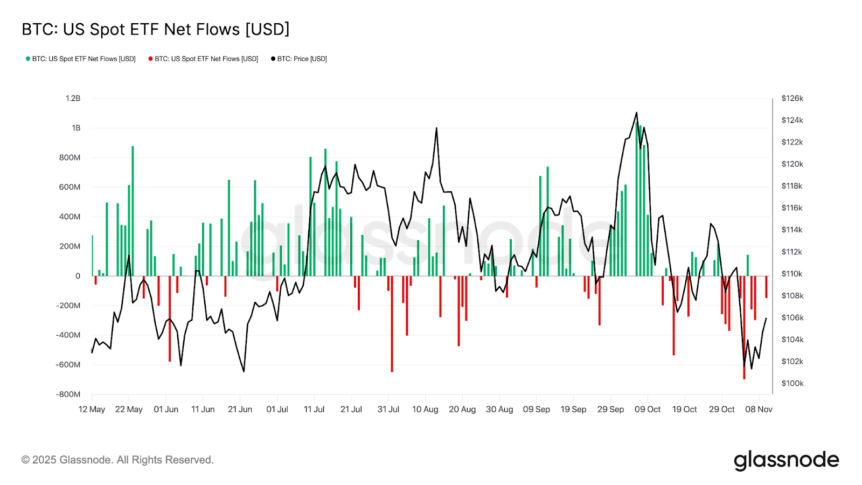

After a tumultuous start to October, the cryptocurrency market appears to be regaining momentum, with Bitcoin ETFs leading the charge. On Tuesday, US-based spot Bitcoin ETFs experienced net inflows totaling $524 million, the largest daily increase since the market downturn on October 7, according to data from Farside Investors. This uptick indicates growing investor confidence and risk appetite, suggesting a possible recovery phase for crypto assets.

The recent inflows come amid a broader macroeconomic context, particularly legislative efforts in the United States. The Senate approved a funding package that, if enacted by the House of Representatives, could reduce government shutdown risks and create a more stable environment for crypto markets. Such political developments have encouraged more institutional traders, who are now positioning for upside potential, as noted by Nansen’s blockchain analytics platform.

Market sentiment seems to be shifting, with traders identified as “smart money” increasing their net long Bitcoin positions by over $8.5 million in the past 24 hours. However, despite this positive movement, some traders remain cautious; according to Nansen, net short positions on decentralized exchanges still total around $202 million, reflecting ongoing risk considerations.

Analysts See Correction as a Healthy Development

Despite concerns among retail investors about the end of the recent bullish cycle, market analysts suggest that Bitcoin’s current correction is within healthy limits. Lacie Zhang, a research analyst at Bitget Wallet, emphasized that this dip could serve as a strategic reset, reducing leverage and paving the way for institutional re-entry. She pointed out that upcoming macroeconomic data, like the November 13 Consumer Price Index (CPI) report, could influence the market’s trajectory, especially if inflation figures continue to ease amid the ongoing government shutdown delay.

“Looking ahead, all eyes turn to the Nov. 13 CPI print, though a continued data delay from the government shutdown adds uncertainty.”

This macro backdrop, combined with persistent ETF inflows, suggests that the “de-risking” phase among ETF investors may be concluding, with increased demand indicating renewed appetite for digital assets after the recent turbulence.

Data from Glassnode reveals that Bitcoin ETFs have mostly experienced outflows since October’s crash, with daily declines reaching up to $700 million. This pattern suggests a broader phase of de-risking among ETF investors. Conversely, Ethereum ETFs saw $107 million in outflows, while Solana ETFs continued their sustained streak with $8 million in net inflows, pointing to nuanced investor behavior across the crypto spectrum.

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds