Bitcoin has experienced a notable rebound in recent days, climbing back above $114,000 amidst a period of consolidation and strategic de-leveraging in the crypto markets. This upward move suggests renewed bullish momentum, although traders remain cautious about potential short-term risks, particularly from CME gap levels. As the cryptocurrency markets continue to demonstrate resilience, analysts highlight key technical indicators and market dynamics shaping Bitcoin’s near-term trajectory in the evolving landscape of crypto regulation and institutional adoption.

- Bitcoin surged 4.5% in less than 48 hours, retaking the $114,000 mark amid overall market strength.

- Recent decline was driven by long de-leveraging rather than aggressive shorting, setting the stage for healthier rallies.

- The open interest reset, combined with positive spot market flows, points toward a sustainable bullish trajectory.

- A CME futures gap near $111,300 presents a potential short-term correction level, with a high likelihood of being tested.

- Market fundamentals suggest a possible rally beyond $115,000 if bullish momentum persists, despite short-term technical risks.

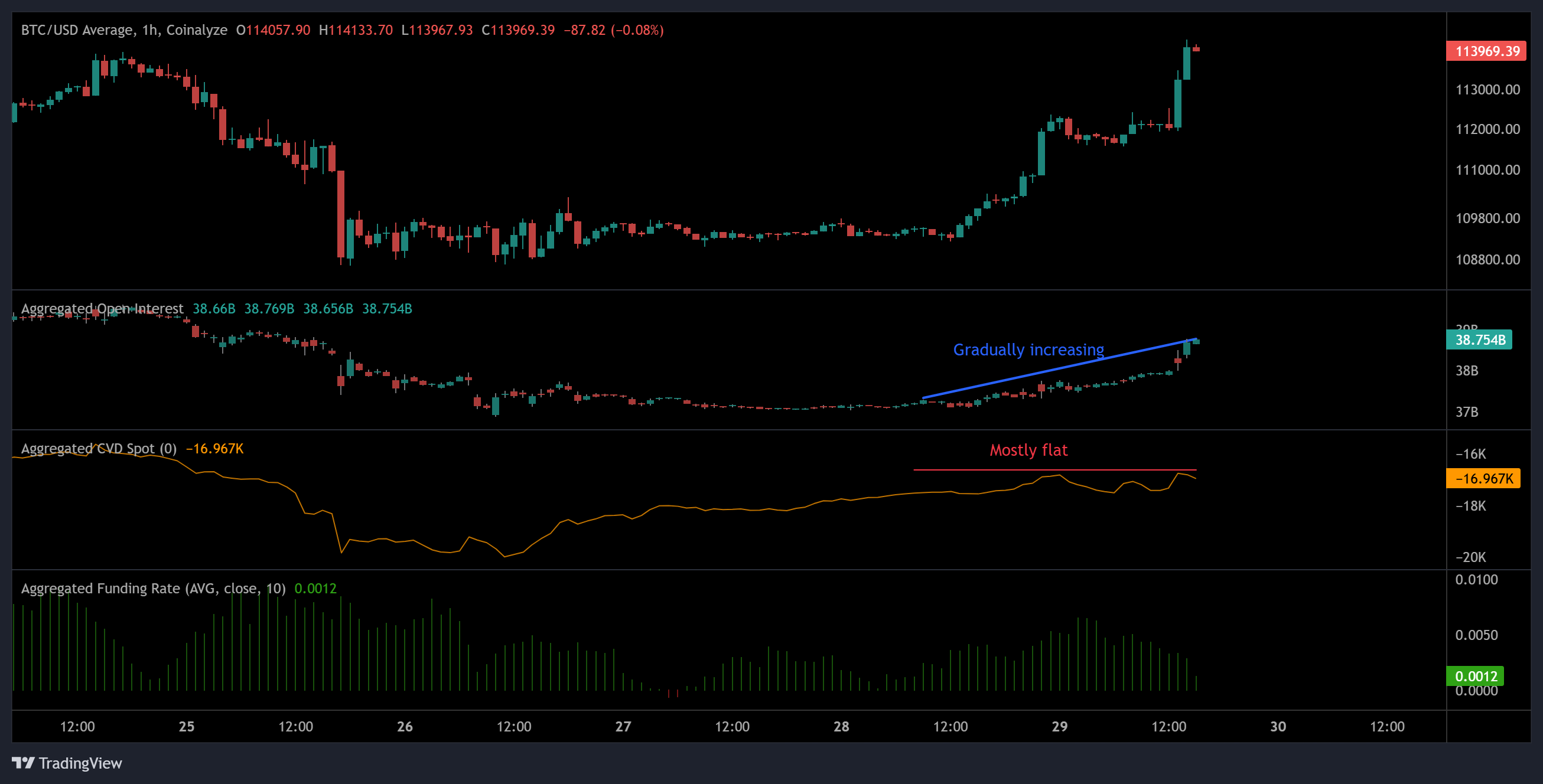

Bitcoin (BTC) rallied by approximately 4.5% within a tight timeframe, breaking past the $114,000 level on Monday. This recovery followed a week of sharp correction—a dip from $115,600 to $109,500—that analysts interpret as a phase of long de-leveraging, rather than panic selling or bearish momentum. This reset in open interest, which declined by roughly 6.2% to $39.9 billion, indicates traders are reducing exposure, thereby clearing excess leverage ahead of a potentially sustained rally.

Between September 21 and September 27, Bitcoin’s price dipped from $115,600 to approximately $109,500, a decline of over 5%. During the same period, open interest in futures markets decreased, reflecting traders’ inclination to reduce margin exposure rather than shorting aggressively. The correlation between spot price and open interest has also tightened, supporting the view that the current pullback is part of a healthy correction process that may bolster future gains.

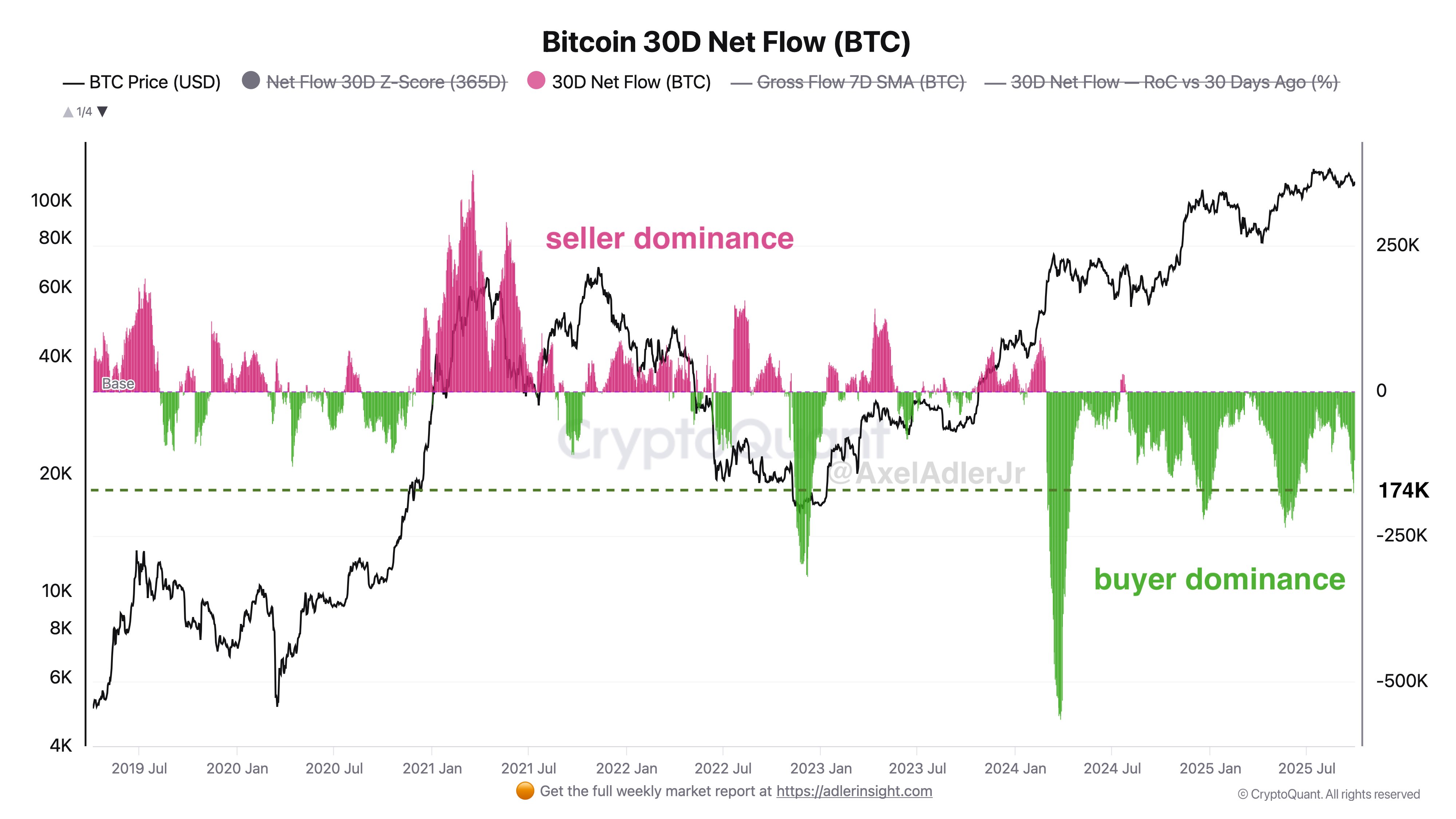

Additionally, spot market activity shows signs of accumulation. Data reveals that over the past 30 days, more Bitcoin is flowing out of centralized exchanges than entering—net flows around 170,000 BTC—an indicator of holder confidence and reduced selling pressure.

“The liquidation divergence has played out pretty well. Spot books remain thin up until ~$115K on Binance. Thin books = easier to move price. Still need the bulls to stay aggressive to get there.”

Market sentiment remains cautiously optimistic. Funding rates have settled into neutral territory, reducing the risk of a cascading long squeeze and encouraging a gradual buildup of leverage. However, certain technical indicators, specifically the open interest and cumulative volume delta (CVD) for spot trading, are showing divergence, which could influence the next moves. The price currently hovers above $113,000, suggesting that if bullish traders can sustain this level, a rally toward $115,000 appears plausible.

CME gap risk persists near $111,300

Despite Bitcoin’s recent breakout, traders remain mindful of the CME futures gap that looms between $111,300 and $110,900. CME gaps form when Bitcoin futures on the Chicago Mercantile Exchange close over the weekend at one price level, only to reopen at a different level, creating a “void” on the chart. Historically, Bitcoin has a strong tendency to revisit these unfilled gaps, with every CME gap since June having been replenished.

This technical setup suggests a brief correction to around $111,000 could occur before Bitcoin resumes its ascent. A decisive daily close above $115,000 would substantially diminish this short-term risk by invalidating the gap’s significance. Traders monitor these levels closely, considering the potential for a dip to be an opportunity for accumulation ahead of a bullish move into October.

While CME gap fills are not guaranteed, the fact that every recent gap has been closed makes it a noteworthy technical factor for traders gauging short-term risk. Expectation of a potential correction towards $111,000 is balanced by the broader bullish outlook, with many analysts predicting that Bitcoin’s momentum will carry it beyond recent resistance levels, reinforcing its position in the broader crypto markets amid growing institutional interest and regulatory developments in the blockchain space.