- Large-scale transfers of dormant Bitcoin to exchanges suggest waning long-term confidence amidst rising concerns about quantum security and market stability.

- Despite significant inflows into Bitcoin ETFs, market sentiment remains subdued, with traders increasingly favoring privacy coins like Zcash, Decred, and Monero.

- Bitcoin struggles to break above $106,000, influenced by macroeconomic factors such as a strengthening US dollar and inflation worries, which impact its price trajectory.

- Major corporate Bitcoin reserve strategies are losing appeal as recent market declines diminish incentives for share issuance in these companies.

- Long-term holders, including notable early investors, are selling off holdings, raising doubts about the asset’s long-term resilience and confidence amid broader macroeconomic uncertainties.

Bitcoin (BTC) continues to face stiff resistance at the $106,000 level, despite the broader equity markets nearing new highs. Meanwhile, gold remains close to its record peak of $4,380, showing signs of resilience amid fluctuating confidence in traditional and digital assets.

The recent strength in the US Dollar Index (DXY) against a basket of major currencies reflects increased confidence in the U.S. government’s ability to manage its fiscal health. When investors worry about stagnating growth amid persistent inflation, the dollar tends to strengthen, often at the expense of assets like Bitcoin. This inverse relationship has been a key factor influencing BTC’s recent price behavior.

Historically, the inverse correlation between the DXY and Bitcoin has played a significant role in price trends. Conversely, a strong dollar tends to benefit the U.S. stock market, as lower interest rates make borrowing cheaper and bolster corporate valuations. Additionally, favorable exchange rates reduce costs for imports, further supporting equities during dollar rallies.

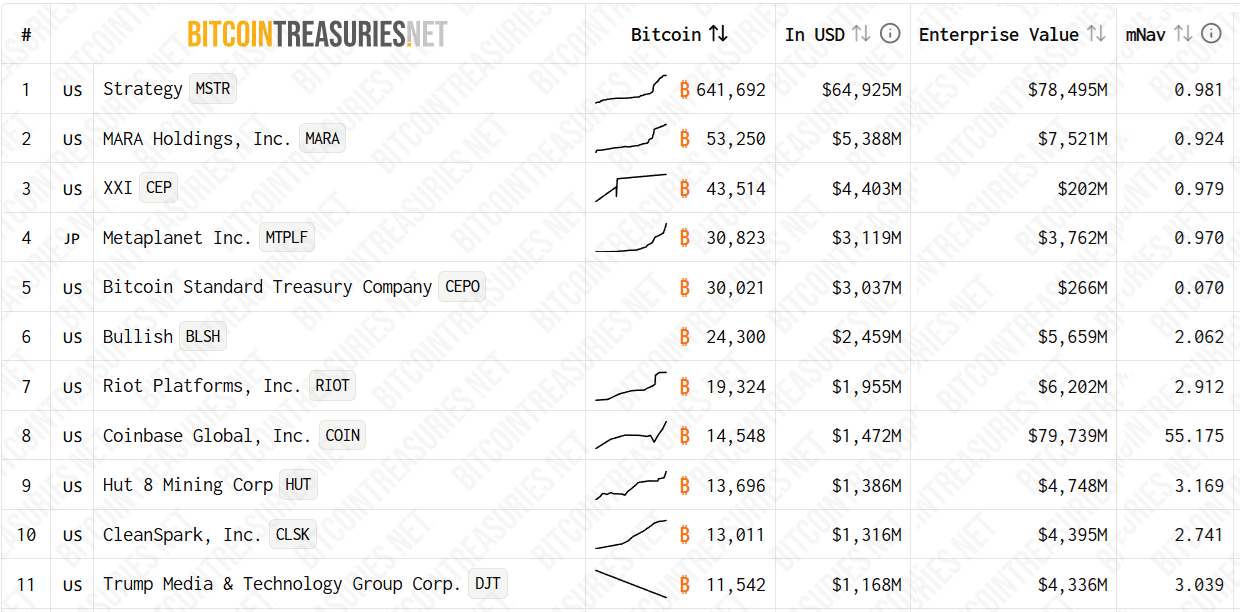

Companies holding Bitcoin as part of their reserve strategy, such as MicroStrategy and MetaPlanet, have historically been among the largest corporate buyers, especially when their stock prices traded at premiums to their underlying assets. The market now indicates that declining Bitcoin prices have eroded this incentive, as issuing new shares would dilute existing shareholders without a sufficient premium, making such moves less attractive.

Bitcoin Market Decline Dampens Corporate Financing Opportunities

The recent downturn has diminished the appeal of issuing new shares for Bitcoin-accumulating companies. Current prices make new share issuance less compelling unless accompanied by a meaningful premium to the net asset value (mNAV). This has prompted firms to explore debt or convertible note offerings, although these options often come with drawbacks, such as collateral demands that limit Bitcoin holdings’ contribution to enterprise value.

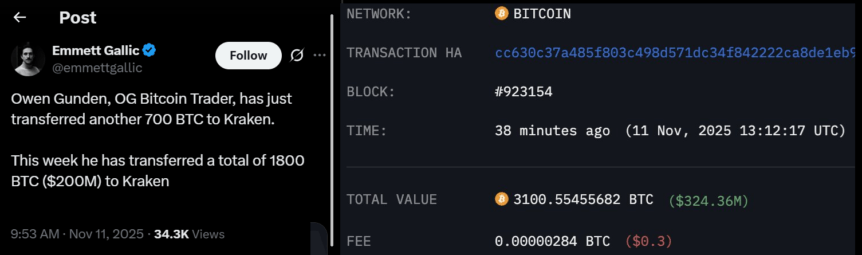

Adding to the cautious atmosphere, seasoned Bitcoin investors—including those from early eras like the Mt. Gox fallout—are also liquidating holdings. Notably, a prominent figure believed to be Owen Gunden transferred over 1,800 BTC—worth more than $200 million—to Kraken, suggesting waning confidence amid a 20% price pullback from the all-time high of over $126,000.

This week alone, the borrower moved over 1,800 BTC, highlighting a shift from long-held positions. The movement of these significant funds raises questions about long-term confidence, especially with mounting concerns over quantum computing threats and the rallying interest in privacy coins such as Zcash (ZEC), which surged nearly 100% over the past month.

Other privacy tokens like Decred (DCR) and Monero (XMR) also experienced double-digit gains, indicating elevated demand for anonymity-focused cryptocurrencies. Despite inflows totaling over $524 million into Bitcoin ETFs on Tuesday, overall buyer sentiment remains muted, and chances of Bitcoin reaching $112,000 in the near term appear slim.

The confluence of factors—large-scale holdings liquidation by long-term investors, a robust dollar, and rising interest in privacy tokens—continue to suppress Bitcoin’s recovery prospects. For now, prices hover below $106,000, suggesting that significant upside momentum may remain constrained in the current macroeconomic environment.