Breez, in collaboration with 1A1z, has unveiled a recent report that explores the role of Bitcoin as both a payments system and a transactional currency. Often referred to as digital gold, Bitcoin’s long-standing narrative highlights its function as a long-term investment or speculative asset. While this framing has helped newcomers grasp the basics, it fails to provide a thorough understanding of Bitcoin’s full potential.

The report thoroughly investigates various aspects of Bitcoin’s functionality as a payment option. It analyzes diverse use cases, the regulatory landscape across different jurisdictions, and examines platforms that currently incorporate Lightning payments.

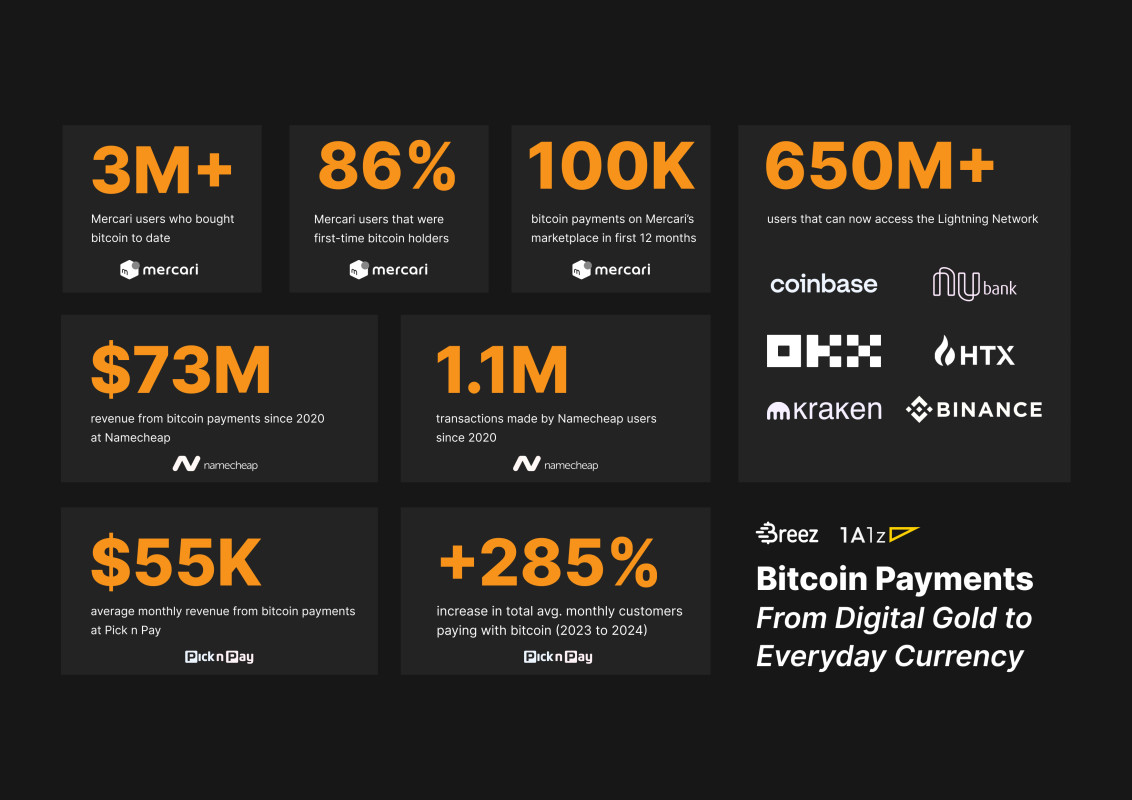

Included within the report are case studies of specific companies that have opened avenues for Bitcoin transactions, showcasing their transaction volumes and user bases. For instance, Mercari, a prominent Japanese marketplace akin to Amazon, allows payments in Bitcoin. Similarly, digital services such as Mullvad VPN, Namecheap, and ProtonMail exemplify businesses that have effectively integrated Bitcoin into their payment frameworks.

While the perception of Bitcoin as digital gold continues to thrive, its application as a payment solution is gradually gaining momentum. Although preserving value is a critical aspect of Bitcoin’s role in commerce, the primary intention behind its creation was to facilitate transactions.

For an in-depth look at how Bitcoin’s utilization as a transaction medium is experiencing a subtle revival, read the full report here.