Bitcoin faces a short-term correction after recent gains, with technical signals indicating that the cryptocurrency might be overextended following a nearly 10% rally over the past week. As markets remain heavily bullish, traders are watching for signs of a consolidation phase amid a surge in institutional interest and ETF inflows, reinforcing Bitcoin’s position as a leading asset in the evolving cryptocurrency landscape.

- Bitcoin hits a six-week high above $119,500 but shows signs of overbought conditions.

- Technical indicators suggest a potential retest of support levels amid a possible short-term pullback.

- Ethereum and other DeFi tokens continue to demonstrate strong momentum alongside Bitcoin’s rally.

- Inflows into Bitcoin ETFs reach $1.6 billion in just three days, boosting institutional confidence.

- BlackRock’s iShares Bitcoin Trust enters the top 20 ETFs by assets, marking a significant milestone.

Bitcoin (BTC) appears poised for a short-term correction after surging close to $119,500 on the Bitstamp exchange. Despite the impressive weekly gains, market analysts caution that technical overbought signals indicate a possible pause or retracement before further upside is realized.

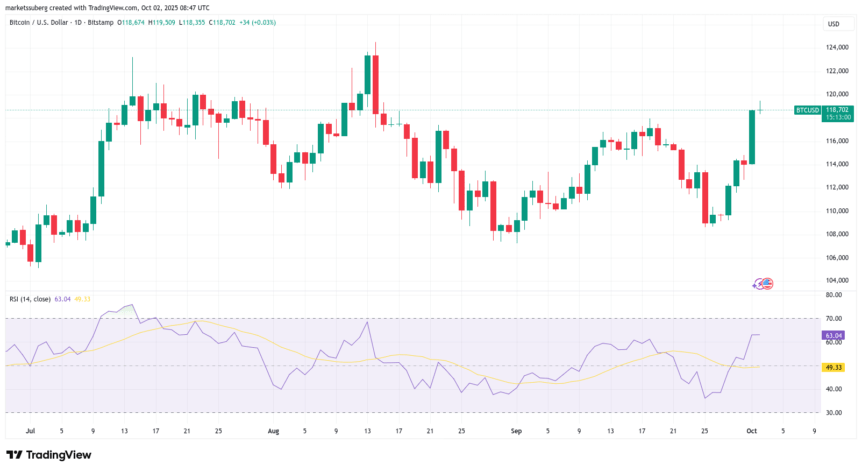

RSI signals potential for a pause in Bitcoin’s rally

Over the past week, Bitcoin has climbed nearly 10%, driven by renewed bullish sentiment and institutional participation, paralleling the recent gold rally. However, the relative strength index (RSI)) now hovers near 90/100 on the four-hour chart, its highest level since July when Bitcoin traded above $123,000.

This overbought reading often signals that a market correction might be imminent, especially on shorter timeframes. Traders like Roman note that “everything is overbought but no signs of initial weakness,” suggesting a *cooling-off* phase could be underway, with a retest of previous support levels likely to consolidate recent gains.

“Looking at this further, pullback/retest makes sense as shown by LTFs,” Roman posted on X.

“Everything is overbought but no signs of initial weakness. Simple breakout & retest.”

While the RSI signals short-term caution, longer-term charts tell a different story. The daily and weekly RSI remain elevated, a characteristic observed during previous bull markets, indicating sustained strength. Volume, RSI, and MACD metrics collectively support the potential for Bitcoin to challenge new highs in the coming days, possibly reaching $124,000.

Bitcoin ETFs bolster bullish sentiment in markets

Institutional interest continues to surge, exemplified by notable inflows into Bitcoin exchange-traded funds (ETFs). Caleb Franzen from Cubic Analytics pointed out a bullish divergence between Bitcoin and the S&P 500, particularly driven by the performance of BlackRock’s iShares Bitcoin Trust (IBIT). This highlights growing confidence in Bitcoin’s prospects amid broader market stability.

Recent data from Farside Investors indicates that U.S. ETF products have attracted over $1.6 billion in net inflows this week alone, with IBIT contributing $600 million. This influx not only supports Bitcoin’s higher price levels but also underscores the ETF’s increasing dominance in asset allocations.

Bullish RSI divergence for Bitcoin relative to the S&P 500 (IBIT/SPY). pic.twitter.com/hGH2XZoPWc

— Caleb Franzen (@CalebFranzen) October 1, 2025

Further affirming Bitcoin’s institutional appeal, Bloomberg ETF analyst Eric Balchunas confirmed that BlackRock’s ETF is now among the top 20 largest by assets under management. He suggests that, based on current growth trends, Bitcoin ETFs could soon challenge the top ten, especially if inflows remain steady.

Market analysts agree that the momentum behind Bitcoin ETFs signals sustained institutional confidence, likely to support higher prices and increased mainstream adoption in the crypto markets. Yet, investors should remain cautious as volatility remains inherent to blockchain-based assets.

This surge in Bitcoin’s price and ETF inflows is emblematic of a broader shift towards mainstream acceptance of cryptocurrencies, reaffirming Bitcoin’s status as a leading asset class within the expanding digital economy.