Bitcoin rebounded strongly at the start of the final week of October, signaling cautious optimism among traders as the cryptocurrency grapples with key resistance levels. While Bitcoin neared $115,000, analysts remain mixed on whether the rally will persist, with macroeconomic factors and technical signals influencing market sentiment. Expectations of a Federal Reserve rate cut and positive developments in US-China relations could bolster Bitcoin’s upward trajectory, potentially pushing prices toward new all-time highs.

- Bitcoin closed the week at around $114,500, maintaining its recovery above key technical support.

- Market sentiment is cautious, with some analysts warning of possible bearish reversals despite recent gains.

- Federal Reserve’s upcoming interest rate decision and US-China trade negotiations are pivotal macroeconomic factors influencing crypto markets.

- AI-driven models suggest Bitcoin could reach $125,000 before the end of October, despite recent volatility.

- Short-term holders are back in profit, indicating renewed confidence among recent Bitcoin buyers.

Bitcoin price hurdles linger as $115,000 returns

Bitcoin delivered a notable rally into the weekly close, with on-chain data showing it managed to reclaim $114,500 and the 21-week exponential moving average (EMA). This bounce was celebrated by traders like Rekt Capital, who highlighted the significance of this level as a critical support zone for further upward movement.

Despite the rebound, many analysts remain divided on Bitcoin’s immediate outlook. Roman, a prominent trader, pointed out several technical weaknesses, including low volume and bearish divergences on the relative strength index (RSI), which could threaten the sustainability of the current rally.

Bitcoin is positioned for a positive Weekly Close above the 21-week EMA (green)

The recent breakout from the Ascending Triangle on the Daily timeframe has enabled this positive position on the Weekly timeframe$BTC #Crypto #Bitcoin https://t.co/T7WJgk9Uyw pic.twitter.com/4u42pdGTX9

— Rekt Capital (@rektcapital) October 26, 2025

Market watching suggests Bitcoin may be consolidating within its macro range, with some experts cautioning that a larger move could be imminent. Rekt Capital pointed out that Bitcoin appears to be riding a macro range while also hinting that recent highs could turn into support by month-end.

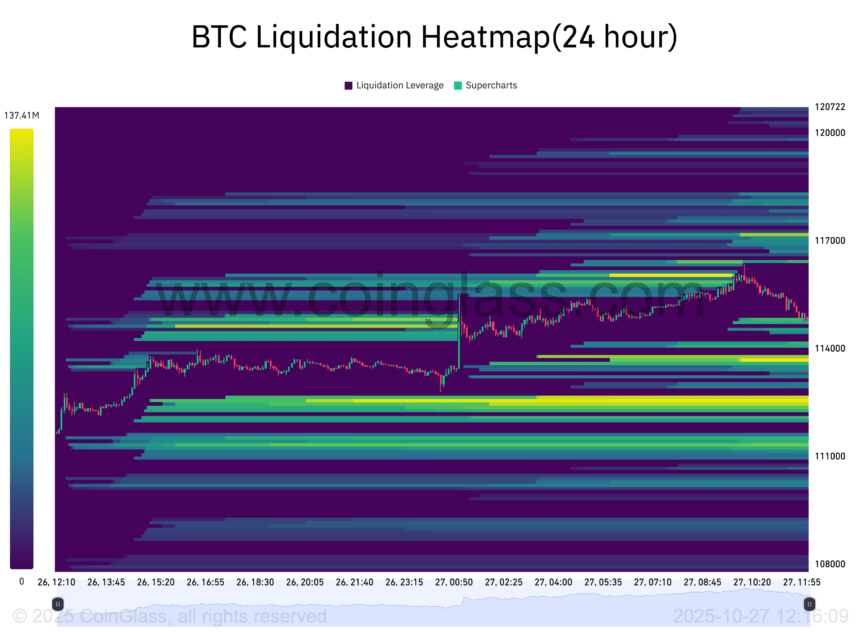

Meanwhile, onchain analytics firm CoinGlass reported increased volatility, with Bitcoin slicing through liquidation levels in both directions, highlighting ongoing market uncertainty.

Federal Reserve’s interest rate outlook and US-China trade tensions

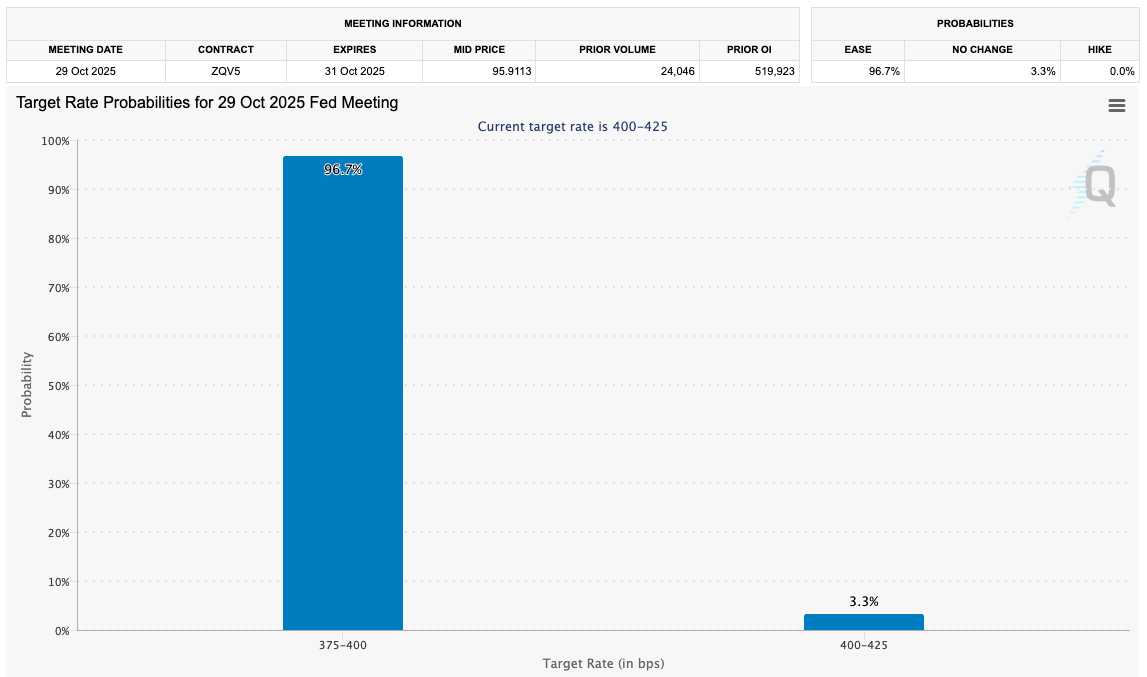

The upcoming Federal Reserve interest rate decision is set to dominate macroeconomic headlines, with markets largely betting on a 0.25% rate cut, despite limited inflation data due to the government shutdown. The CME FedWatch Tool places the probability of such a cut at over 95%.

Recent macroeconomic data, including softer-than-expected inflation figures, bolster the case for a rate cut, which could foster a more favorable environment for Bitcoin and other crypto assets.

Additionally, optimism surrounding US-China trade negotiations has surged, with the announcement that a deal is near, and US President Donald Trump scheduled to meet China’s Xi Jinping. The development has sparked a rally in stock futures, with the S&P 500 adding over $3 trillion since the October 10 lows, signaling reduced geopolitical risk and supporting the broader risk-on sentiment.

AI models and analyst forecasts point toward new highs

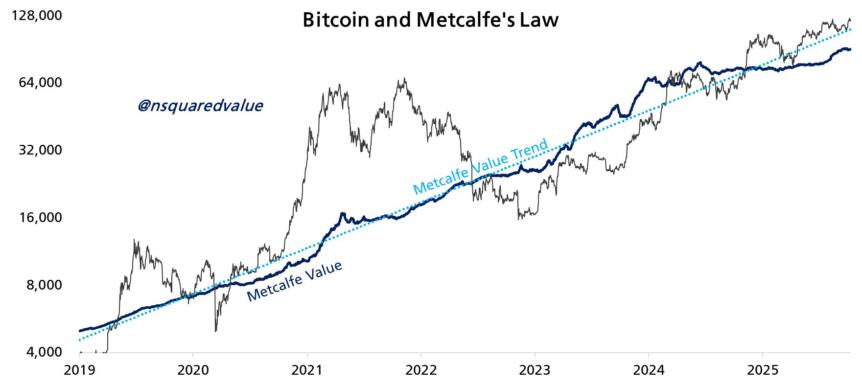

Economic researchers and AI-driven models are increasingly bullish on Bitcoin’s near-term price potential. Timothy Peterson, an economist with a focus on network metrics, argued that rate cuts and monetary easing could propel Bitcoin to $125,000 by the end of October, with the current cycle influenced by Metcalfe’s law, which links network growth to valuation.

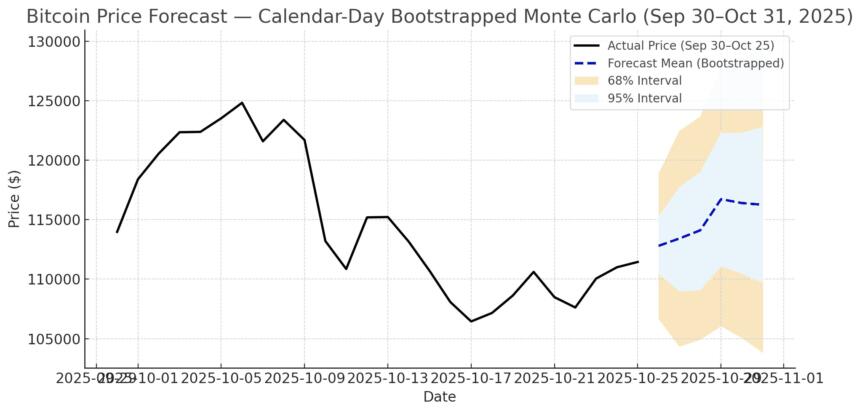

Simulations from AI models support this optimism, predicting Bitcoin could reach $125,000 before month’s end, despite recent dips below $102,000.

Uptober’s momentum and market outlook for November

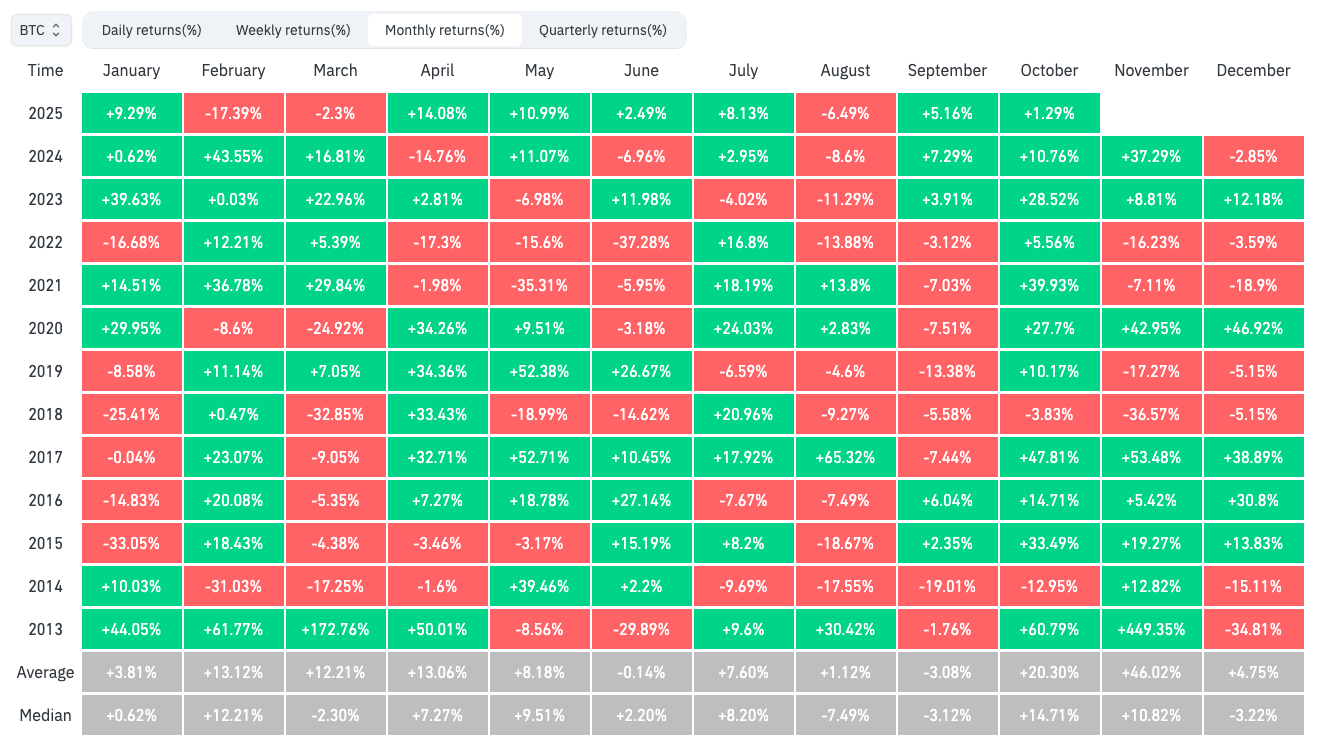

Although Bitcoin’s October performance has been mixed, it has avoided a significant monthly loss, ending the month a mere 1% above its opening price. This resilience sets the stage for a strong start to November, often a bullish month for Bitcoin, with expectations of “Growvember” taking hold among traders.

Market analysts predict that volatility could surge in the coming weeks, especially with potential quarterly disclosures and ongoing geopolitical developments. Daan Crypto Trades foresees a more volatile period ahead, forecasting increased price swings before the end of 2025, pointing to a potentially more dynamic environment for Bitcoin.

Uptober was… interesting.

But we still have Growvember!!!

— Kyle Chassé / DD🐸 (@kyle_chasse) October 27, 2025

Overall, Bitcoin’s recent price action suggests cautious optimism, with macroeconomic tailwinds and technical developments supporting the possibility of a new bullish phase heading into the final quarter of 2025. Traders and investors remain watchful, awaiting decisive catalysts that could propel the cryptocurrency to new all-time highs in the near future.