The landscape of corporate crypto holdings is evolving as more companies diversify their treasuries beyond Bitcoin. Despite increasing competition, MicroStrategy remains the largest institutional holder, but its dominance is waning as new players and a broader adoption of digital assets surface. This trend highlights the growing confidence in blockchain-based assets within the corporate world and signals shifting dynamics in crypto markets and DeFi participation.

- MicroStrategy maintains its position as the top corporate Bitcoin holder but’s share declines from 75% to 60% in October.

- Corporate Bitcoin holdings continue to rise, though at a slower pace, with public and private entities adding 14,447 BTC in October—its smallest monthly increase this year.

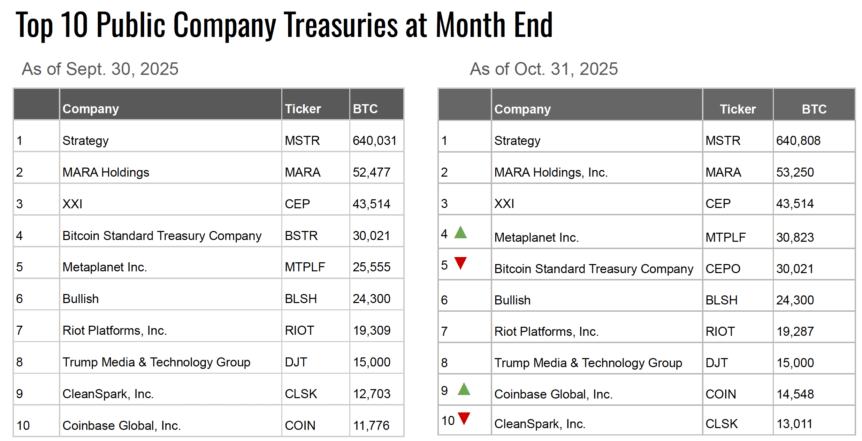

- Metaplanet and Coinbase significantly increased their Bitcoin holdings, with Coinbase explicitly confirming ongoing purchases.

- More companies are diversifying into altcoins like Ethereum and Solana, with Ether now representing a significant portion of corporate crypto reserves.

- Fidelity forecasts that over 42% of Bitcoin will be held in illiquid form by 2032, fueled by long-term holders and corporate treasuries engaging in staking and network participation.

Michael Saylor’s aggressive Bitcoin accumulation strategy has historically positioned MicroStrategy as the dominant corporate holder of Bitcoin, with 640,808 BTC as of October 31. However, its market share among corporate holders has dipped from 75% to around 60%, reflecting a broader trend of diverse companies entering the space and incremental adoption of digital assets as part of treasury management. According to a report by BitcoinTreasuries.NET, October saw public and private companies add 14,447 BTC across their treasuries — the slowest growth this year.

Leading the October acquisitions was Metaplanet, which purchased 5,268 BTC, bringing its total to 30,823 BTC and ranking it fourth among all crypto treasury holders. Coinbase also increased its holdings with a purchase of 2,772 BTC, confirming through CEO Brian Armstrong’s statement that the company remains committed to accumulating Bitcoin long-term.

As of the end of October, the Bitcoin holdings included 353 entities, with 276 being either public or private companies — more than double the count from January. The United States leads with 123 entities holding Bitcoin, followed by Canada with 43, the United Kingdom with 22, and Japan with 15.

The trend toward corporate treasury buybacks also persisted in October, with several firms repurchasing their own stocks or digital assets. Notably, Metaplanet announced plans to buy back up to 150 million shares using a $500 million credit line, while Sequans Communications launched a buyback program involving 1.57 million American Depositary Shares (ADS).

Fidelity Digital Assets observes that Bitcoin’s supply dynamics are shifting as long-term holders and corporations bolster the illiquid supply. A recent report from Fidelity predicts that by 2032, approximately 42%, or over 8.3 million BTC of the total 19.8 million circulating supply, will be held in illiquid entities, primarily due to long-term institutional holdings and corporate treasuries engaged in staking and network validation.

The rise of altcoin treasuries

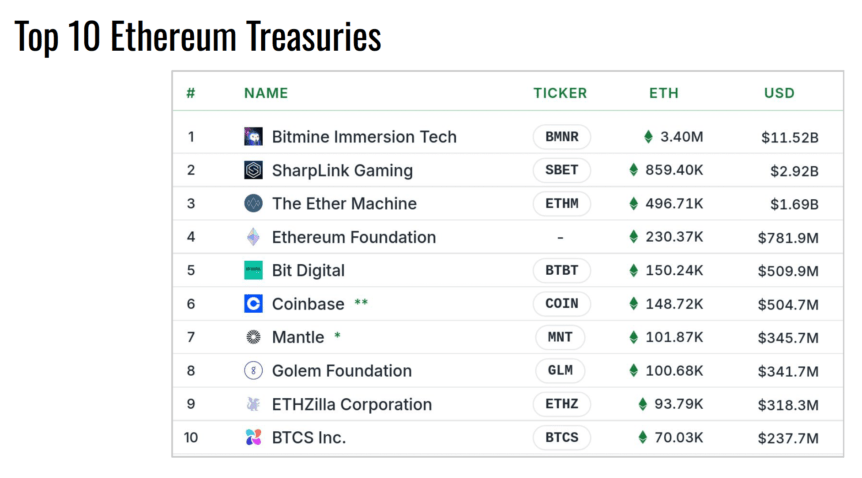

While Bitcoin remains dominant, the report highlights the growing presence of corporate treasuries dedicated to altcoins, particularly Ether and Solana. At the end of October, Bitcoin constituted roughly 82% of total corporate crypto reserves, down from 94% earlier in the year. Ether holdings have increased significantly, rising from 2.5% to 15%, with Solana’s share remaining steady at 2–3%.

Standout among corporate Ether holders is Bitmine, which holds nearly 3% of the total Ether supply—around 3.5 million ETH. Meanwhile, Sharplink Gaming announced plans to deploy $200 million in ETH onto the Ethereum-compatible Linea network to generate higher on-chain yields, exemplifying how companies are leveraging blockchain technology for passive income streams through staking.

This trend toward holding proof-of-stake tokens enables corporations to earn staking rewards by validating network transactions, providing passive income while maintaining exposure to key digital assets, thereby supporting the growth of DeFi and blockchain adoption among businesses.