At the beginning of the year, Bitcoin experienced a significant price surge, increasing by 5% on January 6th to surpass the $100,000 mark after weeks of fluctuations. The price of the digital asset peaked at $102,760 before undergoing a healthy correction, dropping back below $100,000. Currently, Bitcoin is trading between $96,000 and $102,000, with a total trading volume of $6.58 billion.

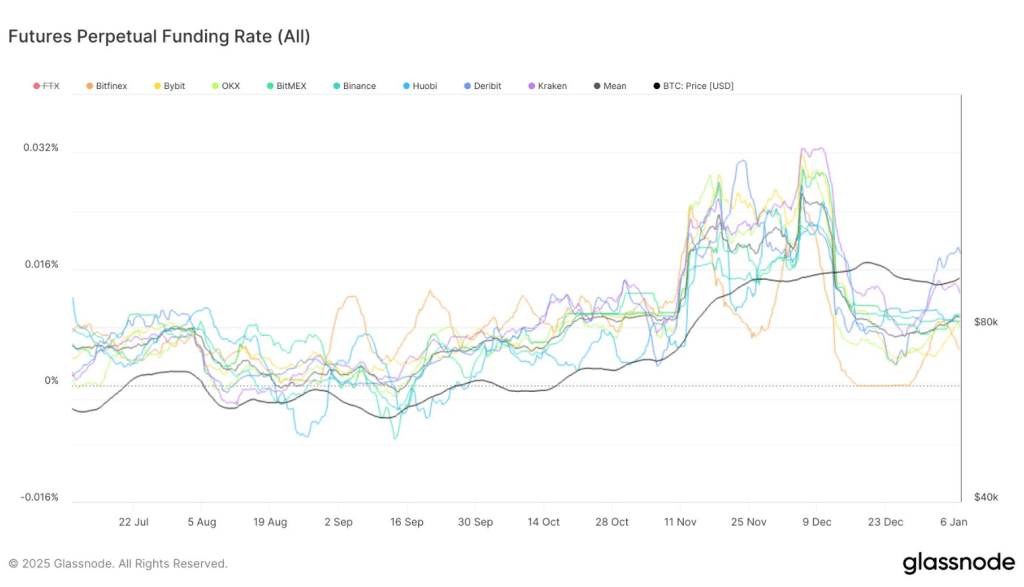

Despite Bitcoin’s recent price performance appearing positive, the data on the asset’s funding rate reveals a different story. According to Glassnode, the average funding rate for Bitcoin has fallen to 0.009%, below the neutral level of 0.01%. This lower-than-usual funding rate indicates a cautious long-term trading sentiment among investors in regards to Bitcoin and other investments.

The weekly MA of perpetual funding rates has decreased to 0.009% from its peak of 0.026% in mid-December, just below the neutral level of 0.01%: https://t.co/CORjRx0X2k

This indicates a cautious approach, with speculators showing limited willingness to pay premiums for long… pic.twitter.com/JwSPpZRpeG

— glassnode (@glassnode) January 7, 2025

Examining Bitcoin’s Average Funding Rates

The average funding rate is a key technical indicator used to gauge market sentiment towards Bitcoin and other investments. This rate, expressed as a percentage, is determined by crypto exchanges for their perpetual futures contracts. A positive rate indicates that long positions periodically settle short positions, while a negative rate implies that short positions periodically settle long positions.

Recent data shows that the weekly moving average of the funding rate has dropped to 0.009%, below the neutral level of 0.10%. This decline from the mid-December high of 0.0026% suggests a cautious sentiment among investors towards long positions.

Is Bitcoin’s Price Surge Sustainable?

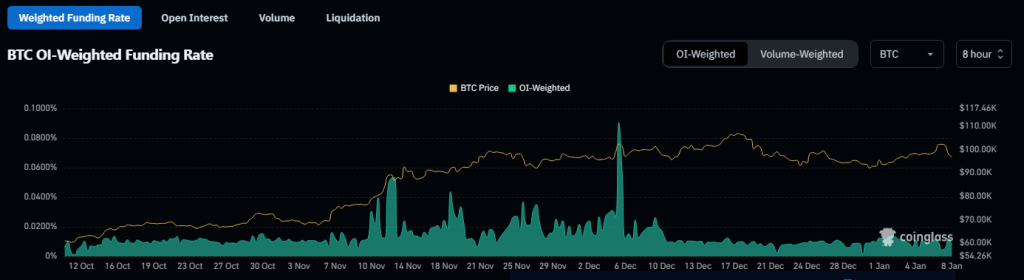

Coinglass reported an increase in the assets’ Open Interest-Weighted Funding Rate to 0.0058%, still below the peak of 0.0113% on January 5th. Additionally, Coinshares indicated that the Volume-Weighted Funding Rate rose to 0.0051%, but significantly lower than the previous high of 0.0111%.

The decrease in funding rates suggests that traders are exercising caution as Bitcoin struggles to breach and sustain the $100,000 mark. Their reluctance to engage in leveraged exposure indicates a lack of confidence in Bitcoin’s ability to maintain its price surge in the near future.

Future Outlook for Bitcoin

Despite the cautious approach of traders, there are positive developments in the market this week. Bitcoin’s derivatives trading activity has increased, with daily trading volume reaching $85 billion, a 42% surge. Open interest has seen a modest rise of 2%, and the Long/Short ratio stands at 1.0243, indicating neutral sentiment among investors. Additionally, Bitcoin’s Chande Momentum Index (CMI) rose to 58.71 during the price rally above $100,000, although it has slowed down as the price settled below this benchmark.

Featured image from The Independent, chart from TradingView