- Crypto whales and long-term holders are increasingly selling their assets, contributing to ongoing market suppression.

- Analyst Jordi Visser compares current crypto dynamics to the aftermath of the 2000 dot-com bubble, highlighting similar sell-side pressure.

- While some believe Bitcoin could bottom around $100,000, others warn of a potential dip to $92,000 if bearish momentum persists.

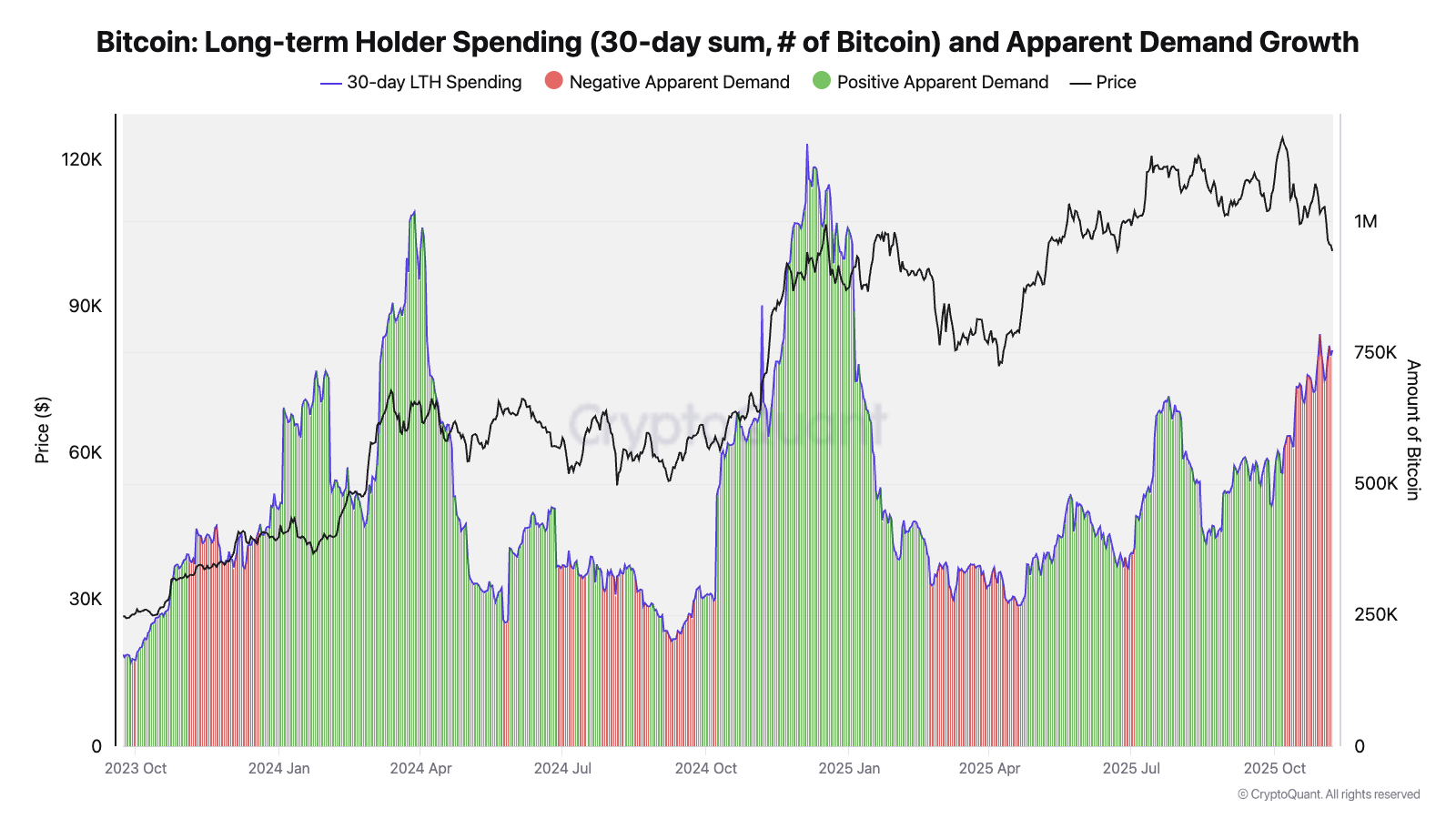

- Long-term holder selling has accelerated since October, but demand contraction hampers overall price recovery.

- Market analysts suggest that the consolidation phase is nearing its end, with a possible breakout within the next year.

Crypto Market Sentiment Mirrors Dot-Com Crash Aftermath

Crypto whales and longstanding investors are currently divesting in large quantities, placing continuous downward pressure on prices. This behavior resembles the period following the dot-com stock market collapse in the early 2000s, where tech stocks plunged by up to 80%, leading to over a decade of market stagnation before reaching previous highs again.

During that time, venture capitalists, locked into their investments due to mandated holding periods, were forced to hold or sell at distressed prices. This selling pressure extended into the broader market, delaying recovery. As one analyst explained:

“Many stocks traded below their IPO prices. We see a similar situation unfolding now, with venture capitalists and insiders selling during rallies, creating persistent sell-side pressure across assets like Solana, Ethereum, and Bitcoin.”

Visser clarified that a similar prolonged timeline is unlikely for crypto markets. Instead, he pointed to the dot-com crash’s aftermath as an analogy for the current sell-side dynamics, suggesting the ongoing consolidation phase could end within a year, paving the way for renewed upward movement.

The analysis emerges amid growing concerns that Bitcoin and broader crypto markets are experiencing a bear trend, confirmed by recent price declines in October, prompting many analysts to lower their bullish forecasts for the asset class.

Related: $100B in Old Bitcoin Moved, Raising ‘OG’ Versus ‘Trader’ Debate

Is Bitcoin Price Stabilizing Around the $100,000 Mark?

Several analysts interpret Bitcoin’s recent price action as a sign of a potential bottom near $100,000. However, concerns remain that continued selling pressure might push the price back down to around $92,000 if demand does not pick up significantly.

While long-term holders and whales typically sell at all-time highs, their sales are not inherently problematic, according to crypto analyst Julio Moreno. Instead, the issue lies in the shrinking demand that fails to absorb the increasing Bitcoin supply on the market, a situation that could extend the consolidation phase.

Moreno emphasized that this increased selling is matched by a decline in buyer demand, suggesting a need for a rebound in interest to stabilize prices and trigger a new bullish phase.

As the broader crypto markets navigate this period of uncertainty, the next few months could prove pivotal in determining whether Bitcoin and other cryptocurrencies establish a firm bottom or experience further declines.