Cryptocurrency trading has once again demonstrated its volatile and highly lucrative nature, with traders leveraging small-cap memecoins on the BNB Chain to generate unprecedented profits over the past week. This surge in activity underscores a renewed wave of speculative interest, driven by social media influence and strategic trading defined by rapid, high-stakes maneuvers. As the market reacts to these explosive gains, industry insiders are paying close attention to the growing role of BNB Chain as a hub for meme-centric trading and DeFi activity.

- Traders on the BNB Chain have turned small memecoins into millions of dollars within days, highlighting a new speculative frenzy.

- Notable investors turned modest initial investments into multi-million dollar winnings, with some achieving up to 2,260-fold returns.

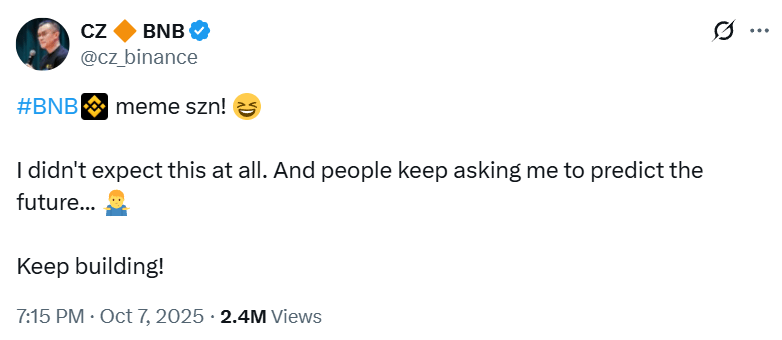

- The recent surge was partly fueled by social media endorsements from Binance’s former CEO, Changpeng Zhao, boosting meme token popularity.

- Industry experts recognize BNB Chain’s evolution into a significant platform for decentralized trading and DeFi activity.

- Record numbers of traders participate in memecoin trading, with many profiting significantly amid a social-driven trading culture.

Cryptocurrency traders have capitalized on small-cap memecoins on the BNB Chain, turning modest investments into millions in just a few days. According to blockchain analytics, a trader known as “0xd0a2” transformed an initial $3,500 investment into nearly $8 million within three days, achieving a 2,260-fold return. Another trader, “hexiecs,” invested $360,000 in the newly launched “4” memecoin, which surged following a social media post from Binance’s founder Changpeng Zhao, collectively amassing over $5.5 million.

Other high-profile traders also reaped sizable gains. The trader “brc20niubi” turned an investment of $730,000 into $5.4 million, recording a 1,200-fold increase, primarily driven by social sentiment and hype around the memecoin. These activities follow a significant trade earlier this week when a wallet identified as “0x872” made nearly $2 million after investing just $3,000 in the same token. Zhao’s endorsement of the token, retweeted to his 8.9 million followers, catalyzed the surge.

The “4” token’s rise was initiated after a phishing attack on BNB Chain, where the hacker pocketed only $4,000 before the community turned the event into a meme, further fueling speculation and trading volume. The phenomenon highlights the influence social sentiment and community-driven narratives hold in the current crypto environment.

Traders wake up to BNB Chain potential

Industry observers, including Binance’s Zhao, have noted the unexpected growth of memecoin trading activity on BNB Chain, termed “BNB meme szn.” Zhao remarked that he “didn’t expect at all” to see such a rebirth of meme-driven trading on the ecosystem.

DeFi experts note that BNB Chain’s strengths in decentralized finance and onchain trading are driving this renewed enthusiasm. According to Marwan Kawadri, DeFi lead at BNB Chain, “what you’re seeing with ‘BNB meme szn’ is the market waking up to the fact that BNB Chain has become the leading ecosystem for trading.” He explained that record numbers of active addresses and soaring decentralized exchange (DEX) volumes underscore the platform’s newfound prominence in crypto markets.

“The community’s trading culture is what accelerates the rapid adoption of new meme trends on BNB Chain,” Kawadri added.

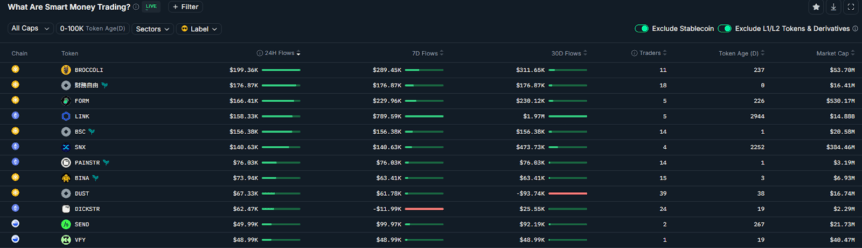

Analysis from blockchain intelligence platform Nansen shows that smart money — seasoned investors tracking blockchain transactions — have notably favored BNB-native tokens. The three largest assets purchased by these traders over the past 24 hours were all tokens native to BNB Chain, with substantial inflows indicating growing institutional interest.

Leading up to this week, over 100,000 traders had bought into the new memecoins, with roughly 70% in profit, according to data from Bubblemaps. Some addresses generated extraordinary gains, with one wallet netting over $10 million, and dozens of others exceeding $1 million in profit. This rapid accumulation of wealth signals that the current memecoin momentum isn’t just fleeting speculation but reflects a broader shift in trading culture driven by social sentiment and onchain activity.

Despite their potential for lucrative gains, memecoins remain risky assets, offering no intrinsic value and relying solely on community sentiment. Still, their current popularity highlights the evolving dynamics within crypto markets, where social influence and community engagement can rapidly propel tokens to prominence.

As the market continues to develop, the role of memecoins and their impact on crypto regulation and broader markets will be closely watched in the coming months.