Bitcoin Magazine

How Local Businesses Can Use Bitcoin For Payments

I. Introduction

Bitcoin is frequently hailed as a solid method for long-term savings. However, its function as a transactional medium is equally vital, particularly for businesses of all sizes. From independent coffee shops to global enterprises, a growing number of merchants are exploring bitcoin as an alternative payment method, attracted by its minimal transaction fees, swift processing times, and capability to connect with a youthful, tech-savvy clientele worldwide.

This comprehensive guide examines how local businesses can begin to accept bitcoin, highlighting both the immediate rewards and the sustained strategic benefits. As the landscape of digital payments transforms, grasping the opportunities Bitcoin offers is becoming increasingly crucial for businesses aiming to remain competitive.

II. Benefits of Accepting Bitcoin for Small Businesses

There are several compelling reasons for small businesses to embrace bitcoin:

- Increase Revenue: By appealing to a vibrant, tech-forward customer base, businesses can attract bitcoin users who are often enthusiastic about spending and tipping in bitcoin, making a point to visit local businesses that accept bitcoin.

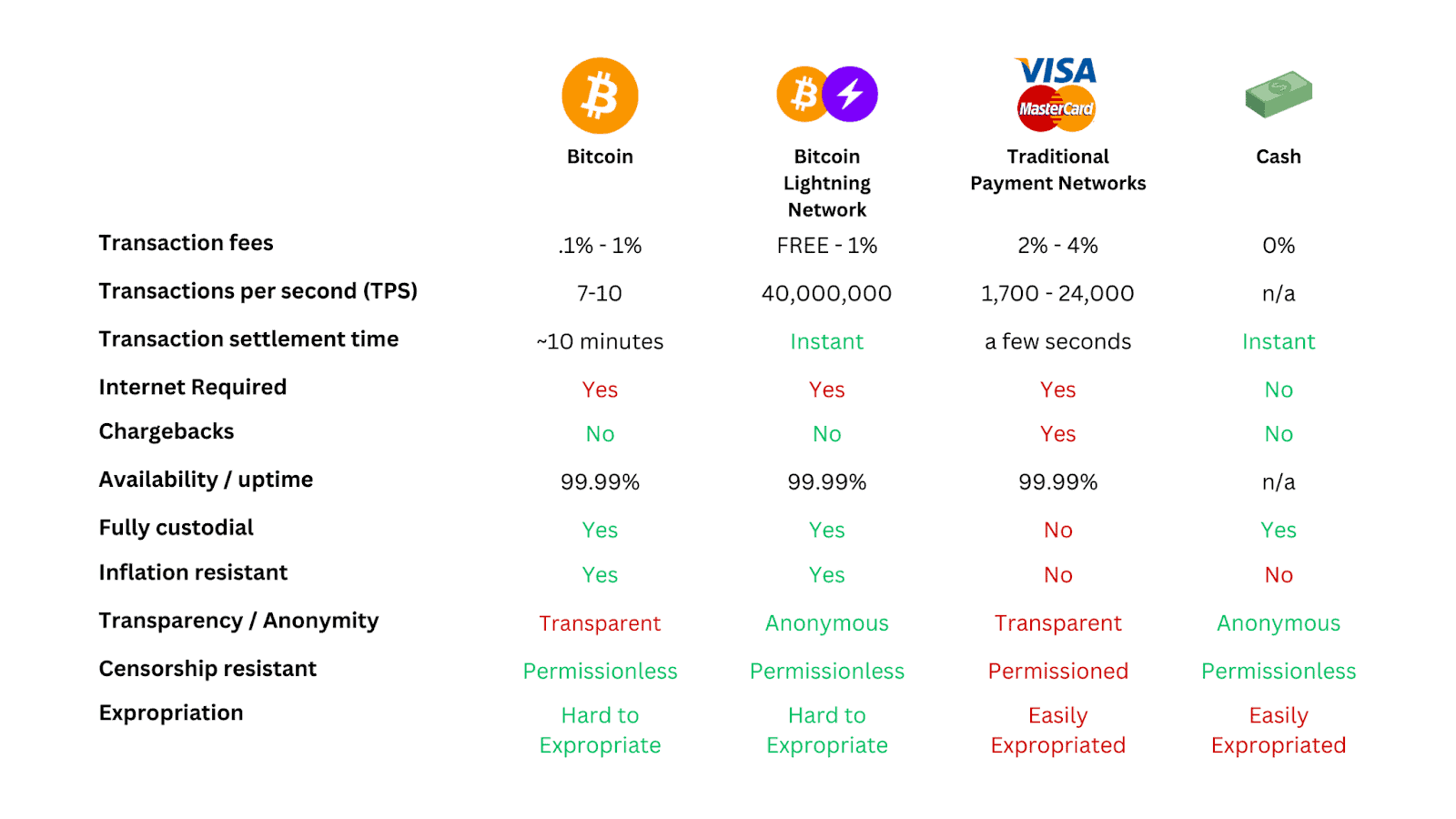

- Reduce Fees: Transaction fees associated with bitcoin payments are generally low and covered by customers, allowing merchants to save between 2-3% on credit card processing fees when utilizing Bitcoin’s secondary layers (like Lightning or Liquid).

- Value Preservation: Bitcoin presents a long-term hedge against inflation, helping preserve the value of earnings thanks to its capped supply. Although the price of bitcoin may fluctuate short-term, historical data indicates a significant upward trajectory over the years.

Additional advantages include:

- Decentralized Transactions: Bitcoin eliminates the need for banks, providing a decentralized financial solution that enables secure and low-cost transactions globally, at any time.

- Instant Settlement with No Chargebacks: Payments made via Bitcoin are final, eradicating the risk of chargebacks and giving businesses a reliable transaction guarantee.

- Enhanced Flexibility: Accepting bitcoin opens up greater flexibility when traditional payment methods face difficulties. Many bitcoin payment systems also allow merchants to bill in dollars while allowing payment in either bitcoin or dollars.

- Environmental Impact: Contrary to popular belief, Bitcoin can be a net positive for the environment, as mining can enhance the efficiency of energy companies and promote the growth of renewable resources. As the industry moves toward sustainability, Bitcoin’s carbon footprint is likely to decline.

III. Implementing Bitcoin in Business Operations

Each business, whether a quaint café or a large corporation, has distinct requirements for facilitating payments. Thus, it is vital to recognize how bitcoin might align with your business model. A small café might benefit from a simple mobile Bitcoin wallet, whereas larger businesses may prefer a more sophisticated integration. This guide aims to equip you with the knowledge and steps necessary to incorporate bitcoin payments smoothly.

- Bitcoin Atlantis Conference – BTCPay Server

- Wilson & Wilson Dentistry – Zaprite

- How Hodl Hodl used BTCPay to accept bitcoin payments – BTCPay Server

- How Cherito Café is using Bitcoin to drive his business – Blink

Step 1: Understand Bitcoin

Before diving into the logistics, it’s crucial to comprehend what Bitcoin is and why it should be integral to your business. Beyond being just a new payment option, Bitcoin is a revolutionary currency and a powerful monetary network. Integrating Bitcoin can not only widen your payment options but may also reduce operational costs.

The Bitcoin network is globally recognized as the most secure computer network available today. It functions as a immutable, censorship-resistant, and decentralized system of value, operating beyond the control of governments and traditional banks. Additionally, its capped supply of 21 million coins—each divisible into smaller units—marks it as a genuinely limited and robust form of currency. Importantly, Bitcoin acts as a bearer asset, meaning holders possess actual ownership of the asset rather than mere claims or debts as is often the case with traditional fiat accounts.

For more information, read >> What is Bitcoin & Why Does it Have Value

Step 2: Familiarize Yourself with Transaction Layers

Layer 1 (High Security with Minutes Settlement)

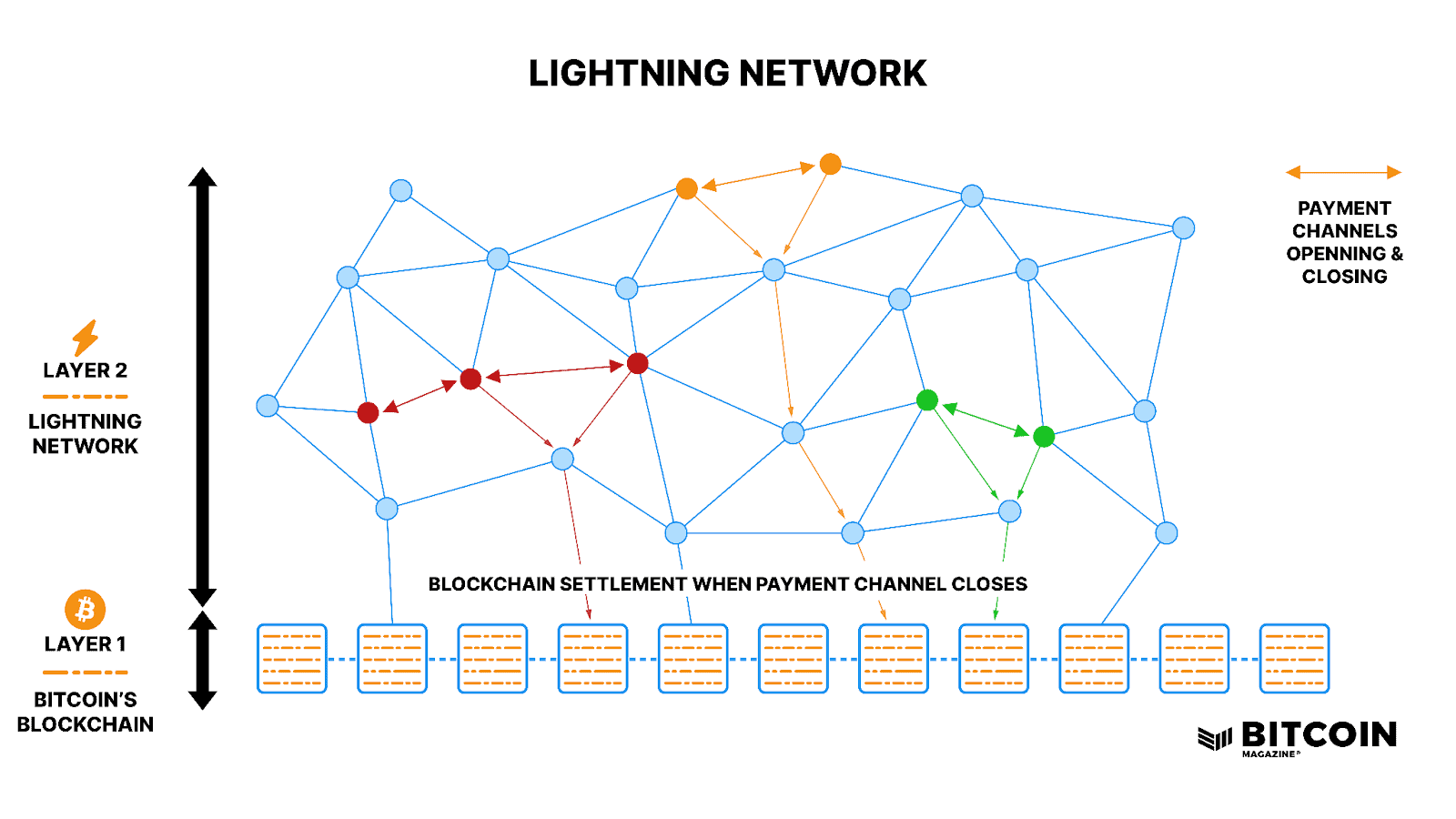

The primary Bitcoin layer is a triple-entry ledger accounting system, functioning as a timestamp server where transactions are securely timestamped, cannot be reversed, can be verified publicly, and rely on nodes and hash power for security. This establishes it as the most secure financial settlement system ever developed.

Layer 1 settlements occur approximately every 10 minutes, which makes it aptly suited for high-value transactions that don’t require instantaneous finality—such as purchasing a vehicle, settling large invoices, or major business transactions.

Layer 2 (Medium Security with Seconds Settlement)

The Lightning Network enables near-instant bitcoin transactions without compromising the security of the primary layer. Acting as a secondary protocol, it permits off-chain transactions while still being secured by Bitcoin’s triple-entry accounting model. When a payment channel is established, funds are locked on the main chain, after which transactions can occur off-chain and are treated as state updates between the involved parties—similar to an abacus tracking balances. The base chain only recognizes these transactions when the channel closes, settling the final results on-chain. With speeds surpassing those of Visa or Mastercard, Lightning is particularly advantageous for day-to-day transactions in cafes, retail stores, and more.

Now that we’ve covered the layers, let’s discuss bitcoin wallets.

Step 3: Select a Bitcoin Wallet

Accepting Bitcoin without proper security measures can be counterproductive. Wallets serve as digital safes for Bitcoin, ensuring its safety and facilitating transactions by generating Bitcoin addresses.

Businesses accepting Bitcoin should prioritize self-custody. Although some might consider relying on third-party custodians, it’s vital to recognize the risks involved. If a third party mismanages your bitcoin or becomes insolvent, your business will lose its assets as those bitcoins stored with third parties aren’t truly yours.

Rather than depending on others, businesses should utilize a cryptographically secure Bitcoin wallet. Different wallets are capable of supporting both transaction layers, generating unique Bitcoin addresses for each transaction type.

For long-term storage, businesses should keep bitcoins in a layer-1 hardware wallet or a multisig wallet. Transitioning bitcoins from a Lightning wallet to a hardware wallet is relatively easy. It’s advisable to maintain only a month’s worth of bitcoins in a Lightning or hot wallet.

- Hardware Wallets work exclusively for layer 1. Typically, they are compact devices similar to USB drives and only connect to the internet when linked via USB or Bluetooth, making them significantly more secure.

- Multisig Wallets are specialized Bitcoin wallets that require multiple private key approvals for transactions. These keys can be distributed among trusted staff or board members. For instance, a 2-of-3 or 3-of-5 setup necessitates that two out of three (or three out of five) keys authorize any transfer. This setup ensures that no single individual possesses unilateral control over the bitcoin.

Step 4: Point of Sale (POS) Payment Solutions

When selecting a payment solution for bitcoin transactions, assess whether a simple wallet suffices or if you require a more specialized application.

Option 1: Utilize a Basic Lightning Wallet

While Lightning wallets are primarily intended for personal use, some provide a light POS solution that serves as an entry point for businesses to familiarize themselves with accepting bitcoin payments.

To begin, download a Lightning wallet from the Android or Apple App Store.

- Wallet of Satoshi, a popular Bitcoin Lightning wallet, rolled out a point-of-sale system in 2023. This user-friendly wallet is easily accessible for almost any user. However, since Wallet of Satoshi is a custodial wallet, the company retains private keys on behalf of users, limiting full control over your bitcoin while stored in the app. If you intend to utilize the Lightning network for larger transactions beyond minimal tips or casual bitcoin purchases, a non-custodial Lightning wallet would be a more sensible choice. (Note: Wallet of Satoshi is not available in the USA.)

- Blink, another established Bitcoin wallet (previously known as “Bitcoin Beach Wallet”), features tools for merchants that streamline receiving payments via Lightning and on-chain, including LN addresses, a Lightning cash register, and a QR code for payments. It facilitates receipt of payments in bitcoin as well as stablecoins ( peso equivalent to USD). Transactions can be exported as CSV files for bookkeeping purposes.

It is prudent to upgrade from basic Lightning wallets when the amount of bitcoin transactions begins to increase, as simple wallets can introduce various minor challenges that can be addressed by a more tailored solution.

Option 2: Implement a Bitcoin Point-of-Sale Application

Specialized payment apps are recommended for local businesses because they encompass an array of vital features conducive to business operations.

- Labeling: Without proper labels, payments received lack contextual information, complicating accounting practices.

For example, a labeled transaction might read: “2023-08-24: Coffee – Latte – $3 – Invoice #12345,” while an unlabeled one appears as: “2023-08-24 – XYZ123 – $3.”

- Address Reuse: If a business consistently utilizes a single wallet address for payments, informed customers can track that address on the public Bitcoin network to view total funds received. To preserve privacy, it’s advisable to avoid address reuse, which specialized payment applications can facilitate.

Note: While payment processors do not address the risks associated with zero-confirmation transactions, the Lightning network does. Accepting payments without network confirmations, referred to as “zeroconf,” can lead to potential double-spending issues.

All that is needed is a smartphone with one of the following applications, available on the Google Play Store or the Apple App Store.

- Breez merely requires a smartphone and can be set up as a non-custodial Lightning POS terminal. Retailers can conveniently add products within the app, create a manager password, print receipts, and transfer funds to an on-chain address if necessary.

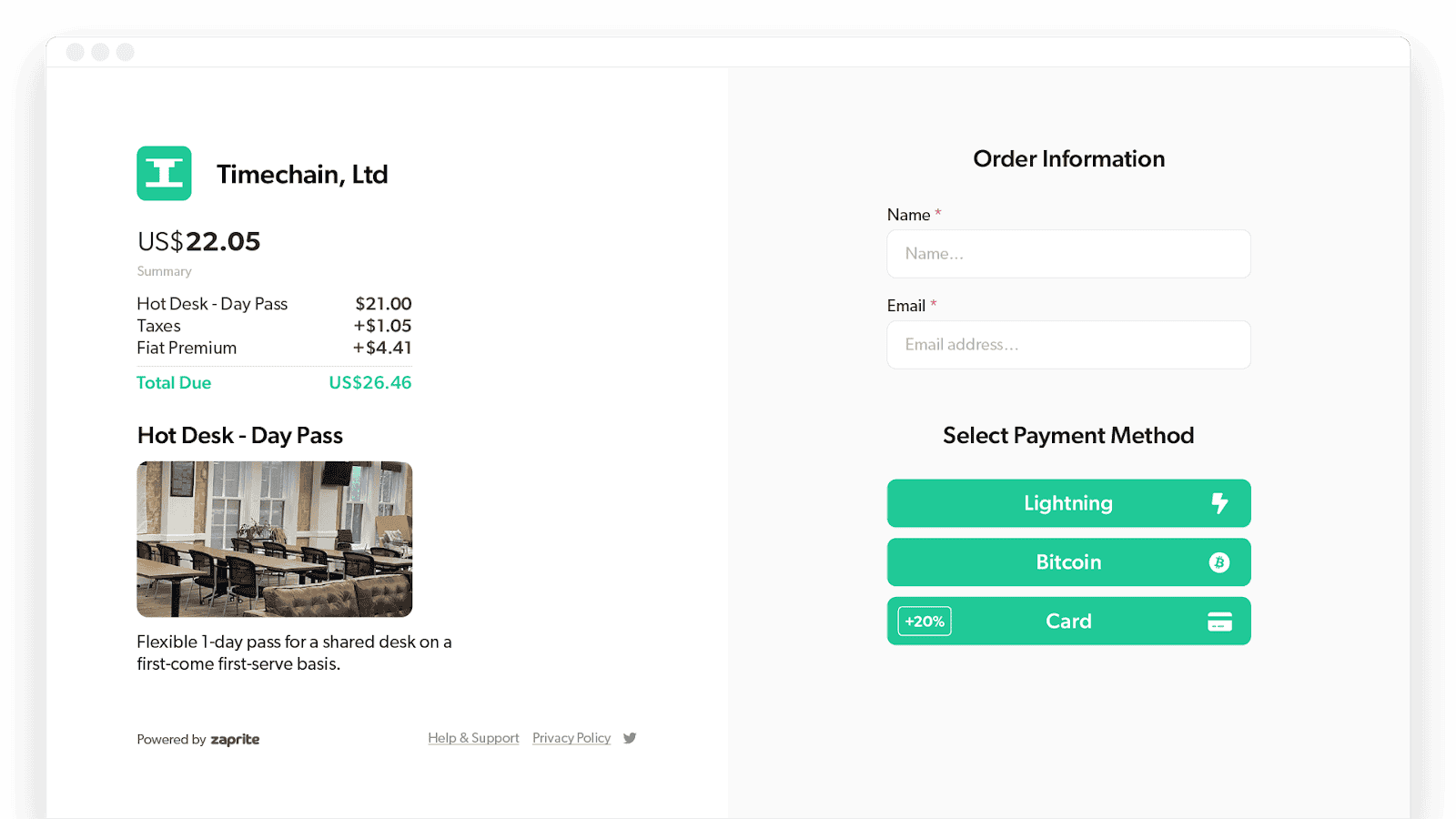

- Zaprite provides a POS-like experience, allowing businesses to seamlessly accept bitcoin payments in person. Service-oriented merchants can establish tipping pages for customers wishing to provide gratuities in bitcoin. Additionally, fiat payments can be accepted by connecting to payment gateways such as Stripe.

- Opago enables small merchants to accept bitcoin quickly, easily, and securely, providing access to the Lightning network with custom POS terminals. It features a merchant dashboard that details all transactions, including a valuable tax reporting feature, especially beneficial for EU-based merchants. The transaction fee is 1% for all payments processed through the POS terminals, which are priced at €99.

- Bitcoin Suisse Pay is an easy-to-set-up, KYC-free method. Business owners can opt to receive bitcoin instantly in their preferred wallet or choose to auto-convert bitcoin to euros, with payments deposited in the designated bank account the following day. Each account is linked to one main device and can have multiple “receive-only” devices for employee use, allowing staff to accept payments without accessing the funds. See their 90-second promotional video.

- Coin Corner: Checkout provides a straightforward Bitcoin payment solution. With CoinCorner Checkout, businesses can accept bitcoin payments in-store, online, or via email invoicing. The fees are only 1%, and merchants have the option to hold BTC or convert it instantly to EUR, thus mitigating any risks associated with price volatility. Although CoinCorner can hold bitcoin for businesses, they also allow recurring Lightning payments to the merchant’s own wallet for those wishing to handle their assets directly.

- With VoltPay, merchants can set predetermined tips, but the customer cannot select their own. This app enables merchants to create an inventory of products, making it ideal for smaller cafes with a limited product range. Payment invoices are easily accessible within the invoice section. The application can export a spreadsheet of transactions, and bitcoin can be manually withdrawn to a wallet.

- Flash offers a streamlined Bitcoin point-of-sale option that utilizes the Lightning network for quick, secure, and economically viable transactions. The app has a user-friendly interface that generates detailed, labeled invoices while ensuring privacy by avoiding address reuse.

With all these setups, you can enhance operations by using a dedicated mobile device loaded with one of the aforementioned applications embedded in an NFC-enabled POS terminal. This approach offers a clearer interface for customers to tap their devices or Bolt Card for transactions.

Option 3: Utilize an Enterprise POS Solution

- IBEX Pay offers enterprise-level payment solutions via the Lightning network. IBEX Pay allows retailers to designate specific wallet addresses and currencies for different branches, which can use the IBEX Pay app for payments. Business owners can choose to receive payments entirely in bitcoin, dollars, or a combination of both.

- BTCPay Server, a self-hosted, open-source cryptocurrency payment processor designed for businesses, emphasizes security, privacy, and resistance to censorship, enabling businesses to accept bitcoin payments without incurring fees and without relying on external processing services. It offers crucial built-in applications, including a POS app for brick-and-mortar outlets and invoicing capabilities for smoother accounting. Although it integrates with e-commerce platforms, its primary advantage for retail establishments is its direct payment processing and wallet management function. Operators are responsible for managing channel liquidity (both incoming and outgoing) to facilitate payments.

- OpenNode provides a full-featured Bitcoin payment platform designed to meet business needs. It enables quick and low-cost Bitcoin transactions through its robust API, e-commerce plugins, and hosted payment pages. Merchants can accept Bitcoin payments while opting for automatic conversion to local currencies like EUR, GBP, and USD. OpenNode guarantees instant settlements via the Lightning network and offers price fluctuation protection through automatic bitcoin-to-fiat conversions. Additionally, the platform focuses on security, diminishing fraud and chargeback risks and enhancing global accessibility for cross-border payments.

Option 4: Is Traditional POS Software Available?

Most established point-of-sale systems aren’t fully equipped for native Bitcoin payments yet, as conventional payment processors remain heavily interlinked with the fiat banking framework. However, some providers are starting to experiment with Bitcoin integration in response to increasing demand from businesses and consumers alike.

As this trend continues, more traditional POS providers are likely to incorporate Bitcoin capabilities. For the time being, merchants will need to explore workarounds or hybrid structures to accept Bitcoin while operating within their existing systems.

Step 5: Processing Transactions

A. In-Person Payments

1. Customer places an order: When a customer orders a product, calculate the total amount in your local currency as you would with any other payment method.

2. Create a Bitcoin invoice: Using your payment app, input the total dollar amount of the order. The app will automatically convert this figure into its bitcoin equivalent based on the current exchange rate.

3. Show the payment prompt: Once the invoice is generated, the app will display a QR code or activate an NFC prompt for the customer to scan or tap with their device.

4. Customer submits payment: The customer opens their Lightning-enabled wallet app on their phone and can either:

a. Scan the QR code shown on your device, or

b. Tap their phone against yours if both devices support NFC.

c. Alternatively, if the customer possesses a Bolt Card (Bitcoin NFC card), they can simply tap it against your device.

5. Confirm payment: Once the payment is submitted, the customer’s wallet app will show transaction details, including the bitcoin amount and merchant information (i.e., your cafe). They should check that all details are correct.

6. Customer authorizes the transaction: Upon verifying the payment details, the customer will be prompted to approve the transaction on their app, tapping the “Accept” or “Confirm” button.

7. Transaction confirmation: Your payment application will receive confirmation of the payment instantly, often within seconds, thanks to the Lightning network.

B. Invoicing

Zaprite, CoinCorner Checkout, and Bitcoin Suisse Pay are platforms that enable users to create customized invoices payable in bitcoin or via bank transfer. The appealing aspect of these solutions is that invoices can be issued in dollars, settled in dollars, and still ultimately received in bitcoin. Payers need not be aware that a bitcoin transaction is occurring; they may never learn that the recipient received bitcoin.

C. E-commerce Integration

For businesses with an online presence, integrating bitcoin payments can be done smoothly using solutions like Zaprite, BTCPay Server, OpenNode, Flash, CoinCorner Checkout, or Bitcoin Suisse Pay.

Additionally, Shopify merchants can incorporate Bitcoin payments through third-party integrations like BTCPay Server and OpenNode. This integration allows customers to make payments in Bitcoin, ensuring a smooth and familiar checkout experience.

Step 8: Educate Your Team and Stakeholders

As with any new technology or system adopted by an organization, understanding its functionalities is essential for maximizing its benefits and seamlessly integrating it into existing workflows. Stakeholders must be well-informed about Bitcoin to avoid impulsive or uninformed decisions regarding its implementation.

Your staff plays a crucial role in daily operations, and their capacity to manage Bitcoin transactions effectively will significantly influence customer satisfaction and your brand’s standing. In essence, providing adequate training safeguards company assets, maintains client trust, and ensures that the decision to embrace bitcoin yields positive outcomes. Furthermore, utilizing services like Bitwage or CashApp to pay employees in bitcoin can position your company as a forward-thinking entity and help staff feel a sense of ownership over their contributions.

Step 9: Accounting and Tax Considerations

Being aware of the tax implications and accounting requirements tied to bitcoin is essential. Regular discussions with a financial advisor or accountant who is well-versed in cryptocurrency can help ensure compliance and accurate reporting. In the USA, the Financial Accounting Standards Board (FASB) will permit fair value accounting starting in 2024. Consequently, businesses based in the USA can adjust their balance sheets according to their treasury movements.

For the most part, taxation arises only when the asset is sold. Therefore, a realistic aim for many small businesses may be to acquire a fraction of bitcoin anticipated to appreciate over time, particularly in the initial stages. It’s critical to maintain thorough records of transactions to facilitate precise capital gains calculations in the future.

If a business faces tight cash flow conditions, keeping the volume of received bitcoin minimal would be prudent, achievable by configuring the payment app to primarily accept payments in dollars.

Disclaimer: This article, including any guidance and information included, serves purely informational purposes and should not be regarded as tax advice. Bitcoin Magazine and the author do not offer tax advice to readers. Tax laws and regulations are complex and can change, potentially impacting investment outcomes. Readers should consult their own tax advisor or accountant to understand the tax implications of their investment and financial choices.

Step 10: Promote Your Bitcoin Acceptance

Make it known that your business accepts bitcoin payments. At minimum, include a sticker or sign at your checkout space indicating bitcoin as a valid payment method. Additionally, positioning a sign in your storefront can attract Bitcoin enthusiasts and other passersby.

Engage with local bitcoin communities by collaborating with enthusiasts and attending meetups to promote your services. You could also reach out to local media and blogs to spark a PR campaign that informs the broader community about the option of paying with bitcoin. Enhancing the appeal for customers to choose bitcoin over dollars can also significantly benefit businesses, provided margins aren’t already too tight. Businesses able to amass bitcoin reserves stand to gain from its long-term value appreciation.

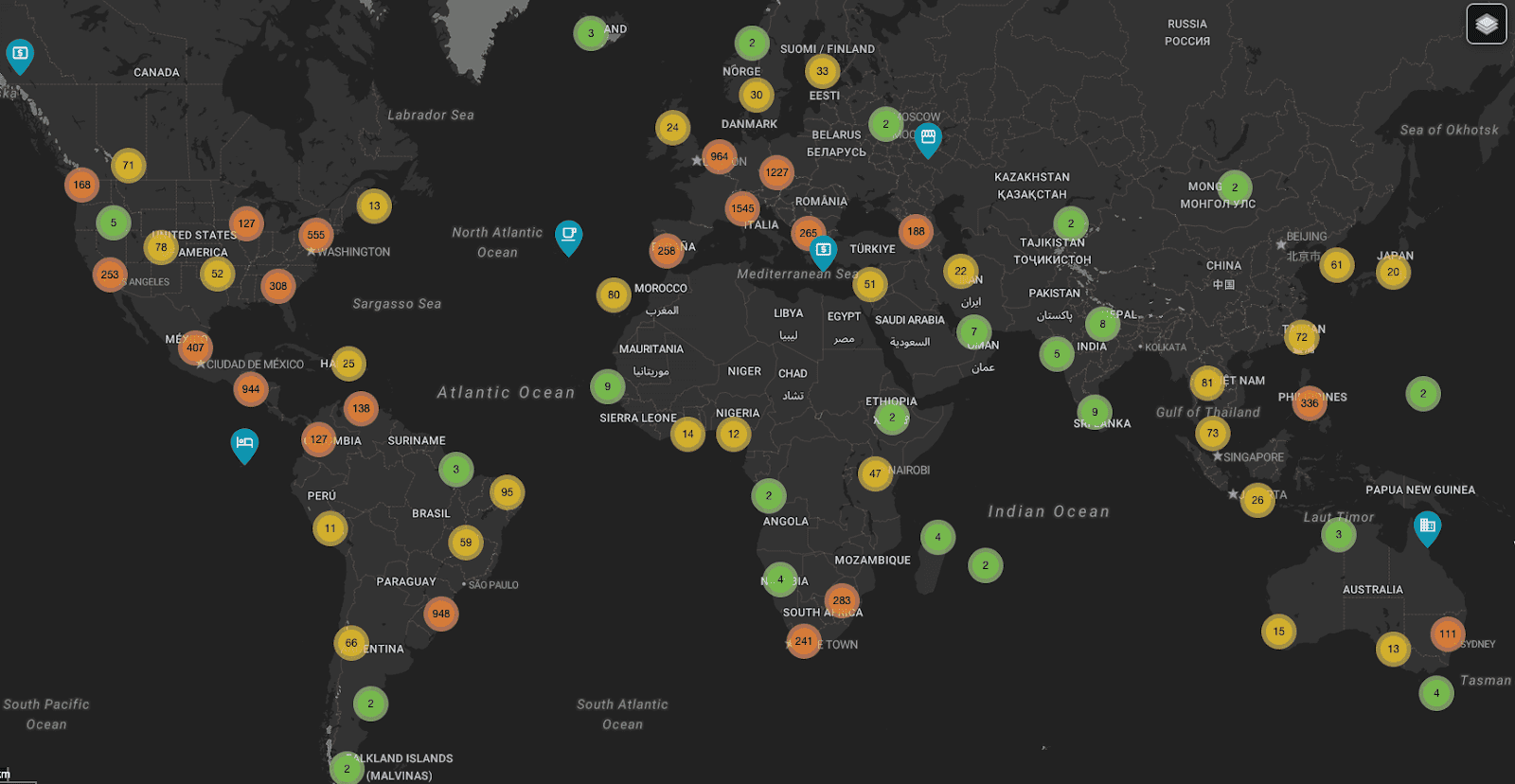

The image above is sourced from BTC Map, 2024.

Ensure that you list your business on Satmap and BTC Map to help your business gain visibility among potential visitors from across the globe.

IV. Challenges and Considerations

Bitcoin is Still Growing: As Bitcoin is still an emerging technology, think of it as an addition to traditional payment options rather than a substitute. The early adoption of bitcoin provides advantages akin to having a business website in the 90s. By adopting bitcoin and integrating it into your company’s reserves, you can leverage its potential for price appreciation in contrast to conventional currencies. Numerous companies like Newegg, Starbucks, Microsoft, Bed & Beyond, and Tesla recognize these advantages by accepting bitcoin payments.

POS hardware solutions, such as Clover, Toast, and Square, will eventually integrate bitcoin capabilities, if they haven’t done so already. Until that happens, small businesses bear the responsibility of educating themselves on bitcoin and developing a robust solution suitable for their needs.

Price Volatility: Bitcoin’s market price can be volatile. Nevertheless, businesses can adopt strategies, such as immediate conversion or fund splitting, to minimize potential risks associated with price fluctuations.

Security Protocols: Implementing best practices in securing bitcoin assets and transactions is crucial for preventing breaches and losses.

Regulatory Landscape and Taxation: Staying informed on legal requirements and tax regulations is vital for ensuring compliance. In many regions, taxing authorities classify bitcoin as an asset subject to capital gains taxation. Consultation with your accountant or tax advisor regarding the tax obligations related to any bitcoin received is recommended.

This article How Local Businesses Can Use Bitcoin For Payments was first published on Bitcoin Magazine and composed by Conor.