Bitcoin (BTC) continues to solidify its reputation as a crucial financial tool in the face of ongoing inflation and economic instability. Advocates highlight its potential to help individuals preserve wealth and foster social stability, especially amid concerns over fiat currency devaluation and rising inequality. As discussions around crypto regulation and mainstream adoption intensify, understanding Bitcoin’s foundational value remains essential for navigating the future of money and global markets.

– Experts emphasize the importance of financial literacy to grasp how fiat inflation erodes purchasing power and fuels economic crises.

– Bitcoin’s decentralized nature makes it a vital lifeline for those fleeing tyranny, war, or natural disasters, enabling secure, portable assets.

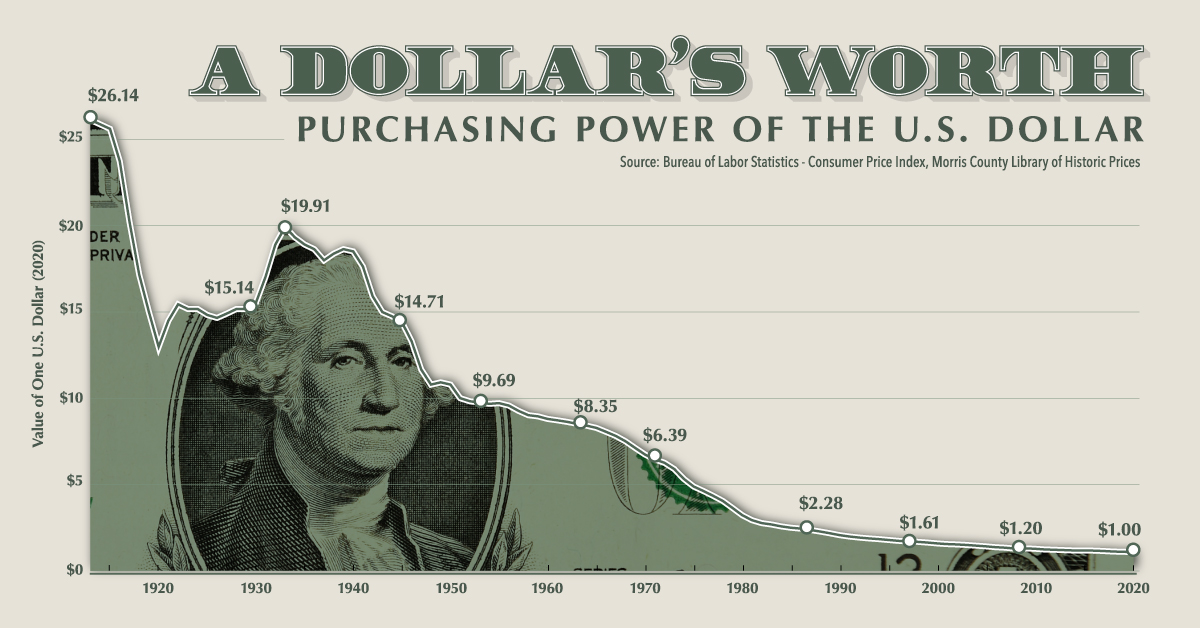

– Increasing fiat money supply, as reflected in M2, continues to diminish the dollar’s value, underscoring Bitcoin’s appeal as a store of value.

– Long-term savings in Bitcoin promote low time preference, fostering innovation, community building, and generational wealth.

Bitcoin (BTC) has emerged as a potential safeguard against the erosion of purchasing power caused by inflation and a broken monetary system. Advocates argue that understanding the true value of Bitcoin is key to appreciating its role as a reliable store of wealth, especially as fiat currencies face continuous devaluation. Experts believe that embracing Bitcoin could be transformative for individual financial security and broader social stability.

Natalie Brunell, a journalist and author of “Bitcoin is for Everyone,” highlights her personal journey from economic hardship to recognizing Bitcoin’s significance. Her immigrant family’s experience during the 2008 financial crisis exposed her to the pitfalls of a fragile financial system. Brunell explains that it took years for her to understand that currency inflation and a flawed monetary system undermine social mobility and economic stability.

“Until you learn how the financial system really works, why acquiring assets is so important, and what inflation really is, I don’t think you appreciate what’s really happening in the world and why things are breaking down,” Brunell states.

Brunell emphasizes that Bitcoin’s capped supply of 21 million coins and its proof-of-work consensus mechanism create a scarcity that effectively stores economic energy, contrasting sharply with the relentless expansion of fiat currency supply.

Related: Last US penny minted underscores the need for Bitcoin savings

Time preference and the social effects of currency inflation

Brunell underscores that inflation’s damage extends beyond falling prices. Fiat currency’s continuous devaluation incentivizes short-term consumption, undermining long-term planning and social cohesion. Saving in assets like Bitcoin, which maintain their value, encourages low time preference—a focus on future gains, investments, and community development.

Our current monetary system discourages such behavior. Brunell notes that with fiat, individuals often spend quickly or risk losing value, fostering everyday economic instability. Over time, these behaviors contribute to social issues such as declining mental health, rising crime, and unaffordable housing.

Self-sovereign money in crisis situations

Brunell points out that Bitcoin’s portability and sovereignty make it invaluable in times of crisis. Whether fleeing authoritarian regimes, war zones, or natural disasters, individuals can retain their wealth securely, often by memorizing a seed phrase that can be carried anywhere.

“You can take Bitcoin anywhere with you. If you needed to flee in an emergency, you can literally memorize a 12-word or 24-word seed phrase and take your whole net worth with you,” she explains.

Big Questions: Did a time-traveling AI invent Bitcoin?