- Solana’s network activity has declined, affecting transaction fees, yet investor interest persists driven by ETF prospects.

- Institutional inflows and possible ETF approvals may serve as catalysts for SOL’s future gains.

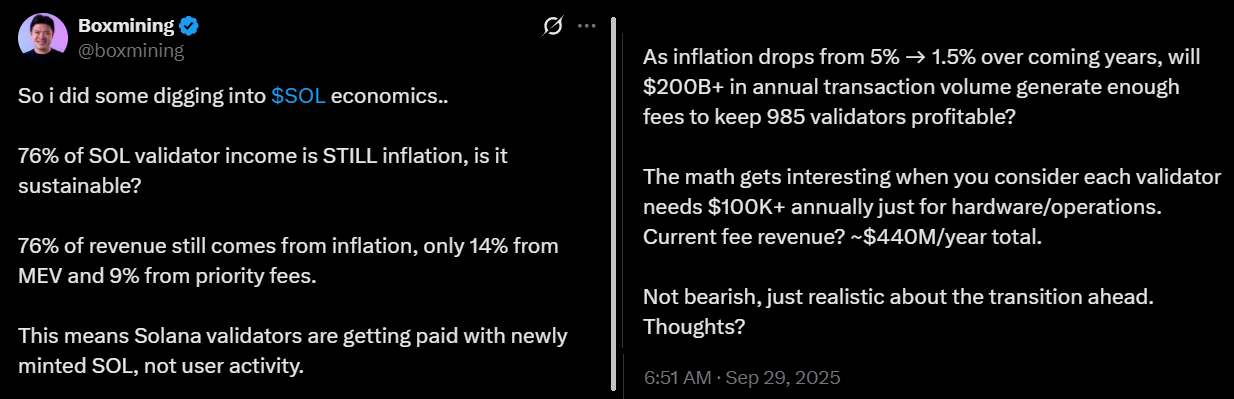

- Concerns remain around validator income sustainability and the impact of staking inflation on SOL’s long-term outlook.

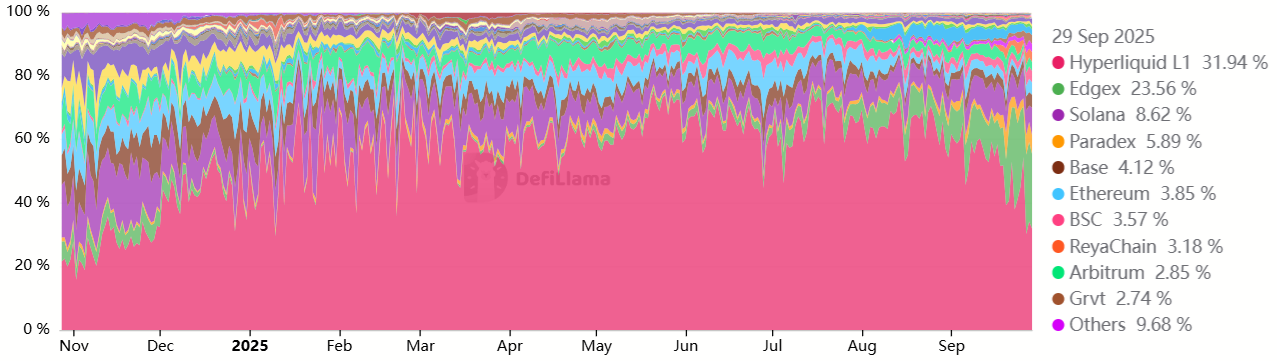

- The rise of synthetic perpetual futures on platforms like Hyperliquid, Aster, and edgeX is influencing SOL sentiment.

Solana’s native token, SOL, surged by 10.5% after testing the $191 resistance level on Friday. Despite this short-term rebound, the token’s price remains roughly 10% lower over the past two weeks, lagging behind competitors like Ethereum and Binance Coin. Traders are now evaluating whether SOL can regain momentum and challenge the $250 mark, amid concerns over its recent weaker performance.

Investor sentiment improved over the weekend as hopes grew that the U.S. government might avoid a shutdown, following signals from President Donald Trump indicating his reluctance to pursue non-essential federal closures. However, congressional efforts to pass a temporary funding bill remain stalled, creating uncertainty about potential economic repercussions. Meanwhile, gold prices hit an all-time high of $3,833, reflecting ongoing concerns around U.S. fiscal stability and debt, which continue to direct investors toward scarce assets like cryptocurrencies.

Although the broader crypto markets posted gains, SOL continues to struggle to maintain key support levels, hampered partly by decreasing activity across its network. Data from Nansen shows a 10% drop in Solana transactions over the past week, with nearly 50% falling fees. In contrast, competitors such as BNB Chain and Arbitrum recorded significant increases in transaction fees, highlighting shifting DeFi activity within the blockchain ecosystem.

Perpetual Futures and Competitive Dynamics Impact SOL’s Sentiment

The rapid growth of synthetic perpetual futures on platforms like Hyperliquid, Aster, and edgeX has influenced overall sentiment toward Solana. Once a leader in decentralized exchange activity through protocols such as Meteora and Raydium, Solana’s perceived competitive advantage has come under pressure. Hyperliquid’s move to launch its own chain aims to reduce fees and maximize validator revenue, while Aster — backed by Yzi Labs (formerly Binance Labs) — plans to develop its own layer-1 network, further fragmenting the ecosystem.

A key driver for SOL’s future hinges on the anticipated approval of U.S. spot ETFs for cryptocurrencies, including those based on Solana. The SEC’s final decision deadline is October 10, with a high probability (estimated at over 95%) of approval. Such a move could unlock substantial inflows, providing much-needed momentum to SOL and other crypto assets. Nonetheless, the sustainability of Solana’s staking yields remains a point of concern, given the high operational costs associated with running a validator network of nearly 1,000 nodes.

Analysis from industry experts indicates that about 76% of validator income on Solana is derived from newly issued tokens rather than transaction fees or MEV. This raises concerns about the long-term sustainability of staking rewards, which could influence the appeal of potential SOL-based ETFs. Despite these challenges, inflows from institutional investors and anticipation of regulatory approval continue to underpin optimism for a possible rally toward $250.

Ultimately, SOL’s price outlook depends on several factors: the pace of network activity recovery, regulatory developments around ETFs, and investor sentiment toward its staking yields. While near-term volatility remains, the convergence of institutional interest and market catalysts could provide a substantial boost for Solana in the near future.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.