The recent attack on the Hyperliquid platform underscores the inherent vulnerabilities of DeFi protocols and the evolving landscape of crypto market manipulation. An unknown trader orchestrated a sophisticated scheme that resulted in the loss of nearly $5 million from the protocol’s liquidity vault. The incident highlights the ongoing risks within automated market-making platforms and the importance of resilient security mechanisms amidst rising concerns over crypto regulation and market stability.

- An attacker drained almost $5 million from Hyperliquid’s vault after manipulating its market using a $3 million capital burn.

- The attacker employed strategic market moves, including building and collapsing buy walls, to induce cascading liquidations.

- The incident appears to be a targeted stress-test, with the attacker’s own funds wiped out, indicating a focus on structural damage rather than profit.

- Hyperliquid temporarily paused withdrawals as a precaution before resuming platform operations within an hour.

- The case emphasizes the risks associated with DeFi liquidity pools and the potential for artificial market manipulation in crypto markets.

Hyperliquid market manipulation causes massive losses

A coordinated scheme on Hyperliquid resulted in nearly $5 million in losses, primarily from a market manipulation designed to exploit the platform’s liquidity architecture. The threat actor withdrew $3 million in USDC from the OKX exchange and distributed the funds across 19 wallets, then leveraged over $26 million worth of perpetual contracts tied to Hyperliquid’s POPCAT protocol. The manipulator created a false sense of market strength by placing a $20 million buy wall near the $0.21 price point, only to cancel it moments later, triggering a rapid sell-off and cascading liquidations.

The resulting liquidity shortage led to the forced liquidation of numerous highly leveraged positions, with Hyperliquid’s vault absorbing losses of nearly $5 million, marking one of the largest single-event setbacks since the platform’s inception.

Related: Sour crypto sentiment could fuel an unexpected rally this month: Santiment

Market stress testing or malicious intent?

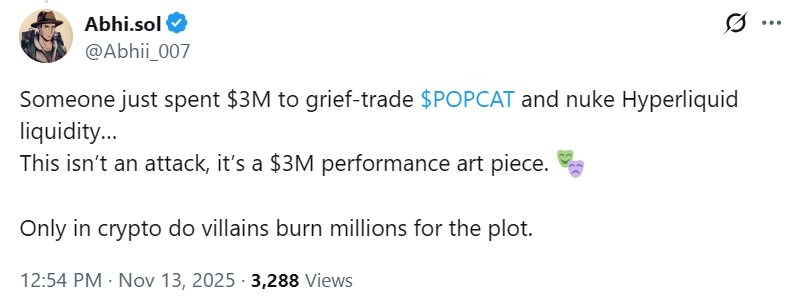

The incident not only caused significant financial damage but also raised questions about the motives behind such high-stakes manipulation. Interestingly, the attacker’s own $3 million was entirely lost, suggesting that the purpose wasn’t profit but perhaps a deliberate stress test aimed at damaging the platform’s stability or testing its vulnerabilities.

This event distinguishes itself from typical crypto market manipulations by the absence of profit; instead, it appears to have been a calculated move to trigger system-wide liquidations by artificially skewing the market. Observers believe that the manipulator’s actions might have been a form of structural damage testing or a statement on the fragility of DeFi protocols.

Community reactions varied. Some speculated that the $3 million was hedged elsewhere, implying the attack was more of a strategic experiment than a profit-driven malicious act. Others viewed it as perhaps crypto’s version of a performance art piece, where villains burn millions as part of a larger narrative—highlighting the unpredictable nature of DeFi and the willingness of some traders to push boundaries.

One commentator described it as “peak degen warfare,” emphasizing how automated liquidity pools without adequate safeguards are vulnerable to such deliberate shocks. This incident serves as a stark reminder that decentralized markets can be highly susceptible to manipulation without strict controls.

Platform responds with temporary measures

In response to the attack, Hyperliquid temporarily halted withdrawals as a precautionary step. A community member reported that the platform’s bridge paused processing, utilizing the “vote emergency lock” function to safeguard user assets. About an hour later, withdrawal processing resumed, with no official statement linking the incident directly to the freeze.

This quick response underscores the importance of emergency protocols within DeFi protocols, especially as regulators continue scrutinizing decentralized platforms for security and transparency issues.