- Injective Protocol launches onchain pre-IPO perpetual markets for private company tokens, starting with OpenAI.

- Trades are fully onchain, offering features like programmability and capital efficiency, differentiating from centralized platforms.

- The new market is powered by decentralized oracles from Seda Protocol and private market data from Caplight.

- This move aligns with Injective’s broader goal of expanding DeFi into traditional financial markets and real-world asset tokenization.

- Restrictions apply in the U.S., U.K., and Canada, reflecting ongoing crypto regulation challenges.

Injective Protocol, a decentralized layer-1 blockchain focusing on financial markets, is breaking new ground by launching onchain pre-IPO perpetual trading markets. This platform allows investors worldwide to trade synthetic representations of private companies, starting with OpenAI, offering leverage of up to five times. The initiative underscores Injective’s commitment to expanding DeFi’s reach into real-world assets and traditional equity markets by enabling permissionless access to private market data on a blockchain.

“Unlike other pre-IPO offerings on platforms like Robinhood, Injective’s pre-IPO perpetual markets are fully decentralized, built on chain with advanced features such as programmability and composability,” the protocol stated. The initial offering features a market on OpenAI, with additional private companies expected to be added soon, further broadening investor options.

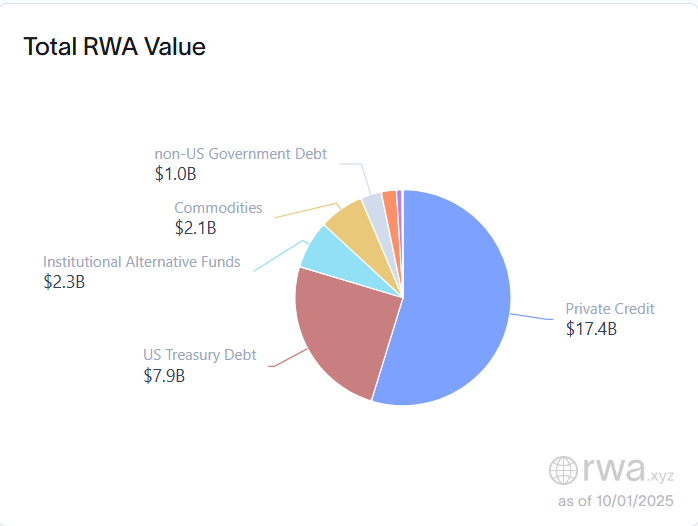

The new initiative forms part of Injective’s aspiration to bring every financial market onto the blockchain, highlighting its focus on real-world asset (RWA) tokenization. The RWA sector has seen rapid growth, approaching a total value of nearly $32 billion, primarily driven by private credit and U.S. Treasury debt, according to industry data.

A Clearer Distinction from Robinhood’s Private Equity Tokens

Historically, access to pre-IPO markets has been confined to institutional and accredited investors, creating barriers for retail participants. Injective’s model introduces a permissionless way for anyone to gain exposure through synthetic derivatives linked to private company valuations—though these do not equate to direct equity ownership.

This approach stands out amid regulatory scrutiny faced earlier this year by Robinhood over its private equity tokens. Unlike traditional tokens, Injective’s perpetual derivatives are based on onchain reference prices, providing a transparent mechanism for trading private company valuations without claiming ownership rights.

However, regulatory restrictions remain a concern, with jurisdictions like the U.S., U.K., and Canada not yet permitting such products. An Injective spokesperson emphasized that their offering is fundamentally different, as it’s based on perpetual derivatives tied to private company reference prices rather than tokens representing actual ownership.

In July, the Bank of Lithuania, Robinhood’s primary regulator in the EU, sought clarifications regarding the firm’s stock tokens, highlighting ongoing regulatory challenges in this space. Nonetheless, Injective continues to position its product as a transparent and innovative alternative within the evolving landscape of crypto regulation and private market access.