Brazil continues to solidify its position as Latin America’s leading hub for cryptocurrency adoption. In a strategic move, KuCoin Pay has integrated with Pix, Brazil’s national instant payments network, enabling users to seamlessly convert and spend cryptocurrencies at any merchant accepting Pix QR codes. This development signals a significant step toward mainstreaming crypto payments and expanding utility for digital assets in the region.

- KuCoin Pay partners with Brazil’s Pix system to facilitate instant crypto-to-fiat transactions.

- Over 26 million Brazilians actively use digital assets, marking a major growth in crypto adoption.

- Brazil accounts for nearly one-third of Latin American crypto activity, driven by high transaction volumes.

- Local and international firms are launching innovative crypto initiatives, further commercializing digital assets.

- Regulatory landscape remains evolving, with recent tax reforms and new crypto projects in the pipeline.

KuCoin Pay’s integration with Pix provides Brazilian users with a streamlined way to convert cryptocurrencies into reais, the country’s official currency, and make direct payments or transfers to local banks. The system offers real-time crypto-to-fiat conversions, enabling users to seamlessly spend their digital assets at thousands of merchants nationwide. Additionally, KuCoin’s multi-functional wallet tools inside the app help manage both cryptocurrencies and fiat currencies efficiently, fostering greater adoption in everyday financial activities.

Pix, launched in 2020 by the Central Bank of Brazil, has quickly become a cornerstone of the country’s financial infrastructure, serving over 175 million users. Its rapid adoption underscores Brazil’s leading role in Latin America’s expanding crypto ecosystem. KuCoin, ranked as the eighth-largest global cryptocurrency exchange with over $6.2 billion in spot trading volume, aims to capitalize on this momentum by integrating crypto payments directly into the country’s existing digital payment landscape.

Brazil Dominates Latin American Crypto Scene

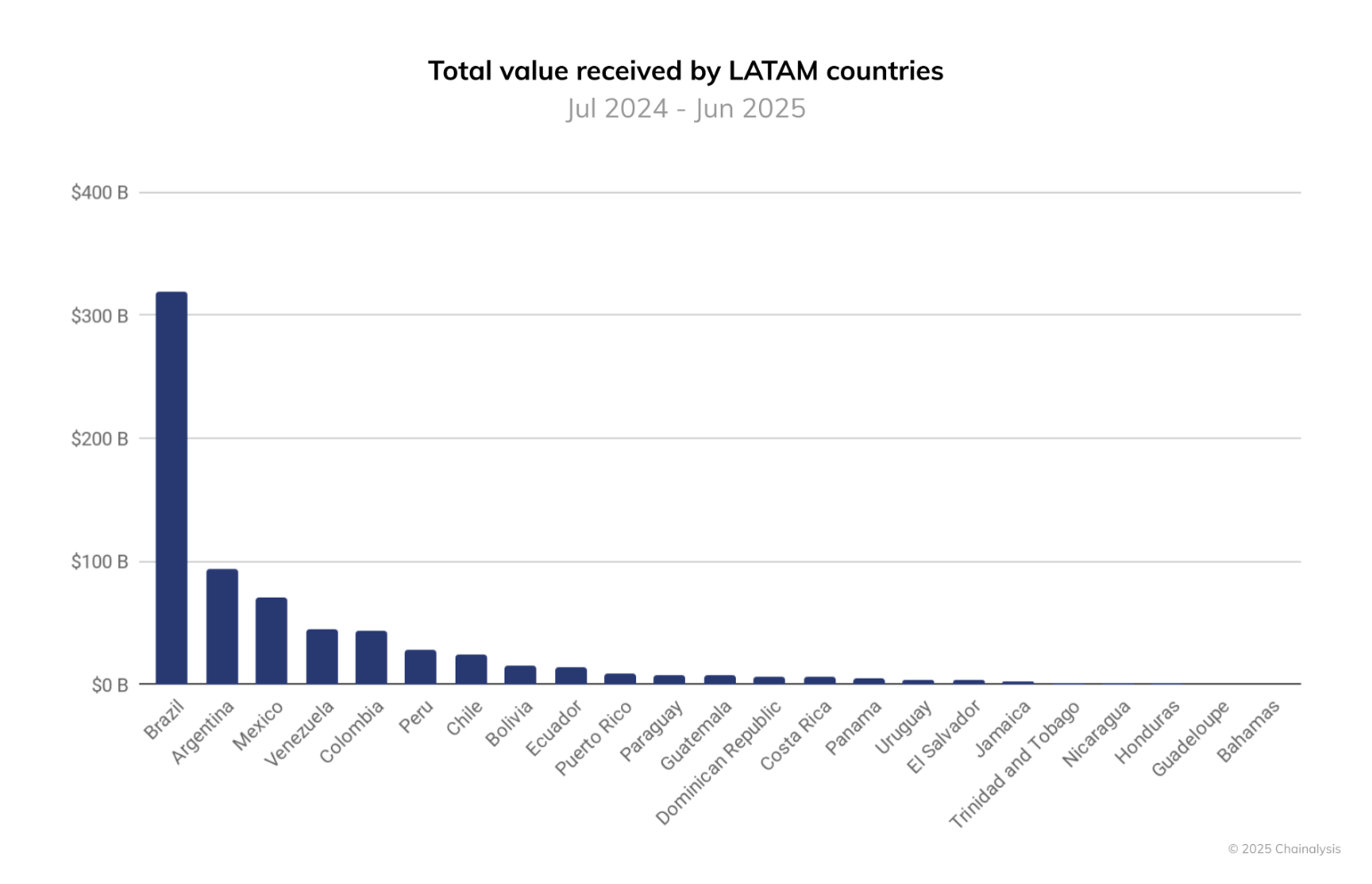

A recent Chainalysis report highlighted Brazil’s dominance in the Latin American crypto market, accounting for nearly a third of regional activity with around $318.8 billion in transaction volume from July 2024 to June 2025. This vibrant market activity has attracted an influx of innovative initiatives from both local and international companies seeking to leverage Brazil’s digital asset momentum.

Leafing through recent developments, Brazil’s largest private asset manager, Itaú Asset Management, launched a dedicated crypto division in September, appointing former Hashdex executive João Marco Braga da Cunha to lead it. The firm manages over 1 trillion reais ($186 billion) in client assets, signaling institutional confidence in crypto assets. Furthermore, fintech company Crown raised $8.1 million in October to establish BRLV, a stablecoin pegged to the Brazilian real, designed to provide easier access to Nigeria’s high-yield fixed income investments.

In another significant move, Brazil’s Banco Inter successfully completed a blockchain-based trade finance pilot in partnership with Chainlink, the Central Bank of Brazil, and Hong Kong’s Monetary Authority, demonstrating how blockchain technology can streamline cross-border transactions. Coinbase has announced plans to introduce its decentralized trading platform, DeFi Mullet, in Brazil, offering local users access to tens of thousands of tokens without leaving the app.

Despite these advancements, regulatory clarity remains an ongoing concern. In June, Brazil implemented a new flat 17.5% tax on all crypto capital gains, replacing previous progressive tax rates. The evolving regulatory environment aims to strike a balance between fostering innovation and protecting investors, positioning Brazil as a resilient and forward-looking crypto market.

Magazine: Ethereum’s Fusaka fork explained for dummies: What the hell is PeerDAS?