- OpenAI officially becomes a public benefit corporation, enhancing its ability to raise capital for AI development.

- Microsoft secures a 27% stake valuation at roughly $135 billion, extending access to OpenAI’s core technologies for seven years.

- The partnership involves a commitment of $250 billion in Azure cloud services, deepening the strategic alliance.

- Despite the change, OpenAI remains a for-profit entity, sparking ongoing debate over its original nonprofit mission.

- ChatGPT leads global usage, now being integrated into AI trading bots that outperform competitors like Google’s Gemini in simulated crypto trading scenarios.

OpenAI has officially transitioned into a public benefit corporation, a move aimed at providing greater flexibility for raising capital as it advances its artificial intelligence ambitions. This restructuring allows the company to attract investments more easily while maintaining a focus on societal impact, an important consideration within the emerging world of cryptocurrency and blockchain applications.

According to The Wall Street Journal, this move grants Microsoft a 27% stake in the new entity, with a valuation of approximately $135 billion. The deal also ensures Microsoft continues access to OpenAI’s leading AI technologies for the next seven years, cementing their strategic alliance in the fast-evolving AI and crypto markets.

Despite this restructuring, OpenAI’s status as a for-profit corporation remains intact, allowing it to raise capital, issue equity, and generate returns for investors. However, this has not quelled criticism from figures such as Elon Musk, who argues that OpenAI has strayed from its nonprofit roots — a concern within the AI and crypto community about the direction of major technology firms.

ChatGPT’s Growing Role in AI and Cryptocurrency Trading

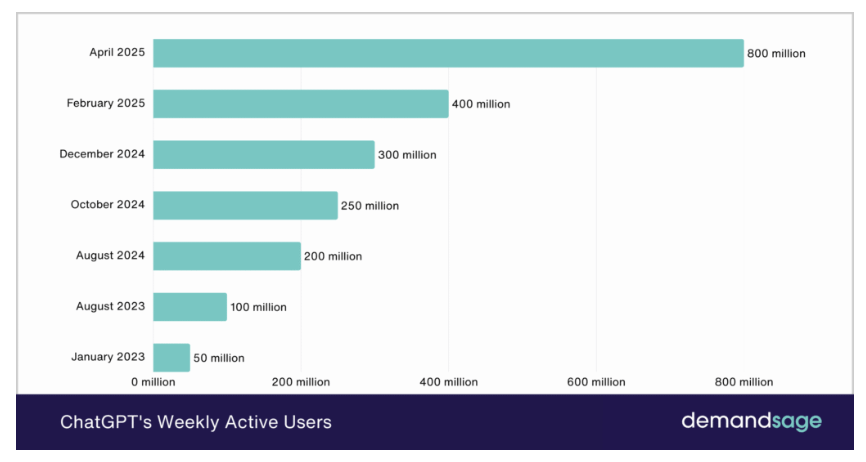

With an estimated 800 million weekly active users, ChatGPT continues to dominate as the world’s most popular large language model. Its capabilities now extend well beyond conversational AI, as the technology is increasingly embedded in AI-powered trading bots for cryptocurrencies and traditional stocks. These bots leverage ChatGPT’s analytical abilities to interpret market data, adapt to trading patterns, and optimize strategies in real time.

Recent studies have highlighted the competitive edge of specialized AI models in crypto trading. Researchers found that models like Grok, developed by an unnamed AI lab, and China’s DeepSeek outperformed ChatGPT and Google’s Gemini in simulated crypto trading exercises. Starting with an initial $200, these models managed to scale investments up to $10,000 by executing trades on decentralized exchanges such as Hyperliquid.

This growing sophistication and market integration reflect the increasing influence of AI in shaping the future of digital asset trading, as more investors and traders turn to automation driven by advanced language models.