Economists, investment firms, and financial analysts are examining past trends, economic signals, and regulatory changes to forecast the potential peak of Bitcoin in 2025. Projections for Bitcoin’s price in 2025 vary from $125,000 to $350,000.

Predictions for Bitcoin Price in 2025

#1 Fundstrat: $250,000

Tom Lee, co-founder of Fundstrat, suggests that Bitcoin could surge to $250,000 within the coming year. Lee points to the impact of halving events on price increases, noting that each reduction in new Bitcoin supply historically triggers significant surges in price.

He also highlights the evolving political landscape in the United States, with a new administration showing interest in Bitcoin’s potential. According to Lee, if the US government starts accumulating Bitcoin as part of its reserves, it could add credibility to the cryptocurrency and drive up its value. He also mentions the example of companies like MicroStrategy investing in Bitcoin, stating that increased corporate adoption could further boost demand.

#2 VanEck’s Matthew Sigel: $180,000

Matthew Sigel, Head of Digital Assets Research at VanEck, anticipates a $180,000 price for Bitcoin in 2025, under the condition that certain key indicators remain stable. Sigel discusses Bitcoin’s cyclical pattern of performance over four years, with strong years following halving events.

Based on the last halving in April 2024, Sigel predicts robust performances in 2024 and 2025. He suggests that if Bitcoin repeats even a portion of its past growth cycles, it could reach $180,000 by the peak of the current cycle.

#3 Robert Kiyosaki: $350,000

Renowned author Robert Kiyosaki forecasts a price of $350,000 for Bitcoin by 2025. Kiyosaki has been a long-time advocate for using Bitcoin as a hedge against traditional financial uncertainties and encourages long-term investment in the digital asset.

#4 Bernstein: $200,000

Investment research firm Bernstein released a report projecting Bitcoin’s price to reach $200,000 by the end of 2025. The report highlights the rise of institutional interest in Bitcoin, driven by advancements in AI, developments in Bitcoin ETFs, and favorable regulatory changes. Bernstein suggests that these factors could lead to increased institutional adoption and drive the price of Bitcoin upwards.

#5 H.C. Wainwright & Co.: $225,000

H.C. Wainwright & Co. revised their 2025 Bitcoin price target to $225,000, citing historical trends, macroeconomic factors, and changing institutional sentiment. The investment bank predicts Bitcoin will hit a high of $225,000 by the end of 2025, pointing to the potential impact of increased institutional investment and more favorable regulations.

The analysts at H.C. Wainwright & Co. suggest that if Bitcoin were to become a strategic reserve asset for the US government, its price could see even greater appreciation.

#6 Standard Chartered: $250,000

Standard Chartered, known for accurately predicting Bitcoin’s price climb to $100,000 in 2024, now anticipates further price growth to $200,000 or potentially $250,000 by the end of 2025. Their projections depend on specific conditions being met, such as increased adoption by retirement funds and sovereign wealth funds.

According to Geoff Kendrick, global head of digital assets research at Standard Chartered, the pro-Bitcoin stance of the US government could drive institutional demand. Growing options trading for Bitcoin ETFs could also attract more investors, potentially leading to significant price increases.

#7 Bitfinex: $200,000

Crypto exchange Bitfinex suggests that Bitcoin’s price could reach around $200,000 by mid-2025, with a possible mid-year minimum of $145,000. The analysis points to the possibility of Bitcoin surpassing its moving averages, indicating potential for even higher prices.

However, Bitfinex researchers note a trend of diminishing returns in recent cycles, projecting a more moderate price surge to the $160,000–$200,000 range by mid-2025.

#8 Peter Brandt: $125,000–$150,000

Veteran trader Peter Brandt forecasts Bitcoin’s next major high around late 2025 in the range of $125,000–$150,000. Brandt emphasizes the importance of halving dates in past bull markets, suggesting a potential peak within the $130,000–$150,000 zone during the current cycle.

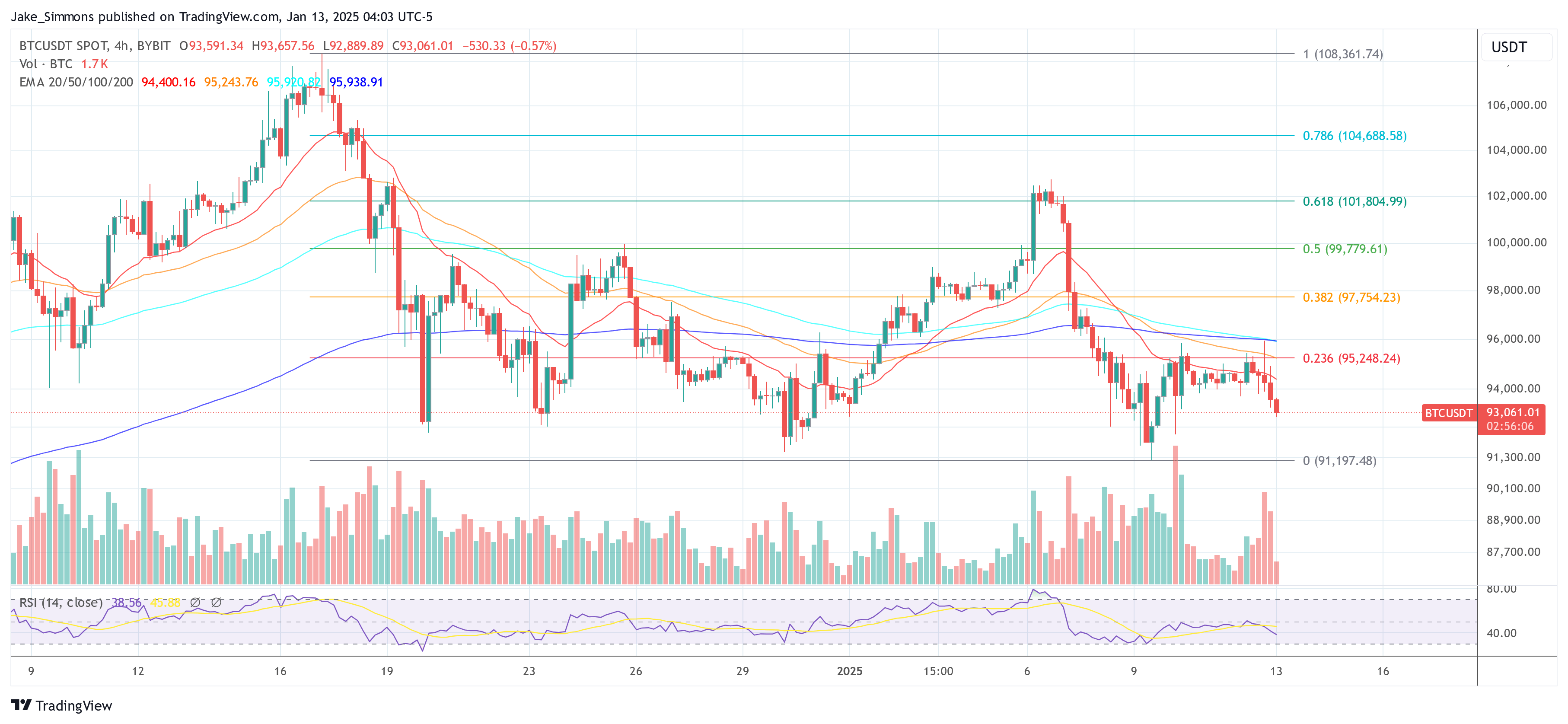

As of now, the price of BTC stands at $93,061.