In recent trading activity, the cryptocurrency landscape continues to reflect growing caution among investors amid macroeconomic uncertainties. Despite Bitcoin’s recent rally, market indicators reveal heightened risk aversion, with increasing demand for protective options and significant inflows into Bitcoin ETFs. Meanwhile, economic data points to potential turbulence ahead, as slowing job markets and volatile monetary policies influence crypto and traditional markets alike.

- Elevated Bitcoin put option premiums suggest a cautious trader sentiment amid broader economic concerns.

- US job openings near five-year lows intensify fears of an impending recession.

- Bitcoin ETFs saw a record $518 million inflow on Monday, with institutional players accumulating holdings, tightening available supply.

Bitcoin (BTC) traders remain cautious despite the cryptocurrency’s recent push to $114,000, as derivatives metrics depict rising fear in the market. Analysts speculate whether this sentiment reflects widespread concerns over the global economy or is specific to the crypto sector.

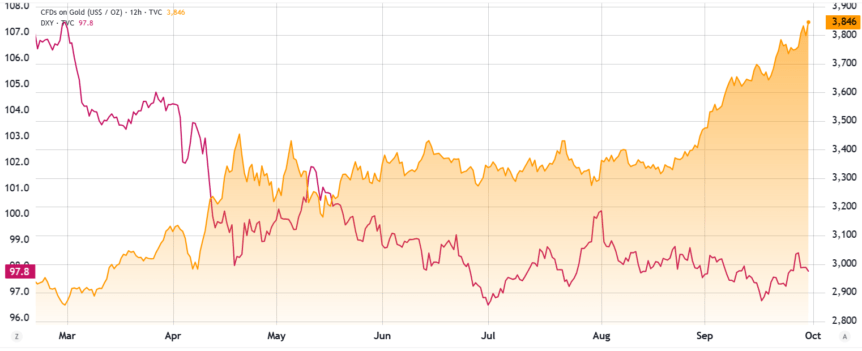

The Bitcoin skew metric fluctuated around 8% on Tuesday after hitting a high of 5%, indicating increased premiums on put (sell) options. Under normal conditions, BTC skew ranges between -6% and 6%, but the failure to regain $115,000 has dampened bullish sentiment, especially as gold continues to shine. Gold’s price has surged 16.7% over the past two months, amidst a struggling US Dollar Index (DXY), which failed to reclaim the 98.5 level, signaling waning confidence in US fiscal policy. A weaker dollar often dampens consumption and hampers U.S. dollar revenue for multinational corporations.

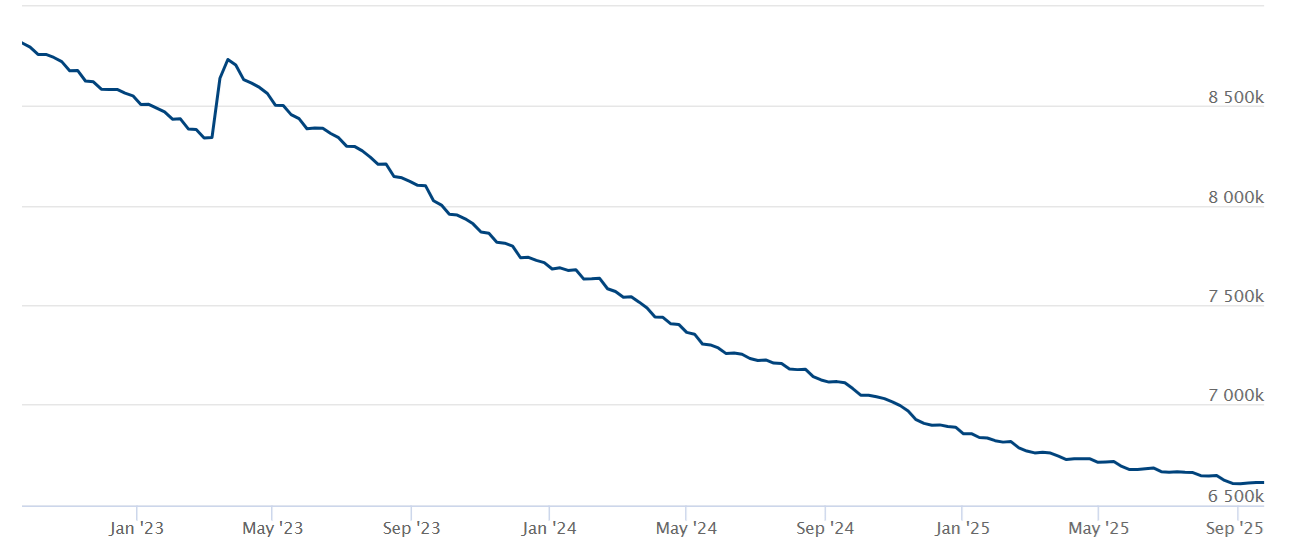

Meanwhile, job market data indicates economic fragility, with August US job openings plunging to near five-year lows at 7.23 million. Economists warn that rising unemployment claims—about twice those recorded last year—could foreshadow a slowdown. This has tempers of concern simmering among investors, even as the S&P 500 shows resilience, buoyed by expectations of further interest rate cuts and potential liquidity injections by the Federal Reserve.

The easing of restrictive monetary policies, coupled with rising asset prices, benefits listed companies, which can leverage dividends and buybacks over economic growth. However, this environment also fuels crypto market activity, as investors seek alternative hedges.

Stable Bitcoin Options Demand and ETF Inflows Signal Sector Resilience

Despite some short-term volatility, the demand for downside protection via Bitcoin options remains subdued. The put-to-call ratio on Deribit shows that, overall, traders favor neutral or bullish strategies. A notable spike in put options last Saturday was modest and does not indicate widespread bearishness, with total premiums under $13 million.

In addition, recent data shows a significant flow of $518 million into Bitcoin ETFs—a sign of growing institutional interest and diversification away from traditional assets. Public companies such as MicroStrategy (MSTR), Marathon Digital (MARA), and others continue accumulating Bitcoin as part of their reserve strategies, potentially causing supply constraints in the market.

Overall, the reduced appetite for bearish Bitcoin positions and the inflow into crypto investment vehicles suggest that broader macroeconomic concerns are influencing market behavior more than pure bearish sentiment. Investors appear to be hedging against economic uncertainty rather than expecting a downturn in crypto markets.

This ongoing dynamic underscores the complex interplay between global economic indicators and crypto market resilience, shaping the future outlook for cryptocurrency investments amid evolving financial conditions.

This article is for informational purposes only and should not be construed as legal or investment advice. Views expressed are solely those of the author and do not reflect the wider opinions of the publication or affiliated entities.