On Thursday, January 23, the US Securities and Exchange Commission (SEC) revealed the withdrawal of Staff Accounting Bulletin (SAB) No. 121. This directive had enforced strict accounting practices for cryptocurrency custody among US banking and financial entities. The new SAB 122 is expected to act as a more significant driver for Bitcoin’s price movements than the anticipated US Bitcoin Reserve (SBR), as noted by various experts in the industry.

Effects on Bitcoin

SAB 121, introduced in 2022, required banks to classify cryptocurrencies held on behalf of customers as liabilities on their balance sheets. This requirement substantially raised operational costs and complexities for financial institutions, leading many to shy away from offering cryptocurrency-related services. Consequently, this regulation acted as a barrier, limiting the acceptance of Bitcoin and other digital currencies within mainstream banking.

With the introduction of SAB 122, these accounting challenges have been addressed. SEC Commissioner Hester Peirce celebrated this decision on social media, tweeting, “Bye, bye SAB 121! It’s not been fun: http://SEC.gov | Staff Accounting Bulletin No. 122.”

The cryptocurrency community has welcomed the SEC’s announcement. Andrew Parish, the founder of x3, underscored the relevance of SAB 122 on X, claiming, “The repeal of SAB 121 is a more significant trigger for Bitcoin than the SBR. Mark this post.” Fred Krueger, the founder of Troop, also pointed out the wider market implications, stating, “SAB 122 is extremely favorable for Bitcoin. More crucial than the Bitcoin Reserve, which is forthcoming. Now, watch the banks start accumulating.”

Vijay Boyapati, a former Google engineer and the author of The Bullish Case for Bitcoin, elaborated on the significant impact of the SEC’s decision, saying, “It’s hard to stress the magnitude of the transformation we’re observing. We’ve shifted from the most adverse anti-Bitcoin, anti-innovation, anti-growth, anti-business leadership to a remarkably pro-Bitcoin administration. This level of change isn’t yet priced in.”

MicroStrategy’s Executive Chairman, Michael Saylor, succinctly captured the prevailing market sentiment in his tweet: “SAB 121 has been rescinded, enabling banks to manage Bitcoin custody.  ” This aligns with Saylor’s previously identified three catalysts for Bitcoin reaching $1 million per coin, where traditional banking custody was the last remaining factor.

” This aligns with Saylor’s previously identified three catalysts for Bitcoin reaching $1 million per coin, where traditional banking custody was the last remaining factor.

This shift in regulation is anticipated to increase institutional engagement in the Bitcoin and broader cryptocurrency markets. Brian Moynihan, CEO of Bank of America—the second-largest bank in the US by assets—discussed the potential for more extensive cryptocurrency adoption during a CNBC interview with Andrew Ross Sorkin at the World Economic Forum in Davos, Switzerland. Moynihan remarked, “If the regulations make it viable to conduct business, the banking system will engage actively on the transaction side.”

This aligns with the SEC’s recent directive, which suggests that banks are now more inclined to develop and provide cryptocurrency services, including custody solutions that were previously limited under SAB 121. The elimination of these regulatory barriers is expected to improve the liquidity and accessibility of Bitcoin, potentially triggering a new surge in demand similar to what was seen with spot ETFs last January.

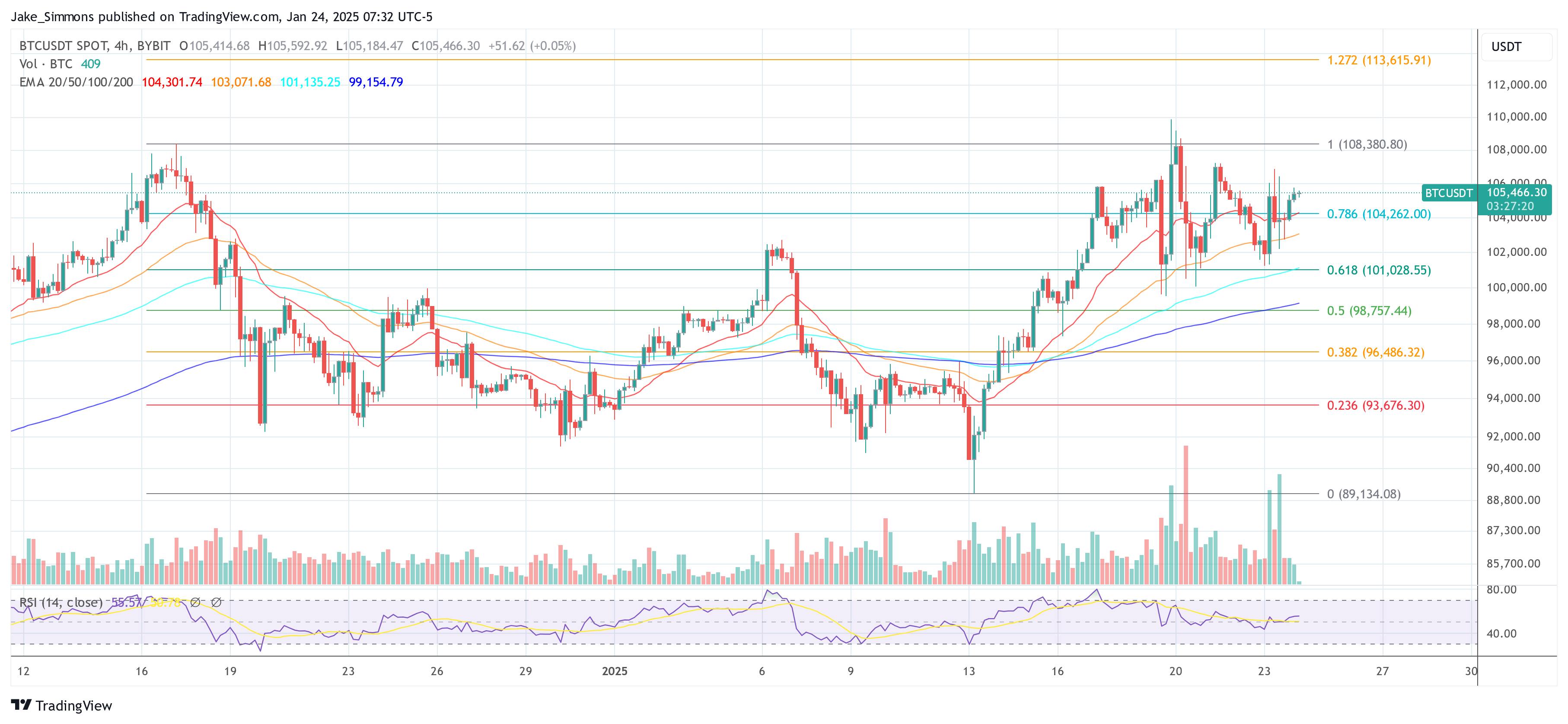

As of the latest update, Bitcoin (BTC) is trading at $105,466.