- Bitcoin’s price has fallen to a six-month low around $88,267 amid broader crypto market declines, but traders are optimistic about a possible rebound towards $98,000.

- Market analysts emphasize that reclaiming $97,000–$98,500 is crucial for flipping momentum to bullish, with failure risking continued downside dominance.

- Despite recent declines, significant accumulation zones remain, including a strong demand area between $94,000 and $95,000, supporting potential recovery scenarios.

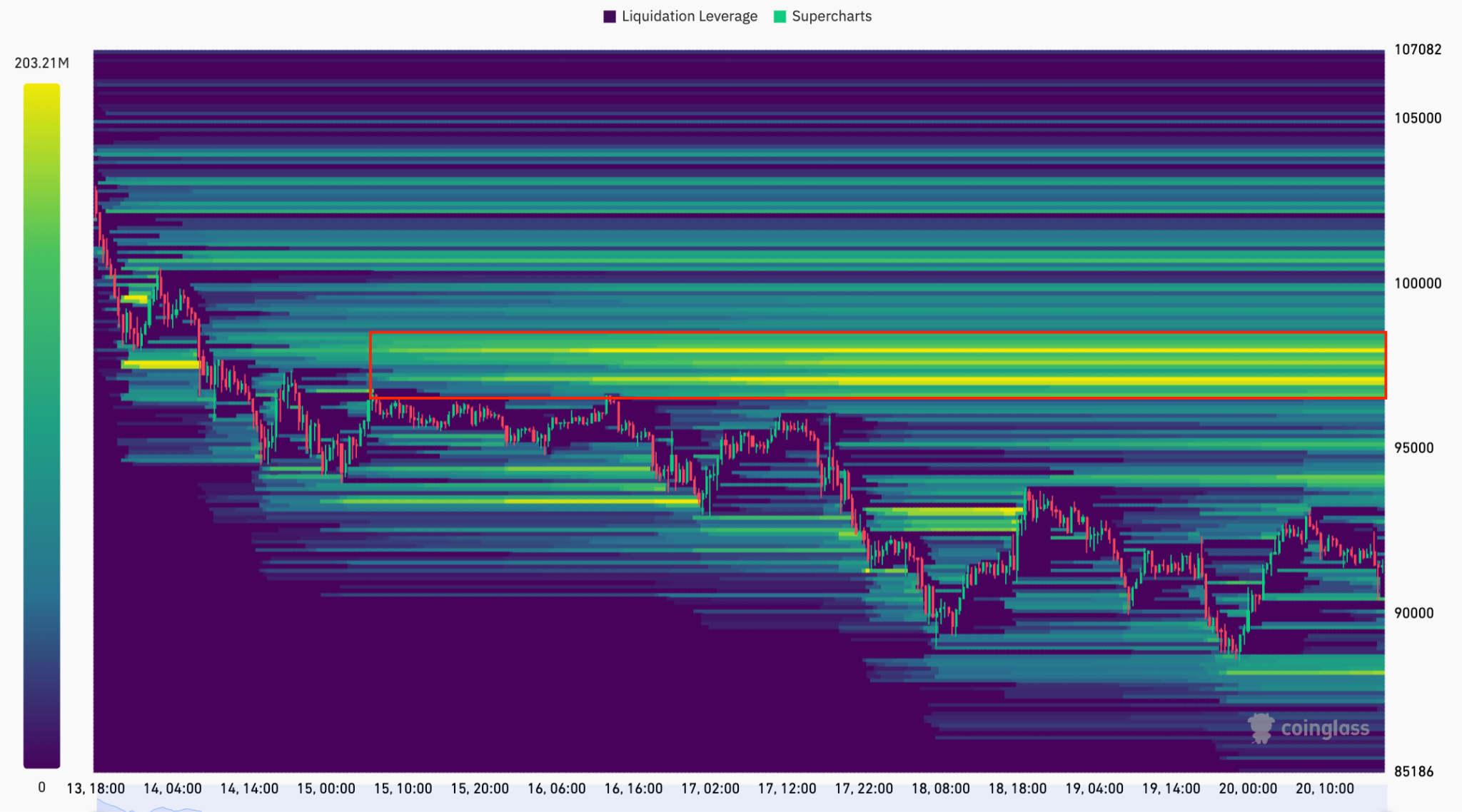

- Liquidation data shows over $2.1 billion in ask orders near $97,000, indicating a critical battleground for bulls seeking to push Bitcoin higher.

- A short squeeze targeting $100,000 remains plausible if Bitcoin breaks above $98,000, with traders watching liquidity levels closely ahead of upcoming market catalysts.

Bitcoin (BTC) has been trending downward since early November, recently hitting a six-month low of approximately $88,267. The decline coincides with a broader crypto market sell-off, with traders wary of imminent economic data releases that could trigger increased volatility and quick price swings.

Bitcoin must reclaim $98,000 to “flip momentum” bullish

The latest downturn saw Bitcoin’s price fall below key support zones, including the 50-week exponential moving average near $100,000 and the yearly open at about $93,300. This has fueled mixed sentiment among investors — some questioning whether the recent lows mark a bottom or signal the end of the current bull cycle. A private wealth manager, Swissblock, noted Bitcoin was hovering around $90,000, suggesting the market has reached “cycle-level exhaustion.”

An analysis chart illustrated that Bitcoin’s recent momentum declined to levels seen during its March bottom and after the October 10 market crash. Swissblock commented, “This is where bottoms build,” emphasizing that a strong recovery depends on reclaiming certain price levels. They stated:

“Reclaiming $97K–$98.5K flips momentum constructive, failing to do so hands bears full control.”

Meanwhile, Glassnode analysts noted that the price zone between $95,000 and $97,000 — where the −1 standard deviation short-term holder cost basis currently resides — acts as a local resistance. They explained that reclaiming this level would signal a market shift toward greater equilibrium, a positive sign for traders.

To break the current downtrend, Bitcoin needs to surpass the $94,000 mark, a crucial demand zone where more than 290,300 BTC were accumulated. As per Glassnode’s Cost Basis Heatmap, this level represents significant buying interest and is vital for potential upward momentum.

Will liquidations drive BTC to $100,000?

Market data indicates that traders see a liquidity cluster around $98,000, with over $2.1 billion in ask orders positioned between $96,600 and $98,500. A break below this zone could ignite a rapid short squeeze, propelling Bitcoin toward $100,000 — an area traders consider a prime target above the early November consolidation zone.

Traders like AlphaBTC suggest that a sustained push above $98,000 could trigger a short squeeze, pushing Bitcoin toward $100,000 to $104,000, especially if market liquidity and momentum align favorably in the coming days. As market inflows and outflows stabilize, signs point to cautious optimism — including recent inflows into US spot Bitcoin ETFs, which climbed back to $75 million after a five-day decline, hinting at market stabilization.

This evolving market dynamic underscores Bitcoin’s susceptibility to sudden moves in response to liquidity levels and macroeconomic developments, making close monitoring essential for active traders and investors aiming to capitalize on the next big move in the crypto markets.

This article does not constitute investment advice. The cryptocurrency market is highly volatile, and investors should conduct their own due diligence before making any trading decisions.