The journey of Bitcoin, transforming from a niche digital asset to a dominant force in the financial landscape, has been remarkable. As we enter a new phase of Bitcoin’s development, various stakeholders, including institutions, governments, and developers, are keen on maximizing its capabilities. Recently, Matt Crosby, the chief market analyst at Bitcoin Magazine Pro, engaged in a discussion with Rich Rines, a contributor for Core DAO, focusing on Bitcoin’s forthcoming growth trajectory, the expansion of Bitcoin DeFi, and its emerging role as a global reserve asset. You can watch the complete interview here: The Future Of Bitcoin – Featuring Rich Rines

The Journey of Bitcoin & Institutional Embrace

Rich Rines has been part of the Bitcoin landscape since 2013, observing its growth from a groundbreaking experiment to a widely accepted financial tool.

“By the 2017 cycle, I was quite determined that this would become my lifelong career.”

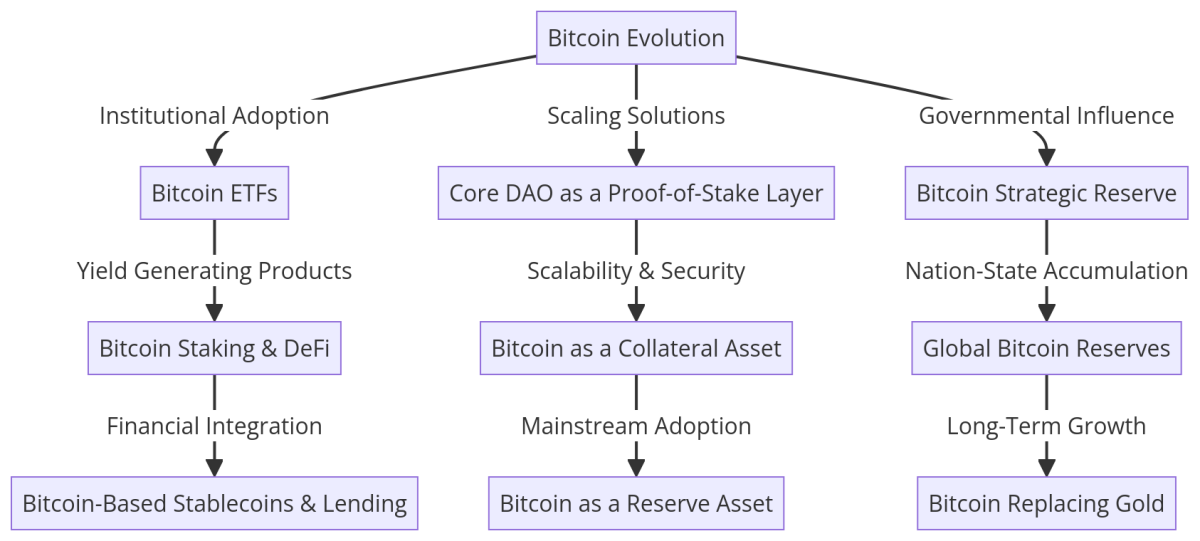

The dialogue covers Bitcoin’s increasing significance in institutional investment portfolios, with spot Bitcoin ETFs recording inflows exceeding $41 billion. Rines contends that the move toward institutional adoption of Bitcoin will fundamentally alter global financial structures, particularly with the introduction of yield-generating products that attract Wall Street investors.

“Now, every asset manager globally has the ability to buy Bitcoin through ETFs, fundamentally transforming the market.”

Understanding Core DAO

Core DAO represents a cutting-edge blockchain ecosystem aimed at enhancing Bitcoin’s capabilities via a proof-of-stake (PoS) framework. Unlike conventional Bitcoin scaling strategies, Core DAO employs a decentralized PoS architecture to boost scalability, programmability, and interoperability, all while preserving the security and decentralization of Bitcoin.

Essentially, Core DAO serves as a Bitcoin-aligned Layer-1 blockchain, extending Bitcoin’s functionalities without modifying its base layer. This advancement fosters a variety of DeFi projects, smart contracts, and staking ventures for Bitcoin enthusiasts.

“Core is the premier scaling solution for Bitcoin, functioning as its proof-of-stake layer.”

By safeguarding 75% of the Bitcoin hash rate, Core DAO emphasizes Bitcoin’s security principles while providing increased functionality for developers and users alike. With an expanding ecosystem that features over 150 projects, Core DAO is setting the stage for Bitcoin’s financial evolution.

Core: Bitcoin’s PoS Layer & DeFi Development

A significant challenge Bitcoin faces is scalability. The Bitcoin network’s elevated fees and sluggish transaction speeds render it a robust settlement layer but restrict its practicality for day-to-day transactions. This is the space where Core DAO plays a pivotal role.

“Bitcoin suffers from scalability and programmability issues. It’s too costly. These characteristics that make it an excellent settlement layer reinforce the necessity for a solution like Core to expand those capabilities.”

Core DAO serves as a PoS layer for Bitcoin, permitting users to earn yield without third-party risks. It creates a platform where Bitcoin holders can engage in DeFi applications without sacrificing security.

“In the next three years, we’re going to see Bitcoin DeFi eclipse Ethereum DeFi because Bitcoin is a far superior collateral asset.”

Bitcoin: The New Reserve Asset

Governments and sovereign wealth funds are increasingly recognizing Bitcoin not merely as a currency but as a reserve asset with strategic significance. The possibility of a U.S. Bitcoin strategic reserve, alongside broader global acceptance at the national level, could usher in a new financial paradigm.

“For the first time, conversations are emerging around establishing strategic Bitcoin reserves.”

The concept of Bitcoin superseding gold as a fundamental store of value is becoming more credible. Rines argues that Bitcoin’s scarcity and decentralized nature position it as a superior alternative to gold.

“Within the next ten years, I believe Bitcoin will emerge as the global reserve asset, supplanting gold.”

Bitcoin Privacy: The Last Challenge

Though Bitcoin is widely celebrated for its decentralization and resistance to censorship, privacy issues remain a considerable obstacle. Unlike cash dealings, Bitcoin’s public ledger makes all transactions transparent to anyone with blockchain access.

Rines acknowledges that enhancing Bitcoin’s privacy will be a vital evolution.

“I’ve long wanted private Bitcoin transactions. While I’m skeptical about its viability on the base layer, there is promise in scaling solutions.”

Solutions such as CoinJoin and the Lightning Network offer some enhancements in privacy, but achieving complete anonymity still presents a challenge. Core is investigating innovations that may enable private transactions without sacrificing Bitcoin’s foundational security and transparency.

“On Core, we’re collaborating with teams to potentially enable confidential transactions—where the existence of a transaction is visible, but details like amounts or parties involved remain private.”

As government scrutiny of digital financial transactions intensifies, the demand for robust Bitcoin privacy features is likely to increase. Whether through protocol upgrades or secondary layer solutions, the future of Bitcoin privacy is a critical area for ongoing development.

The Bitcoin Future: A Trillion-Dollar Opportunity

As the interview unfolds, Rines discusses how Bitcoin’s economic framework is evolving beyond mere speculation, moving into the realm of functional financial instruments. He anticipates that within a decade, Bitcoin’s market capitalization could reach $10 trillion, with DeFi applications becoming a significant segment of its economic landscape.

“The Bitcoin DeFi sector presents a trillion-dollar opportunity, and we are just at the beginning.”

His insights reflect a broader industry trend wherein Bitcoin is increasingly viewed not just as a store of value but also as an interactive financial asset within decentralized frameworks.

Rich Rines’ Vision for Bitcoin’s Tomorrow

Concluding Remarks

The exchange between Matt Crosby and Rich Rines offers an insightful preview of Bitcoin’s trajectory. With accelerating institutional adoption, expanding Bitcoin DeFi projects, and growing acknowledgment of Bitcoin as a strategic reserve, it’s evident that Bitcoin’s most promising years lie ahead.

As Rines summarizes:

“Constructing on Bitcoin is one of the most thrilling opportunities in today’s world. A trillion-dollar market awaits to be unlocked.”

For investors, developers, and policymakers, the key takeaway is straightforward: Bitcoin has evolved beyond a speculative asset; it is now the bedrock of a redefined financial system.

For comprehensive Bitcoin analysis and to access cutting-edge features such as live charts, customized indicator alerts, and detailed industry reports, visit Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes only and should not be construed as financial advice. Always conduct your own research before making any investment decisions.