- Ethereum supply on centralized exchanges hits nine-year lows, indicating increased institutional and retail accumulation.

- DeFi activity on Ethereum’s decentralized exchanges (DEXs) increased by nearly 50% in a week, fueling positive market sentiment.

- Historical patterns and recent data point toward a potential ETH price surge in October, with some analysts forecasting over 100% gains in Q4.

Ether (ETH) has rallied past the $4,000 mark on Monday, gaining 3.5% over the previous 24 hours. This resurgence heightens hopes that ETH might continue its bullish trend into October, supported by several onchain signals, historic quarterly performance, and technical analysts’ optimistic outlooks.

Declining ETH supply on exchanges

As previously reported, overall Ether reserves on centralized exchanges have decreased to levels not seen since 2016, driven largely by institutional investors and long-term holders accumulating ETH for staking and other purposes.

CryptoQuant analyst CryptoMe explains that the reduction in ETH reserves can be attributed to three main factors:

- Investors withdrawing ETH into self-custody wallets;

- Moving ETH to staking protocols or exchanges for yield;

- Transfers to newly generated wallets or cold storage.

Data from CryptoQuant further shows that Ethereum outflows from exchanges are at levels last seen during the late stages of the 2022 bear market, a period characterized by aggressive tightening of liquidity. The trend hints at increasing onchain demand and potential supply squeeze, which historically has preceded price rallies.

In addition, recent outflows coincided with a significant withdrawal of ETH following the FTX collapse, which had further depleted exchange reserves. CryptoMe emphasizes that falling reserves can lay the groundwork for an impending rally, stating:

“When demand triggers, the rally starts. Falling reserves prepare the ground for that rally.”

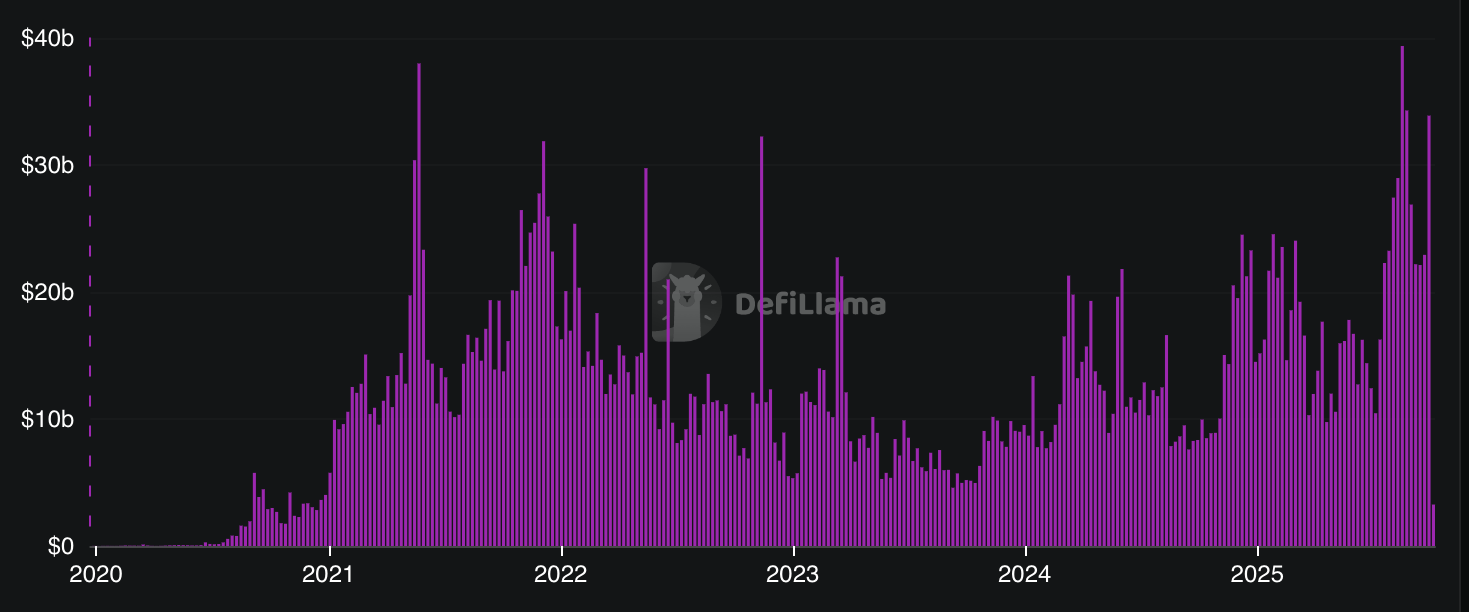

Ethereum DEX volumes surge 47% in a week

Market activity also appears optimistic, with decentralized exchange (DEX) volumes on the Ethereum network increasing by 47% over the past week, reaching $33.9 billion. This upward trend reflects growing demand for onchain trading and liquidity provision, signaling strengthening market confidence.

Notably, DEX activity on layer-2 solutions such as Base, Arbitrum, and Polygon also contributed to this bullish momentum. Meanwhile, Ethereum competitors posted modest increases, with Solana and BNB chain activity rising by 6% and 8.3%, respectively.

Leading DEX protocols like Uniswap and Maverick Protocol recorded 26% and 30% weekly growth, respectively. Historically, such surges in decentralized trading volumes have often been associated with rising ETH prices, with previous instances seeing near doubling of the coin’s value during periods of trade volume spikes.

Ethereum’s upcoming seasonal “pump” in October?

While ETH experienced a 6% decline in September — in line with typical seasonal corrections — historical data suggests October often sees an average 4.77% price increase. If this pattern holds, Ethereum could advance toward $4,300 in the coming weeks.

Crypto analysts note that October tends to be a historically bullish month for Ethereum, with some suggesting it could ignite a strong Q4 rally. One analyst remarked:

“October is often the ignition… get ready for the Q4 $ETH pump!”

Similarly, others see the current technical and seasonal data as supportive of over 100% gains in the final quarter of 2023, echoing patterns similar to those preceding the remarkable surges seen in 2020.

This combination of dwindling exchange reserves, rising DeFi activity, and seasonal trends paints a cautiously optimistic picture for Ethereum as the year closes. Nevertheless, investors are advised to conduct thorough research, as markets remain volatile and unpredictable.