- Bull flag breakout and inverse head-and-shoulders pattern project $3 XRP price.

- Declining XRP supply on exchanges and record outflows indicate strong accumulation trends.

- 90-day spot CVD turns positive, signaling sustained buyer interest and potential upside.

- Technical setups, including breakout targets and pattern confirmations, reinforce bullish sentiment.

- Institutional and large holder activity supports the possibility of a significant price surge.

XRP has recently demonstrated several compelling technical and on-chain signals pointing towards a potential rally to $3. Market analysts highlight patterns such as bull flags and inverse head-and-shoulders, alongside record exchange outflows, which together suggest increasing accumulation and buying pressure that could propel the digital asset higher in the short term.

XRP price bull flag pattern targets $2.97

The four-hour chart reveals XRP validating a classic bull flag pattern. After breaking above resistance at $2.63 on Wednesday, a four-hour close above this level could validate a measured move toward $2.92, representing roughly a 12% increase from current levels.

Bull flags are typically continuation patterns, and XRP’s recent breakout indicates the trend could extend further. Moreover, the relative strength index (RSI) remains at a healthy 60, reinforcing the overall bullish setup.

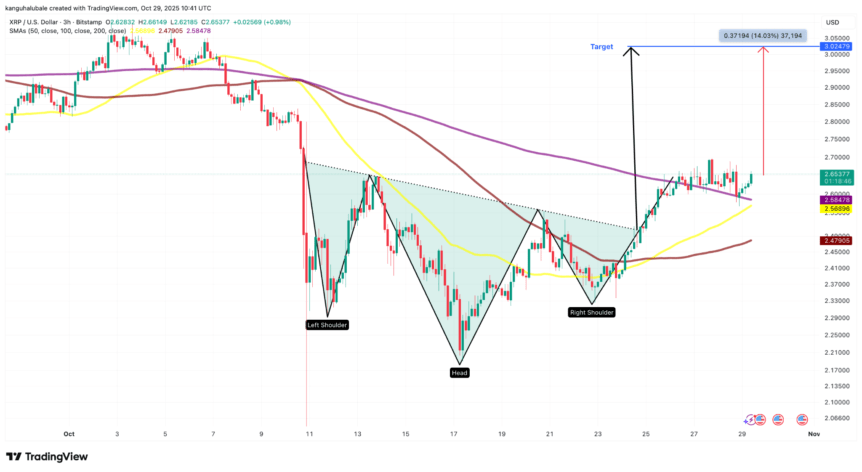

Projected $3.02 XRP target based on classic chart formations

Additionally, XRP’s price has formed an inverse head-and-shoulders pattern on the three-hour chart, a bullish indicator suggesting a possible rise to $3.00 or beyond.

An inverse H&S pattern typically resolves with a breakout above the neckline, which in this case could trigger a parabolic surge, with the pattern’s measured target reaching $3.02 — about 14% above current levels.

Given the strength of the pattern and recent positive momentum, some analysts believe XRP could break higher rapidly, with one noting that an optimal move from the right shoulder could send prices soaring past $3.

As previously reported, these bullish signals come amid institutional activity and record outflows from exchanges, both pointing toward a significant accumulation phase that could lead to a rally targeting $3 and beyond in the coming weeks.

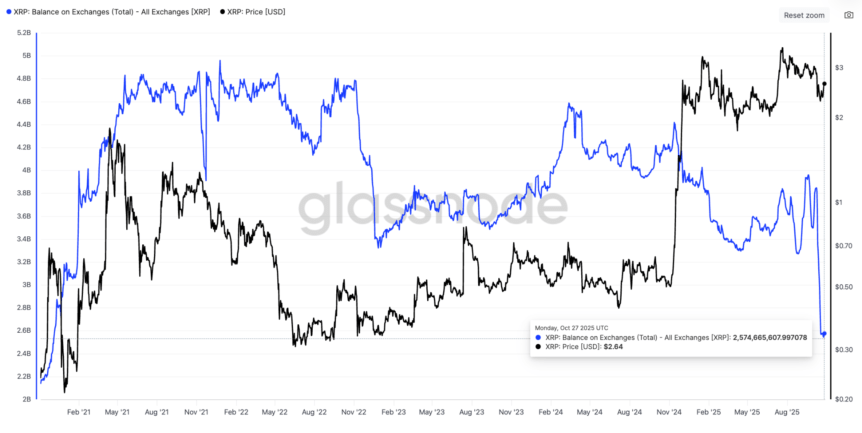

Decreasing XRP supply on exchanges supports bullish outlooks

Data from Glassnode reveals a substantial decline in XRP held on centralized exchanges, dropping by approximately 1.4 billion tokens over the last month. As of October 29, the total XRP reserve on exchanges stood at about 2.57 billion, a sharp decrease from over 3.9 billion in September.

This significant withdrawal indicates that investors are choosing to hold XRP rather than sell, adding to the scarcity factor that often precedes a price rally. The record outflows, with the net change in XRP holdings on exchanges falling by 2.78 million tokens—its largest ever—highlight strong accumulation by large holders, reducing immediate sell pressure.

On-chain demand rises as 90-day CVD turns positive

CryptoQuant data shows that the 90-day spot taker cumulative volume delta (CVD) has recently turned positive, meaning buy orders have overtaken sell orders. This shift indicates sustained demand and increasing confidence among traders, supporting the case for a potential rally.

Positive CVD values denote active accumulation and a market environment where buyers continue to step in, making further upward moves more likely once resistance levels are cleared. Overall, these on-chain metrics suggest that XRP’s bullish momentum might sustain in the near term, bolstered by increasing institutional interest and supply reduction trends.

This confluence of technical setup and on-chain activity underscores the growing optimism around XRP’s price prospects, with many analysts predicting a move toward $3 in the upcoming weeks amid evolving crypto market dynamics.